A week after the Budget, it’s clear that Rishi Sunak has a mountain of unfinished business

Sunak said there is ‘no playbook’ for the pandemic, but there is one for running the economy. Yet he received lukewarm reviews from three former members of the ex-chancellors club

Your support helps us to tell the story

From reproductive rights to climate change to Big Tech, The Independent is on the ground when the story is developing. Whether it's investigating the financials of Elon Musk's pro-Trump PAC or producing our latest documentary, 'The A Word', which shines a light on the American women fighting for reproductive rights, we know how important it is to parse out the facts from the messaging.

At such a critical moment in US history, we need reporters on the ground. Your donation allows us to keep sending journalists to speak to both sides of the story.

The Independent is trusted by Americans across the entire political spectrum. And unlike many other quality news outlets, we choose not to lock Americans out of our reporting and analysis with paywalls. We believe quality journalism should be available to everyone, paid for by those who can afford it.

Your support makes all the difference.A week after his Budget, it’s increasingly clear that Rishi Sunak has to climb a mountain of unfinished business that is now emerging through the fog of figures. Ministers admit privately the chancellor put off tackling the huge pressures on day-to-day public services until his government-wide spending review in the autumn.

The pressures are illustrated by two reports today by spending watchdogs. The National Audit Office warns a £600m black hole in local authority budgets due to coronavirus. Cuts could affect social care, buses and rubbish collection in what might feel like austerity passed down from Whitehall even though Boris Johnson claims to have buried it. As ever, ministers will cynically hope councils get the blame. The Commons public accounts committee reminds us that NHS test and trace will gobble up an “unimaginable” £37bn over two years without making a measurable difference to the fight against the pandemic.

After the Budget failed to provide a cash injection for health, NHS Providers have warned they urgently need an extra £8bn to avoid cuts to patient care. The miserly attempt to limit the NHS pay rise to 1 per cent continues to generate negative headlines. A growing number of Tory backbenchers think Sunak has chosen the wrong ground on which to parade his credentials as fiscally responsible; they sense another inevitable U-turn will be along in a minute.

Some Tories were disappointed Sunak did not boost infrastructure spending, which they see as vital to delivering the “levelling up” agenda. One senior Tory told me: “The Budget didn’t really explain how we will ‘build back better.’ There is an awful lot riding on the spending review. The real battles over money for public services have been postponed until the autumn.”

Sunak, who two years ago was still a junior local government minister, is still a relative novice on a super-fast learning curve. He points out there was “no playbook” for the pandemic. But there is one for running the economy and yet Sunak got rather lukewarm reviews from three members of the ex-chancellors club – George Osborne, Norman Lamont and Alastair Darling – who gave their verdict at an Institute for Government online event yesterday. In their different ways, they doubted whether Sunak’s sums will add up.

Osborne insisted the chancellor was doing “a pretty good job” but criticised his spectacular reversal of Osborne’s decision to bring down corporation tax from 28 per cent; it will now rise from 19 per cent to 25 per cent in 2023. Osborne disputed Sunak’s claim that cutting it had not boosted Treasury revenues, warning that Sunak’s hike would mean “sending a message around the world that Britain is not a particularly enterprising or pro-business place at the very moment when you want to be encouraging that in a recovery”. Interestingly, Osborne suspected Sunak would have preferred to increase VAT (as he and Lamont did) but was “constrained” by the Tory manifesto pledge not to raise it.

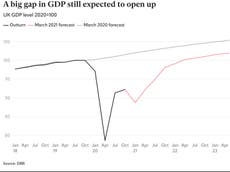

Lamont warned the Budget arithmetic pointed to a very tight squeeze on public spending. "I personally will be surprised if these tax increases are the last tax increases we see in order to deal with the problem of the current deficit in the short-term,” he said.

Darling, the former Labour chancellor, predicted the government would need to raise more money for day-to-day running costs (notably on health and education), to slowly reduce debt and help the “left behind.” He described “levelling up” as “a 30-year project”.

As Osborne, Lamont and Darling agreed, being a popular chancellor is not easy when you have to raise taxes. “The only popular tax rise is one somebody else pays,” Darling said. “If there is one loser, you will hear from them night and day; you will not hear from those who gain.”

That is ominous for Sunak: what if voters don’t thank him for spending £352bn to get the country through the crisis, but start to turn against him when their tax thresholds are frozen in a year’s time?

Although Sunak still rides high in the Tory popularity stakes for now, whatever he decides on further tax rises or spending cuts will make it hard to retain his position. At the back of his mind will be his fate when he joins the ex-chancellors club and the maxim of another member in Gordon Brown: “There are only two types of chancellor, those who fail and those who get out in time.”

Now that Tory talk of Johnson quitting before the next general election has evaporated amid his opinion poll bounce, Sunak might have a long and perilous wait before he can contemplate moving from No 11 to No 10.

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies

Comments