Interest rates – live: Bank of England hikes base rate in fresh blow to mortgage holders

Officials raise base rate for ninth consecutive time

Your support helps us to tell the story

From reproductive rights to climate change to Big Tech, The Independent is on the ground when the story is developing. Whether it's investigating the financials of Elon Musk's pro-Trump PAC or producing our latest documentary, 'The A Word', which shines a light on the American women fighting for reproductive rights, we know how important it is to parse out the facts from the messaging.

At such a critical moment in US history, we need reporters on the ground. Your donation allows us to keep sending journalists to speak to both sides of the story.

The Independent is trusted by Americans across the entire political spectrum. And unlike many other quality news outlets, we choose not to lock Americans out of our reporting and analysis with paywalls. We believe quality journalism should be available to everyone, paid for by those who can afford it.

Your support makes all the difference.The Bank of England has raised interest rates by 0.5 per cent taking the base rate to 3.5 per cent in a bid to tackle soaring inflation.

The latest hike represents a slight cooling in rate increases, after the Bank’s MPC opted for a 0.75 percentage point rise last month – the highest single increase since 1989.

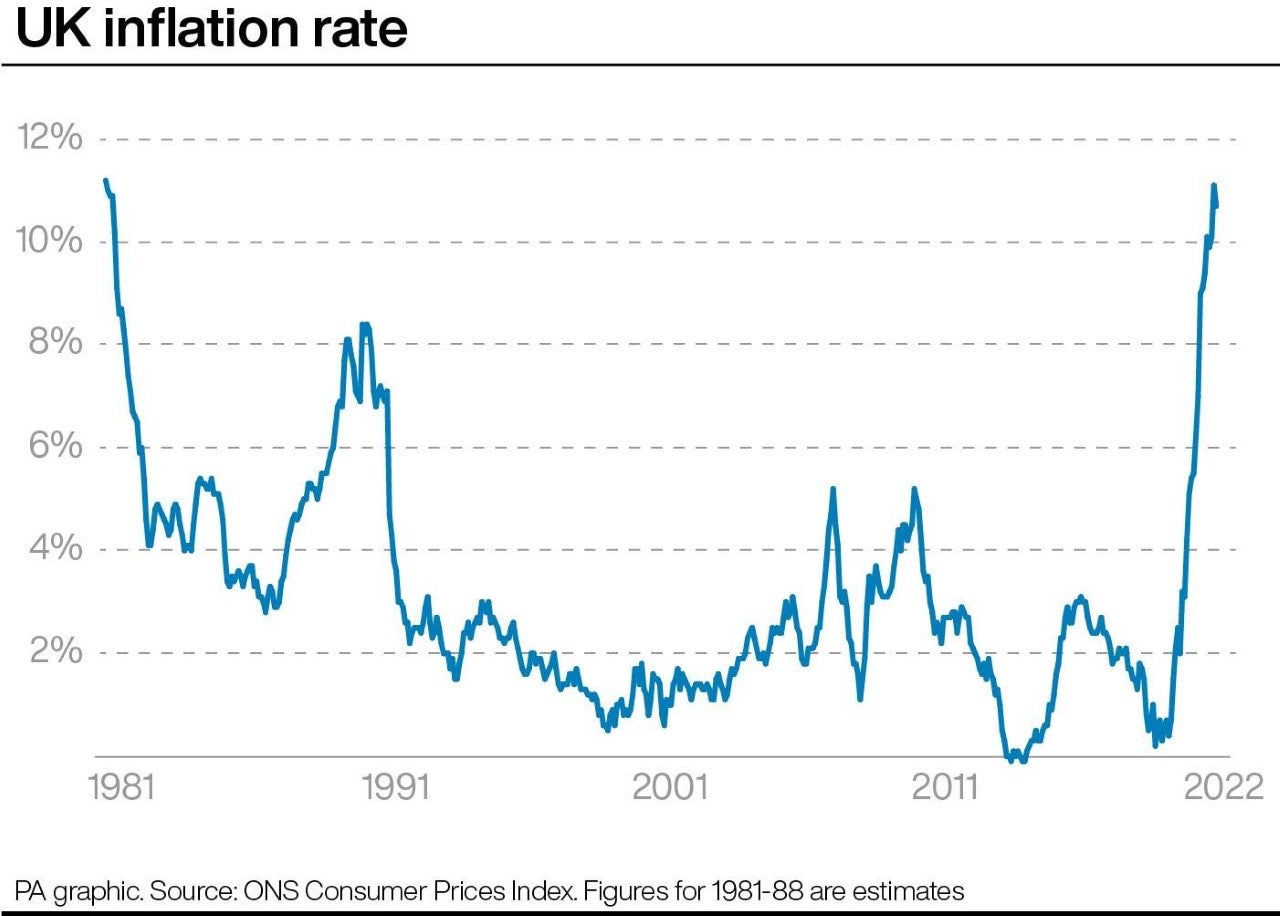

It was the ninth time in a row that officials raised rates as they try to tackle inflation, currently running at 10.7 per cent - down slightly from 11.1 in October but still at historically high levels.

Higher interest rates will bring fresh pain for mortgage holders on deals linked to the Bank’s base rate, while those with fixed rates set to expire soon will have to refinance at higher rates.

Mortgage expert - rate hike not all bad news

Today’s base rate hike is not all bad news, according to a mortgage expert, who says that prices are coming down for people not on tracker deals.

Thomas Jackson, managing director for Tauton-based firm Cooper Associates Mortgages, said several lenders have already announced rate reductions ahead of the Bank hike.

He said: “Differently to the previous interest rate increases, today’s announcement comes with more positive news for homeowners.

“Since late October, mortgage rates have only continued to reduce, even with a base rate rise taking place in November and predictions of another increase today. Ahead of today’s announcement, several lenders have already announced rate reductions of up to approximately 0.4 per cent.”

“For those homeowners who are approaching renewal of their mortgage in the next six months, it’s still crucial to begin the application for re-mortgaging as soon as possible.”

He added: “People can submit their mortgage application six months in advance of their remortgage date; however, having the conversation about re-mortgaging with a financial adviser can happen eight-nine months before a re-mortgage is due.

“By organising re-mortgage options as early as possible, homeowners are able to prepare and plan for the inevitable increase to their mortgage cost (if keeping repayment strategy the same) or restructure their borrowing to assist with affordability and budgeting.”

Union - Bank was ‘wrong’ to hike interest rates

The Bank of England made the “wrong choice” in hiking interest rates for the ninth consecutive time, a union has claimed.

Sharon Graham, Unite general secretary, said: "The Bank of England’s leadership continues to make the wrong choices.

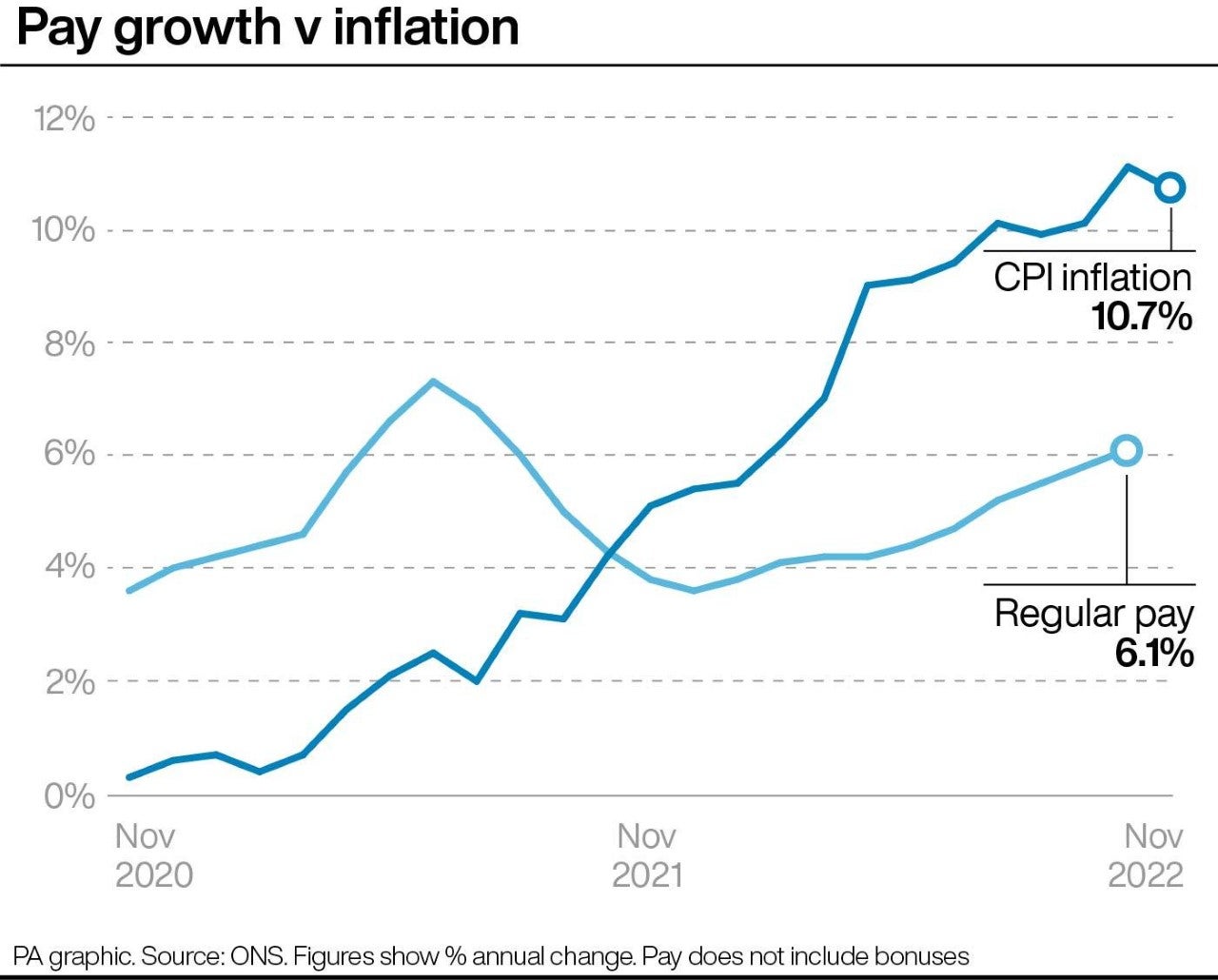

"First, they call on workers not to ask for pay rises. Now, they inflict yet more pain during this cost-of-living crisis while the profiteers, who are the real drivers of inflationary price rises, are let off the hook yet again.”

She added: "Millions are already struggling and by raising interest rates further the Bank of England is adding even more to that pain.

"For many this rise could be the straw that breaks the camel’s back.

"The Bank of England doesn’t have to do it and its leadership should be held responsible for the consequences."

Labour: ‘More evidence’ government has ‘lost control’ of economy

Labour has claimed that today’s base rate hike is “more evidence” that the government has “lost control of the economy.”

Rachel Reeves, the shadow chancellor, said: “This is yet more evidence that the government have lost control of the economy, harming growth and leaving millions of working people paying a Tory mortgage penalty for years to come.

“Only Labour will stabilise our economy and get it growing.”

Lib Dems: ‘More pain’ for struggling families

The Bank’s rate hike means “more pain” for families already struggling with the cost of living crisis, the Liberal Democrats have said.

Sarah Olney, the party’s Treasury spokesperson, said: "This is the nightmare before Christmas for families already struggling with the cost-of-living crisis.

"This government’s complete and utter failure to control inflation and their disastrous mini-Budget have led to mortgage payments soaring at the worst possible time of year.”

She added: "With so many not coping with high energy bills, this latest rate rise is yet more pain."

She reiterated the party’s call for the government to bring in a temporary ban on home repossessions, a mortgage rescue fund to support those hardest hit, and a ban on no-fault evictions for renters.

Chancellor: ‘I know this is tough for people’

Chancellor Jeremy Hunt has said he recognises that the Bank’s latest interest rate hike will be “tough for people”.

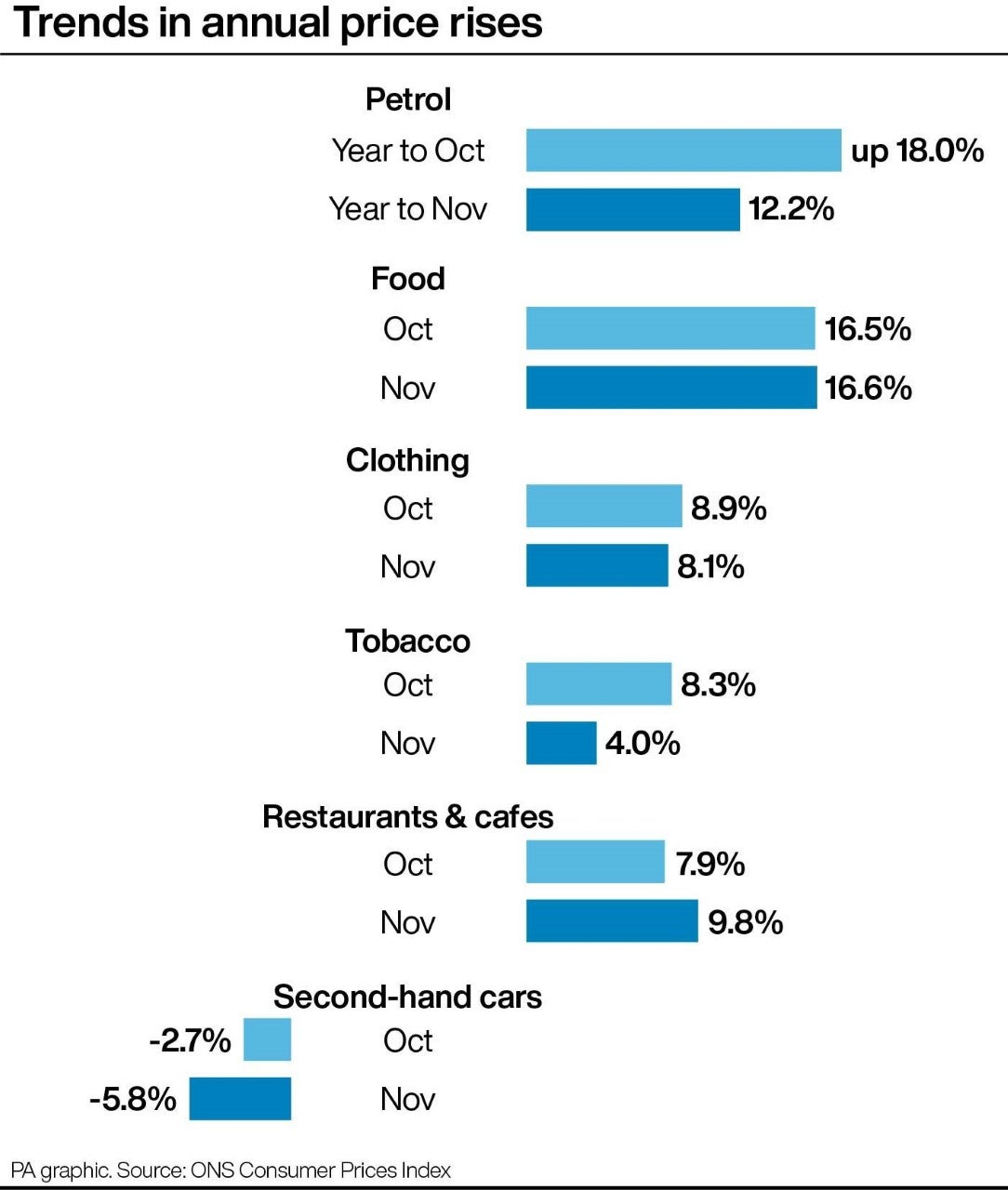

Mr Hunt said: "High inflation, exacerbated by Putin’s war in Ukraine, continues to plague countries across the world, eating into people’s pay cheques and driving up food and energy prices.

"I know this is tough for people right now, but it is vital that we stick to our plan, working in lockstep with the Bank of England as they take action to return inflation to target.

"The sooner we grip inflation the better. Any action which risks permanently embedding high prices into our economy will only prolong the pain for everyone, stunting any prospect of economic recovery."

GDP to decline by 0.1% in final quarter - Bank

The Bank of England has said it now expects UK GDP to decline by 0.1 per cent in the final quarter of 2022, which is 0.2 percentage points stronger than expected in last month’s report but would still show the UK entering a technical recession.

It added that household consumption has remained "weak" and it has seen the housing market "continue to soften".

Market reaction: Pound ‘highly volatile'

A City analyst has said the pound is “highly volatile” in the aftermath of the Bank’s latest interest rate hike,

Naeem Aslam, chief market analyst at AvaTrade, said: “Sterling is highly volatile after the Bank of England’s [announcement], which increased the interest rate as per the market expectations of 50 basis points.

“The fact that BOE members are not on the same page with respect to the bank’s monetary policy has created more confusion for traders.”

He added: “With rates moving higher, the cost of living crisis is going to cripple further, and it would have a further adverse influence on the UK economy.

“This is another reason that the Sterling moved lower on the back of the bank’s decision.”

Bank hikes base rate to 3.5%

Six members of the Bank of England’s nine-strong Monetary Policy Committee voted to raise its interest base rate from 3 per cent to 3.5 per cent

However, two members of the committee - Swati Dhingra and Silvana Tenreyro - voted in favour of holding rates at 3 per cent

Another member, Catherine Mann, called for a firmer 0.75 percentage point increase, at the meeting held on Wednesday.

Graphs show inflation, interest rates and wage levels down the years

What are interest rates and how do they affect you?

Not up to speed on interest rates on how they affect people’s finances?

Here is a quick guide written up following the Bank’s last interest rate hike in November:

All you need to know about interest rates and how they affect you

Bank of England implements biggest hike in more than 30 years

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies

Comments