Interest rates – live: Bank of England hikes base rate in fresh blow to mortgage holders

Officials raise base rate for ninth consecutive time

Your support helps us to tell the story

From reproductive rights to climate change to Big Tech, The Independent is on the ground when the story is developing. Whether it's investigating the financials of Elon Musk's pro-Trump PAC or producing our latest documentary, 'The A Word', which shines a light on the American women fighting for reproductive rights, we know how important it is to parse out the facts from the messaging.

At such a critical moment in US history, we need reporters on the ground. Your donation allows us to keep sending journalists to speak to both sides of the story.

The Independent is trusted by Americans across the entire political spectrum. And unlike many other quality news outlets, we choose not to lock Americans out of our reporting and analysis with paywalls. We believe quality journalism should be available to everyone, paid for by those who can afford it.

Your support makes all the difference.The Bank of England has raised interest rates by 0.5 per cent taking the base rate to 3.5 per cent in a bid to tackle soaring inflation.

The latest hike represents a slight cooling in rate increases, after the Bank’s MPC opted for a 0.75 percentage point rise last month – the highest single increase since 1989.

It was the ninth time in a row that officials raised rates as they try to tackle inflation, currently running at 10.7 per cent - down slightly from 11.1 in October but still at historically high levels.

Higher interest rates will bring fresh pain for mortgage holders on deals linked to the Bank’s base rate, while those with fixed rates set to expire soon will have to refinance at higher rates.

Government determined to get inflation down, says minister

Chief Secretary to the Treasury John Glen said: “We are united with the Bank of England in the determination to get the inflation rate down from 10.7% down to the target of 2%”.

He cited Vladimir Putin’s “weaponisation” of energy prices that had caused “massive challenges” on inflation.

“We recognise this is really hard for people across the economy dealing with inflation,” he said.

Most say government doing badly on cost-of-living crisis – survey

Most Britons describe the economy as being in a bad state, while eight in 10 (78%) say the government is doing a poor job of managing the cost of living, according to a YouGov survey.

Seven in 10 (68%) expect the economy to get worse over the next 12 months.

Even amongst Conservative voters the picture is bleak – most (58%) of this group expect the economy to get worse.

It suggests the Prime Minister and Chancellor still have a lot of work to do to convince the public that they have a grip on the economy and the rising cost of living.

‘Nightmare before Christmas’, say Lib Dems

The Liberal Democrats’ Treasury spokesperson Sarah Olney said the interest rate rise was “the nightmare before Christmas for families already struggling with the cost of living crisis”.

She said the government’s “complete and utter failure to control inflation and their disastrous mini-budget have led to mortgage payments soaring at the worst possible time of year”.

She called for a temporary ban on home repossessions and a mortgage rescue fund to support those hardest hit.

“The government must also finally bring in its long-promised ban on no-fault evictions to protect renters at risk of homelessness this winter.”

Higher rates ‘the last thing UK needs'

Think tank the New Economics Foundation condemned the rate rise, saying it was the last thing the UK needed.

Higher rates “will do little to tackle the main causes of inflation (the high prices of imported food and gas) but they will put a further squeeze on our economy which is already entering recession”, it said.

The European Central Bank (ECB) has slowed its record pace of interest rate hikes, joining the Bank of England and other central banks in slightly restrained measures to tackled inflation.

The ECB, Britain’s central bank and Swiss National Bank all dialled back to half-point increases today from earlier three-quarter rises, following the lead of the US Federal Reserve.

Inflation in the 19 countries that use the euro eased to 10 per cent in November from 10.6 per cent in October, the first drop since June 2021.

But ECB officials have said it is too early to say the pace has peaked, with high energy prices threatening a recession in Europe.

“The Governing Council decided to raise interest rates today, and expects to raise them significantly further, because inflation remains far too high and is projected to stay above the target for too long,” the ECB said of the bank’s 2 per cent goal.

Bank president Christine Lagarde is expected to stick to a strong anti-inflation message during a news conference after the decision.

Interest rate rise could make bad situation worse, says TUC

Unions said the Bank of England’s latest rate rise risks leaving people even further behind cost of living rises.

Kate Bell, head of economics at the TUC, said: “With the UK economy in recession, and the value of everyone’s pay plummeting, this rate rise could make a bad situation worse.

“The priority now should be protecting living standards and boosting the economy to stop the recession and protect people’s jobs,” said the union economist.

“The best way to do this is by giving working people decent pay rises that keep up with the cost of living.”

Earlier, a spokesperson for the Unite union said the Bank was wrong to approve the rate rise, warning another rise in borrowing costs “could be the straw that breaks the camel’s back”.

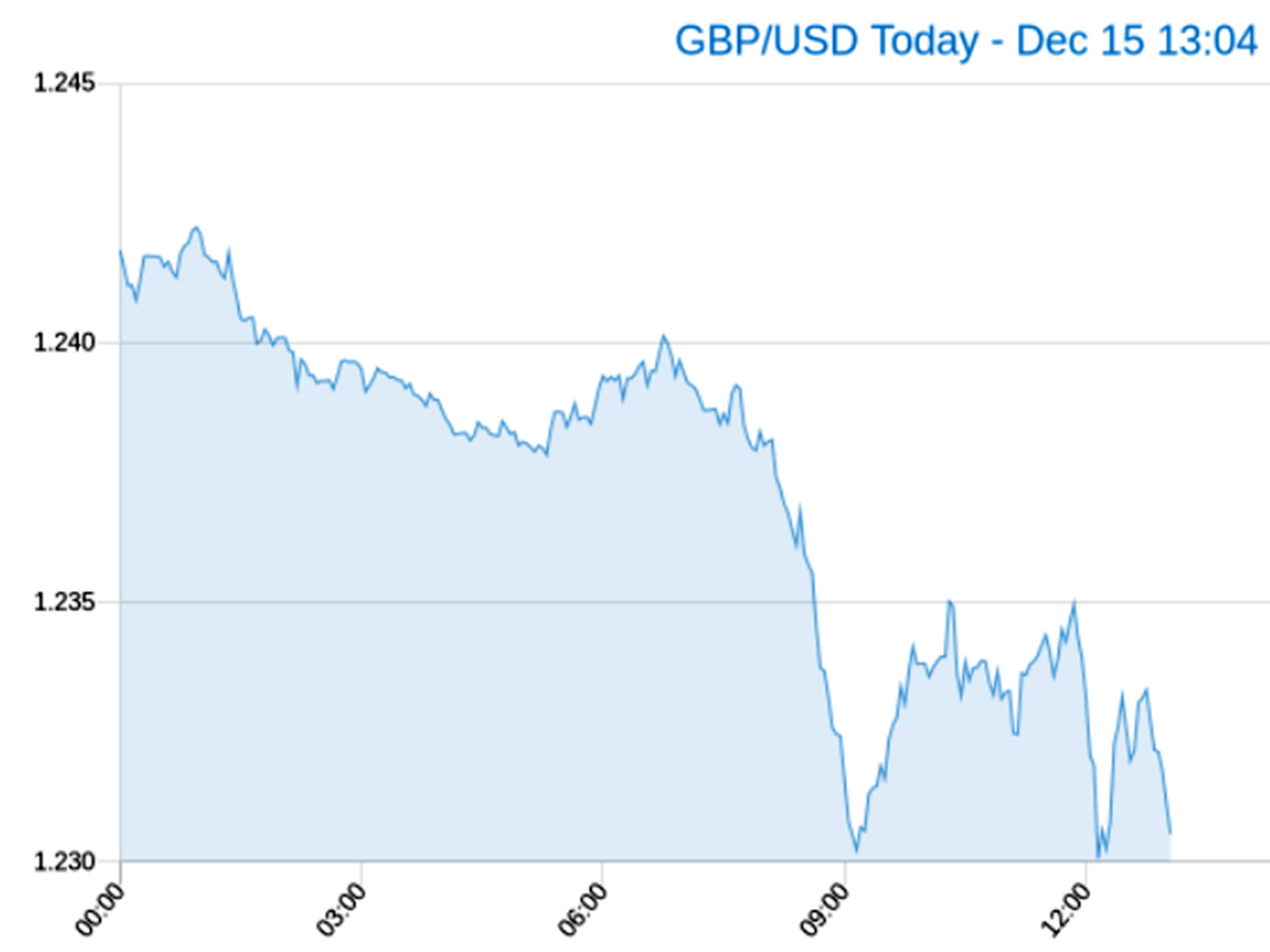

Pound down against dollar after interest rate hike

The pound dipped in response to today’s interest rate announcement, dropping as much as 1 per cent against the dollar.

It bounced back slightly but remains 0.78 per cent lower at 1.232 against the US dollar, and 0.2 per cent lower against the euro at 1.160.

The pound has seen extreme lows this year, sinking to near parity with the dollar in the market turmoil following Liz Truss’s mini-budget.

Since September it has been on a steady rise, hitting a six-month peak of 1.24 on Tuesday.

Bank of England raises interest rates to 3.5% despite inflation easing

My colleague Liam James has a full write-up of today’s Bank announcement here:

Bank of England raises interest rates to 3.5% despite inflation easing

Borrowers hit with higher costs as bankers signal UK not out of the woods yet

Martin Lewis: Mortgage holders on tracker deals to see £300 rise annual in costs

Martin Lewis has said that people on tracker mortgage deals can expect to see their annual costs rise by around £300 per year for every £100,000 of mortgage

The Money Saving Expert added that existing fixes won’t change, while “new fixed rates’ve already likely baked much of this rise in.”

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies

Comments