UK interest rates: Bank of England announces interest rate decision after fall in inflation

Bank decision on interest rates comes a day after inflation fell to 2%

Your support helps us to tell the story

From reproductive rights to climate change to Big Tech, The Independent is on the ground when the story is developing. Whether it's investigating the financials of Elon Musk's pro-Trump PAC or producing our latest documentary, 'The A Word', which shines a light on the American women fighting for reproductive rights, we know how important it is to parse out the facts from the messaging.

At such a critical moment in US history, we need reporters on the ground. Your donation allows us to keep sending journalists to speak to both sides of the story.

The Independent is trusted by Americans across the entire political spectrum. And unlike many other quality news outlets, we choose not to lock Americans out of our reporting and analysis with paywalls. We believe quality journalism should be available to everyone, paid for by those who can afford it.

Your support makes all the difference.Interest rates have been frozen by the Bank of England for the seventh consecutive month despite another drop in inflation.

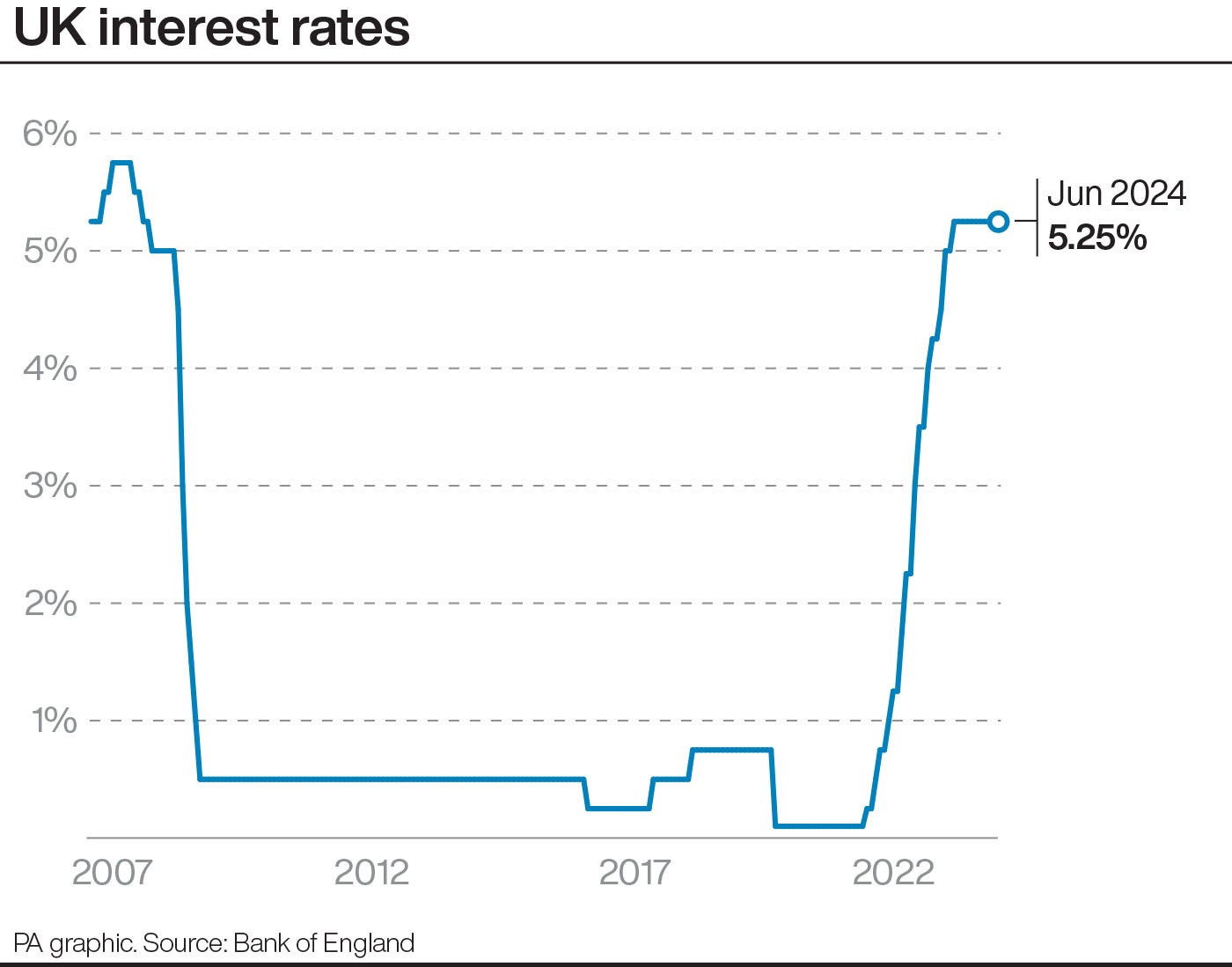

Bank chiefs on Thursday held the rate at 5.25 per cent in another blow to workers, homeowners and borrowers.

It comes after official figures published on Wednesday showed that rising prices had fallen back to 2 per cent - the Bank’s target - for the first time in nearly three years, down from 2.3 per cent in May.

The latest inflation figures mean that prices are still rising across the country, but at a much slower rate than in recent years when households and businesses were being squeezed during the peak of the cost crisis.

After the fall in inflation, the Confederation of British Industry (CBI) said the stage was now set for the bank to cautiously cut interest rates in August.

CBI principal economist Martin Sartorius said on Wednesday: “Today’s data sets the stage for the Monetary Policy Committee to cut interest rates in August, in line with our latest forecast’s expectations.”

How does inflation affect interest and mortgage rates?

UK inflation slowed to 2 per cent in May, dropping to its lowest level since July 2021, according to new official figures.

It has matched the target rate of inflation set by the Government and Bank of England after a slowdown in price rises over the past two years.

Full report:

How does inflation affect interest and mortgage rates?

Hopes have been raised that lower levels of inflation will mean interest rates cuts and in turn lower mortgage costs

UK borrowing costs set to stay the same despite inflation hitting 2% target

Borrowers hoping for some relief from higher costs are likely to be disappointed by expectations that UK interest rates will not be cut on Thursday, despite inflation returning to target.

Most economists are expecting policymakers to hold UK interest rates at 5.25 per cent when the central bank announces its latest decision.

Full report:

UK borrowing costs set to stay the same despite inflation hitting 2% target

Most economists are expecting policymakers to hold UK interest rates at 5.25% when the central bank announces its latest decision.

Breaking: No fall in interest rates despite inflation hitting 2% target, Bank of England announces

The Bank of England has declined to cut interest rates from their 16-year high – despite inflation finally falling to meet its target of 2 per cent.

Homeowners struggling with soaring mortgages will be forced to wait at least another two months for borrowing costs to fall, after the Bank’s nine-member Monetary Policy Committee opted on Thursday to hold the base rate at 5.25 per cent for the seventh consecutive month.

More to follow on this breaking news story:

Bank failing to act in interest of workers - union

The Bank of England has “failed to act in the interest of workers” by deciding against a cut to interest rates, a union has said.

Sharon Graham, Unite general secretary, said: “Once again, the Bank of England has failed to act in the interest of workers and hard-pressed families.

“Major economies across the world have cut interest rates and the UK must follow suit. High interest rates boost the profits of city bankers but hit all of us paying mortgages and rents in the pocket. It’s time for the bank to get a grip.”

7-2 majority vote for rate freeze

The central bank’s monetary policy committee voted by a majority of seven to two to keep rates unchanged.

Members Dave Ramsden and Swati Dhingra voted to cut rates by 0.25 percentage points.

IPPR: Interest rates too high for too long

Interest rates have been too high for too long, an economic think tank has said.

Dr George Dibb, associate director for economic policy at IPPR, said: “The Bank of England has tightened the screws too much for too long, holding back the UK’s economic recovery. It should have followed the European Central Bank by starting to cut rates today.

“The Bank has to balance lingering price rises, notably in services, with the UK’s zero economic growth and a cooling labour market. With inflation expectations back down to pre-pandemic levels, it’s time for the Bank to switch gears, support the economy more, and cut rates.”

We need to be sure inflation stays low, Bank governor says

Officials “need to be sure” inflation will stay low before cutting interest rates, the Bank’s governor Andrew Bailey has said.

The decision comes a day after official figures showed the rate of inflation hit the Bank’s 2 per cent target in May for the first time in nearly three years, prompting the prime minister to declare “we’ve got there” after the milestone was reached.

However, some policymakers on the Bank’s nine-person Monetary Policy Committee (MPC) felt that “more evidence of diminishing inflation persistence was needed” before they could safely cut rates.

In particular, they felt that services inflation – which looks only at service-related prices such as hospitality and culture – had remained stubborn, and wage growth was rising faster than forecast.

How does inflation affect interest and mortgage rates?

UK inflation slowed to 2 per cent in May, dropping to its lowest level since July 2021, according to new official figures.

It has matched the target rate of inflation set by the Government and Bank of England after a slowdown in price rises over the past two years.

Full report:

How does inflation affect interest and mortgage rates?

Hopes have been raised that lower levels of inflation will mean interest rates cuts and in turn lower mortgage costs

ICYMI: Bank of England set to hold rates to avoid ‘rocking the boat’ pre-election

Hopes that the Bank of England could start cutting interest rates this month could be dashed as experts expect policymakers not to “rock the boat” in the run-up to the General Election.

The central bank is due to announce its latest decision on interest rates on Thursday.

Full report:

Bank of England set to hold rates to avoid ‘rocking the boat’ pre-election

The central bank is due to announce its latest decision on interest rates on Thursday.

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies

Comments