Deep trouble: for most electric vehicle makers, the seabed remains off limits

There’s a vast source of battery components at the bottom of the ocean but with the jury out on the damage extraction could cause, auto companies are steering well clear, says Evan Halper

As car manufacturers scour the planet for the metals it will take to build tens of millions of electric cars, they are deliberately taking a detour around one of the only places on Earth where so much of what they need is lying around and available to be plucked.

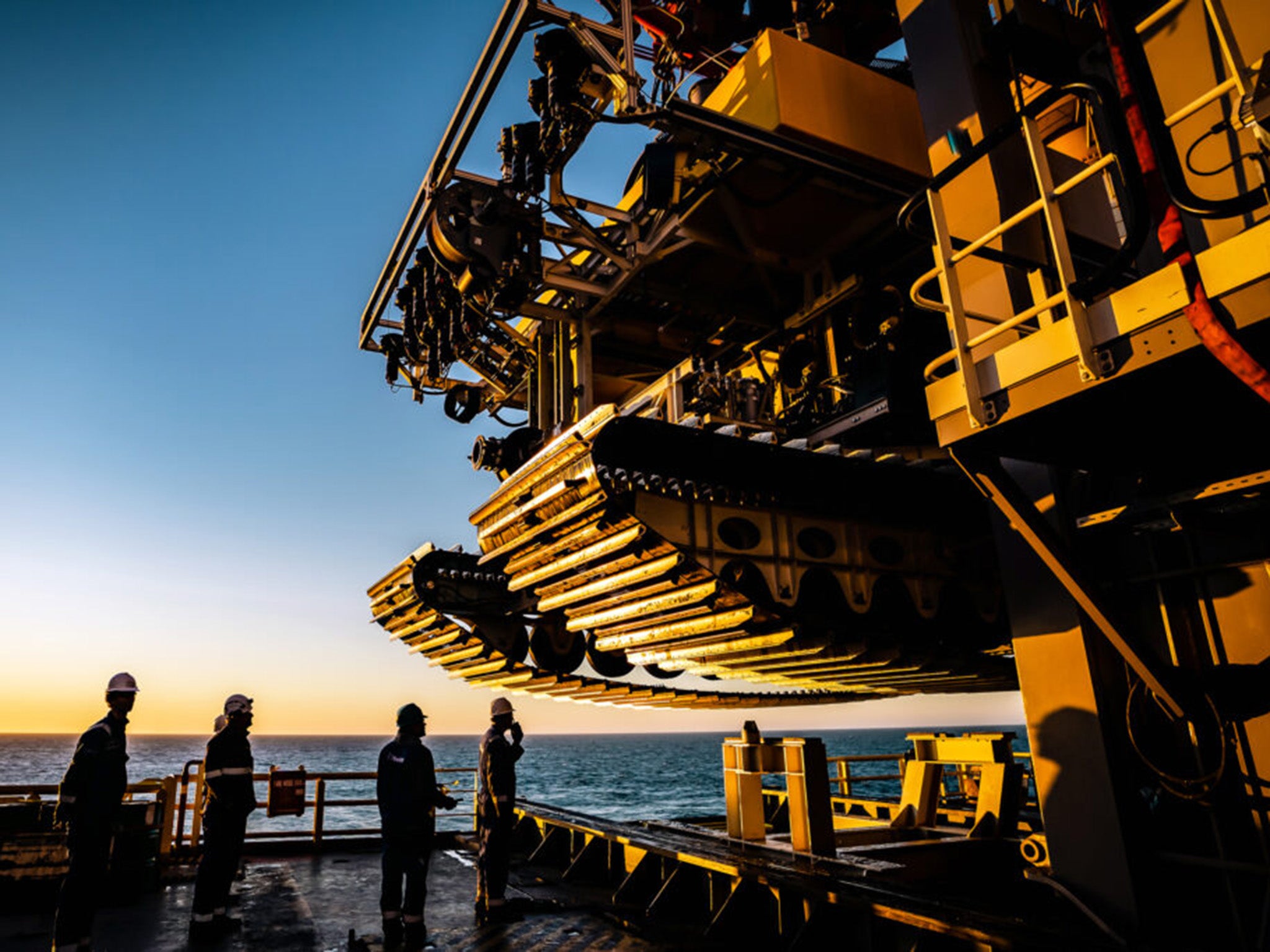

The deep seabed is teeming with potato-sized rocks packed with the nickel, cobalt, copper and manganese EV manufacturers covet. But efforts by mining companies to harvest the nodules with undersea robots are hitting rough waters. EV manufacturers who need the minerals for their batteries are distancing themselves from the practice as diplomats and scientists sound an alarm over the ecological damage that could be caused by rushing to scrape the sea floor.

The misgivings of the auto companies are hardly assuaged by the messy, contentious deliberations over it all at the headquarters of the United Nations-chartered International Seabed Authority (ISA) here in Jamaica. The authority, tasked with protecting and guiding development in international waters, has been in turmoil since the small Pacific Island nation of Nauru invoked a clause tucked in the Law of the Sea that could allow mining within months, likely before the full environmental impact is known or regulations are put in place.

The saga of the seabed is a cautionary tale for the carmakers and their contractors as they race to fulfill a promise of pairing the EV revolution with a new era of sustainable and ethical supply chains. The fight against climate change will push the number of EVs on the road worldwide from 30 million now to about 300 million by 2030, according to the International Energy Agency. Securing materials to build them all is perilous for car manufacturers, in part because the mining required threatens new ecological damage and human rights problems that can sink an auto company’s reputation. The seabed brings its own risks.

“Mining on the scale they are talking about will cause significant harm to some of the only ecosystems we have that are close to pristine,” says Diva Amon, a research scientist at the University of California at Santa Barbara who studies the deep ocean. “Some are incredibly important to the habitability of the planet and home to huge amounts of biodiversity that we don’t yet even know or understand.” More than 700 marine scientists have signed a petition demanding a moratorium, which is also supported by 13 countries. French president Emmanuel Macron is calling for a permanent ban.

At the March meeting of the seabed authority council, composed of representatives from 36 countries, many delegates searched for a legal path to put an indefinite pause on seabed mining. It is unclear if any such “precautionary pause” is possible under the UN Convention of the Law of the Sea, which was modified in 1994 to give countries like Nauru a route to begin mining if the process of developing rules drags on too long. If permits are granted, it is unclear who would buy the nodules.

“Auto companies don’t want EV batteries associated with more destruction than they already have been,” says Ethan Elkind, director of the climate programme at UC Berkeley’s Center for Law, Energy and the Environment. “There has already been a lot of negative publicity around the mining for these metals: human rights abuses, child labour, deaths from mines collapsing. You can imagine the risk with the deep sea. If ecological damage of these sensitive undersea areas comes to light after mining begins, they don’t want to be a part of it.”

Some car manufacturers, including BMW, Renault, Rivian, Volvo and VW publicly support a moratorium on seabed mining. GM, Ford and Daimler are, for now, keeping deep seabed materials out of their supply chain plans amid corporate concerns about environmental impact.

You’re driving an electric vehicle hoping to make a positive impact on the planet, but if you’re ripping up the rainforests and using child labour to procure those metals it is a bit of a juxtaposition

This is not what the mining company at the centre of this fight envisioned. The Metals Company, Nauru’s corporate partner, launched its crusade to mine the seafloor with promises that it could help car companies avoid the unsavoury environmental and public relations issues created as they shift supply chains toward EV production. The firm showcases giant robots that would lumber across the seafloor, scooping up the same metals far from human civilisation. It estimates there are enough nodules in the area they want to mine to produce 280 million car batteries.

“You’re driving an electric vehicle hoping to make a positive impact on the planet, but if you’re ripping up the rainforests and using child labour to procure those metals it is a bit of a juxtaposition,” says Gerard Barron, CEO of the Metals Company. “We believe that the massively reduced environmental and societal impacts of making battery metals from polymetallic nodules mean that consumers would rather buy products that are made with our metals.”

But the seabed creates another conundrum. Most of the species in this dark area far out in the Pacific where the nodules are most plentiful have yet to be discovered. Some of them live on the nodules, or feed off nutrients they sustain.

The area of international waters most coveted for mining – a 3,100-mile stretch out in the Pacific known as the Clarion-Clipperton Zone – is so vast, and research into mining’s potential impacts so costly, that the authority has struggled to develop workable regulations. Delegates on the authority’s council say it is nowhere close to completing that work. But if the Nauru partnership applies for a permit later this year, the authority could be legally required to grant it.

“There is no provision in the convention for a pause,” says Barron.

Barron and Nauru may soon have the right to mine. What they do not have is a single contract with a car manufacturer.

Even Ford and GM, which have not signed a moratorium, are pledging to get their metals from companies that can meet the standards of an independent group called the Initiative for Responsible Mining Assurance, or IRMA, which assesses mining operations for their sustainability. IRMA said in a statement that it currently sees too many risks and unknowns associated with deep-sea mining to allow its system to be used by contractors involved with it.

It seems a reversal of fortune from just a few years ago, when the Metals Company, operating in an earlier incarnation called DeepGreen, attracted considerable Wall Street interest. The company and its backers cited forecasts that suggested all the land-based mines in the world are not equipped to meet the demand spurred by EV production.

Yet, in this fast-moving energy transition, forecasts can change. Battery technology is rapidly evolving, as are mining techniques. Auto companies are increasingly investing in recycling efforts and repurposing materials discarded from other industrial uses for battery production. “It is so uncertain where things are going,” says Ian Lange, director of the mineral and energy economics programme at Colorado School of Mines. “There are a lot of changes that can still happen. It is hard to call anything in a battery right now crucial for the future of automobiles.”

Barron himself acknowledges that environmentalists “scored a good little punch to the ribs by getting those car manufacturers to sign the moratorium.” Yet he’s nowhere close to giving up.

“I don’t think you should look at who’s on that moratorium list,” he says. “You should look at who is not on it.”

Ford referred a reporter to IRMA’s statement warning against seabed mining. GM emailed a statement that suggested seabed metals are off the table until IRMA or a group like it can create “a single common standard and framework that leads to a data-driven evaluation” of its “environmental footprint”.

That could take years or even decades, at which point the Metals Company could be out of time. It is fast running through its cash. The company’s hopes of a bottomless chequebook collapsed after its biggest would-be investor never delivered on a $200m pledge.

The Metals Company could face significant cash-flow issues if it does not get a mining licence by early next year, according to Dmitry Silversteyn, a senior analyst at Water Tower Research. Yet Water Tower is advising investors to stick with the Metals Company.

The plans by car manufacturers to sell hundreds of millions of EVs, Silversteyn says, “are meaningless without the metals necessary to build these batteries. This is the biggest, the cleanest, the least environmentally impactful and most economical resource for nickel, manganese and cobalt that we know of”.

The Metals Company does have powerful allies. A promotional video shot back in 2018, when the company was still called DeepGreen and courting investors, included Michael Lodge, the secretary general of the authority. Lodge wore a hard-hat with a company logo, and spoke of the need to open up mining on the seabed. Lodge says he was a guest on the ship and the video was not meant to be an endorsement.

The bullish posture Lodge has taken toward opening the seabed to exploitation was a point of tension at the March meeting of the authority’s council, where several delegates and observers complained the secretary general steered the council toward fast-tracking approval. “These lawyers, particularly Lodge, are so cunning that it makes you feel helpless,” says Sandor Mulsow, who left his post as the authority’s top environmental official in 2019, after accusing the organisation of shoddy environmental oversight.

Lodge declined requests for an interview. The authority said in a statement that “decision-making at ISA reflects the will of member states and is based on consensus”.

That consensus is proving elusive.

© The Washington Post

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies

Comments