Whether Boris Johnson, Rishi Sunak, Keir Starmer or someone else is at the helm, the government is going to face some unenviable and unpalatable choices. Paul Johnson, director of the Institute for Fiscal Studies, has told The Independent the country must choose between higher taxes for the next 20 years or cutting back the welfare state because it faces a spending black hole of £60bn each year.

He said an ageing population would force politicians to choose between the approach of other western European countries – increasing taxes by another 2-3 per cent of national income – or paring back basic education, health and social care services.

A rise in national insurance contributions, together with increasing energy and council tax bills, will provide a “triple whammy” for many already hard-pressed households in April. The word “crisis” is overused by politicians and the media, but on this occasion it is no exaggeration: the cost-of-living crisis looks set to become the dominant political issue of this year.

Almost two in three workers expect their pay to rise by less than the cost of living this year, according to a Britain Thinks poll for the TUC published today. Three in 10 do not believe their wages will increase at all and only one in 10 expects a rise that will exceed living costs.

As if the government did not have enough on its plate, the British Chambers of Commerce is warning the Treasury of a “cost of doing business crisis”. Its survey of more than 1,000 businesses found that 73 per cent say they are raising prices in response to increasing costs, which the organisation warned would fuel the cost-of-living crisis for households.

These short-term pressures will require a more proactive and generous response than the government has managed to date; spreading the rise in gas and electricity prices over five years will bring only small comfort, and bills could rise again in the autumn.

In the medium term, the pressures on households and business from higher taxes are likely to grow. The IFS’ warning is underlined by a study today by the Resolution Foundation think tank which suggests demographic pressures will add £24bn to state pension spending, and rising health costs a further £52bn to the health budget by 2030. The transition to net zero could cost another £12bn. Overall, the size of the state could rise from 42 per cent to 44 per cent by the end of this decade.

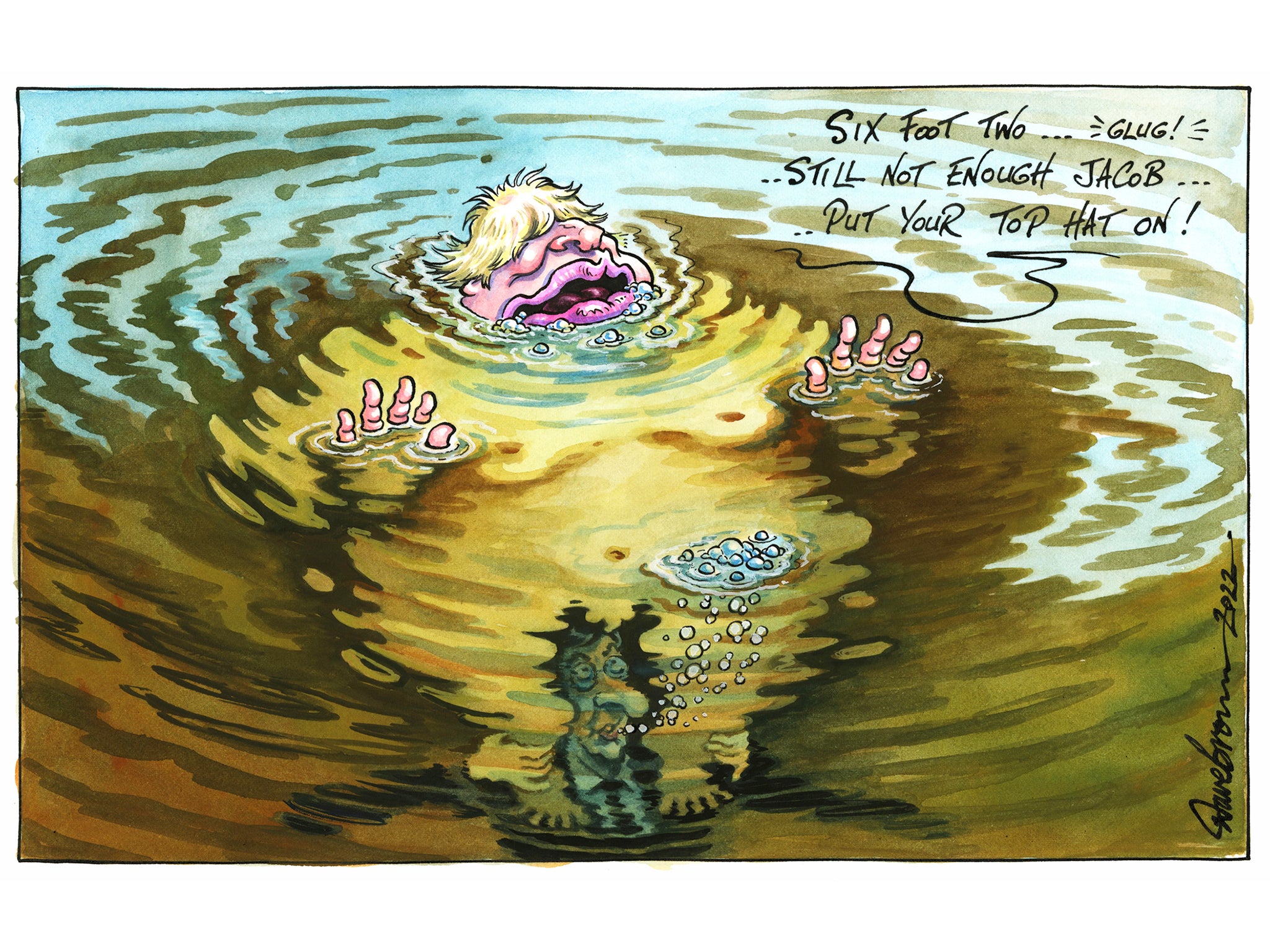

Such gloomy but realistic predictions should act as a reality check when Mr Johnson dangles the prospect of tax cuts before the next general election in front of Tory MPs as part of his struggle to hang on to his job. And when Mr Sunak plays along, knowing he might soon be contesting a Tory leadership election in which he would parade his credentials as a fiscal conservative and instinctive tax-cutter despite his recent actions. Whatever the state of the public finances, the Tories seem to have foolishly locked themselves into pre-election income tax cuts in an attempt to wrong-foot Labour.

To keep up to speed with all the latest opinions and comment sign up to our free weekly Voices newsletter by clicking here

The political debate on tax is dishonest. National insurance has shouldered the burden of tax rises since 2000 and has more than doubled as a share of GDP since the Second World War. At the same time, Tory and Labour governments have announced headline-grabbing cuts in income tax, knowing that voters are more willing to support higher national insurance for health and social care because of its original contributory principle.

Given the inevitable demands on vital public services in future, it would be fairer to raise income tax for higher earners than to increase the burden of national insurance, which starts to bite when workers earn £9,568 a year.

Alternatively, politicians should be ready to raise more from taxes on wealth, which has grown from three to almost eight times the value of national income in the past 40 years. Labour has dipped a toe in this water but is wary of Tory attacks on a single “wealth tax”. However, if the UK is to have the public services it needs and to avoid deeply damaging, regressive cuts to the welfare state, it is a route down which politicians of all hues will probably need to go sooner or later.

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies

Comments