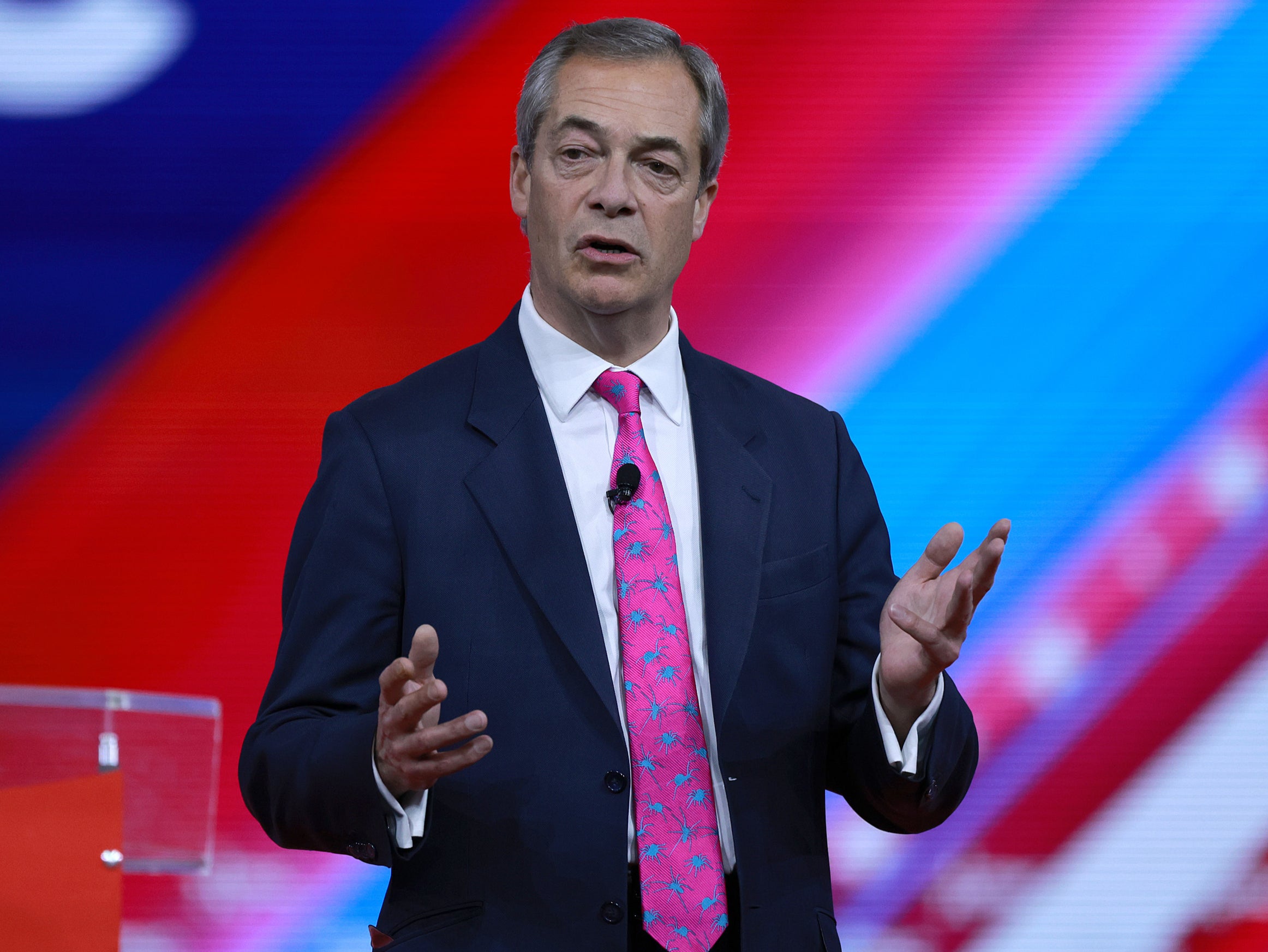

A bit rich: Why I back Nigel Farage in his battle with the banks

Now he’s out of politics, and being ‘cancelled’ by his bank, we should all support the former Brexit leader. That’s a sentence Chris Blackhurst never thought he would write

There are plenty of people, let’s face it, who if they were sat near Nigel Farage in a restaurant, would ask to be moved or leave the place completely. Equally, there are those who would stop by his table for a chat, who would delight in seeing one of their political own.

He’s Marmite alright, is Nigel. But does that make him a bad person, the sort that a bank should refuse to serve?

It does not. Coutts – if indeed it is that bank which he is choosing not to name, instead referring to it as a “high-end” institution that closed his account (it’s known he had a mortgage with them) without explanation – should be ashamed. According to the former Brexit leader, other high street banks then refused to allow him to transfer his funds to them.

At first, it looked as though the banks were reacting to the claim made in parliament that Farage had been in receipt of funding from Russia. Not true, said the ex-UKIP chief, and challenged anyone to repeat the allegation outside, without the shield of parliamentary privilege.

Under the money laundering rules, banks are meant to pay closer attention to “politically exposed persons” – those who might be more susceptible to receiving cash from dubious sources. The Russian allegation would fit with that requirement, except that Farage insists it is false and no one has dared make it in public, without legal protection.

Farage, it transpires, is not alone. Other politicians are saying they have suffered the same, and an Anglican vicar, Richard Fothergill, maintains that his Yorkshire Building Society was shuttered after he wrote to them complaining about their support of Pride.

It seems the banks are applying some sort of arbitrary taste test, deciding who they would like to do business with on the basis as to whether they like them or not, or rather if they offend staff and customers. In essence, they’re closing accounts because they disagree with others’ opinions.

Not only banks. PayPal, the US payments company, last year shut down three accounts connected to Toby Young – his website The Daily Sceptic, the Free Speech Union, and his personal account – only to apologise and restore them less than two weeks later, after an outcry and a question about it raised in parliament. Cancel culture, it appears, has moved to another level.

What’s really occurring is that corporates are terrified. They tend to be deeply conservative organisations, run by people who are petrified of exposure. Their dread in this instance is in being “outed” in some way, of being shamed as guilty by association with those who hold views that others regard as extreme and abhorrent. They will run a mile rather than attract any negative publicity, however slight.

In their desire to stay on what they see as the “correct” side of public debate they’re prepared to banish others, even if it means losing business. They’re desperate not to offend, anxious to avoid being caught in activists’ unforgiving headlights.

Of course, it is always their right to refuse to serve someone. The government is now consulting on the issue, at least where financial services are concerned. This could prove a difficult test for Rishi Sunak. So far, all that’s been said, via the Treasury, is that “As a minimum, it is the government’s view that, without deviation, a notice period and fair and open communication with a customer must apply in situations which relate to termination on grounds other than suspected or actual criminal offences or when otherwise allowed by law.”

It may be that this is enough. It’s hard to see, though, how a notice period would have changed the banks’ approach to Farage and the like who have been shown the door. Perhaps “fair and open communication”, presumably Treasury code for “an explanation”, might have altered the outcome – causing the bank to think twice about raising the prospect of adverse publicity from the barred client or even a legal challenge, although it is difficult to see what that challenge would be.

It’s likely that this is insufficient, and the government may have to move further than the “minimum” and look at enshrining in law freedom of expression as it extends to the ability of someone to be served.

Appealing to companies to use their common sense is unlikely to suffice, not when they are so scared of being accused themselves. Something more drastic is required. This, though, will set Sunak on a collision course he would rather avoid – he, too, as someone who once worked in banking, prefers to stay resolutely away from taking awkward decisions. Sunak will have to climb off the fence.

Farage deserves majority support. Now that’s a sentence I never thought I would write.

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies

Comments