The 2021 Budget in charts

The big economic judgement in the projections of the Office for Budget Responsibility was that the rebound of the economy will be ‘swifter and more sustained’ than it expected in November. But what else did the new forecasts show?

Your support helps us to tell the story

From reproductive rights to climate change to Big Tech, The Independent is on the ground when the story is developing. Whether it's investigating the financials of Elon Musk's pro-Trump PAC or producing our latest documentary, 'The A Word', which shines a light on the American women fighting for reproductive rights, we know how important it is to parse out the facts from the messaging.

At such a critical moment in US history, we need reporters on the ground. Your donation allows us to keep sending journalists to speak to both sides of the story.

The Independent is trusted by Americans across the entire political spectrum. And unlike many other quality news outlets, we choose not to lock Americans out of our reporting and analysis with paywalls. We believe quality journalism should be available to everyone, paid for by those who can afford it.

Your support makes all the difference.The chancellor, Rishi Sunak, has unveiled his second Budget.

Much of it – including a return of help-to-buy subsidies, and an extension of the furlough scheme – was briefed in advance.

But here The Independent presents the story of the 2021 Budget in charts.

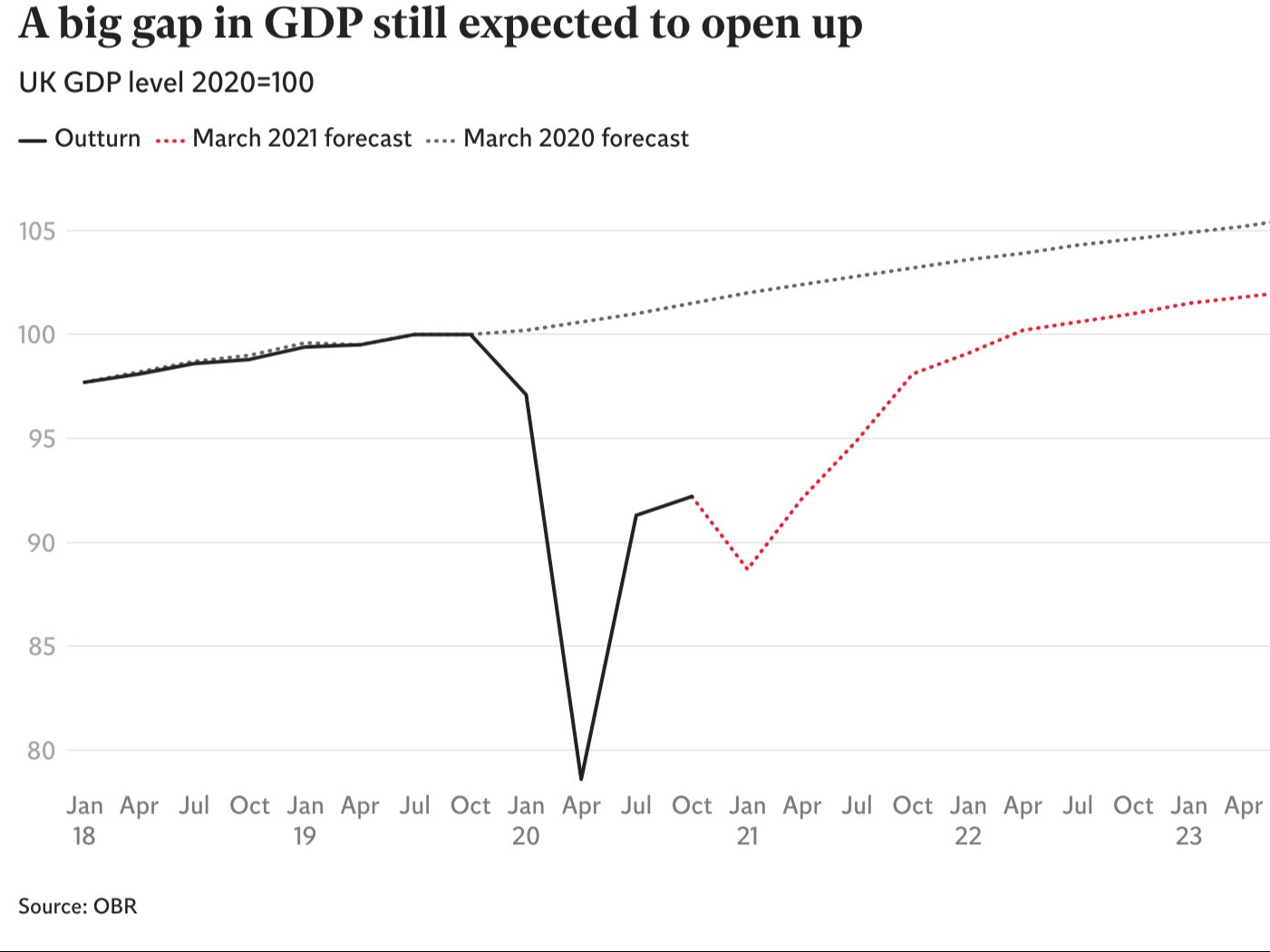

The big economic judgement in the projections of the Office for Budget Responsibility (OBR), the Treasury’s independent forecaster, was that the rebound of the economy will be “swifter and more sustained” than it expected in November.

This is thanks to the impressively rapid rollout of vaccines and the expectation that there will be a consumption boom as wealthier households start to draw down their savings accumulated in lockdown.

Growth this year is projected to be lower as a result of the current lockdown, but in 2022 it is expected to hit 7.3 per cent, up from the previous forecast of 6.6 per cent.

The OBR also expects lower unemployment than it projected in November, due in part to that stronger recovery but also the extension of the furlough scheme to September.

It now sees joblessness peaking at 6.5 per cent at the end of 2021, rather than 7.5 per cent as predicted in November.

And that rate would be far lower than the 12 per cent it presented in a scenario in July 2020, which was based on the assumption that the furlough scheme would have come to an end by autumn.

Despite the downward revisions about the near term, the OBR is still rather pessimistic about the longer term.

As in November, it still sees long-term scarring of the economy, adding up to 3 per cent of GDP relative to pre-pandemic expectations.

That scarring results from lower business investment and damage to workers’ skills over the past year.

The chancellor announced about £60bn of extra near-term financial support for households and businesses.

But he is also planning to start raising taxes from 2022-23 and additionally, despite claiming that austerity is over, to trim department’s budgets by about £4bn a year relative to previous plans.

Those tax rises are mainly made up of an increase in the headline corporation tax rate and a freeze in income tax thresholds, which will drag more people into higher rates.

It will bring the share of total national income taken in tax to 35 per cent.

That will help the deficit fall faster than projected in March, with borrowing down to 2.9 per cent in 2024-25, rather than the 3.9 per cent projected in November.

However, many analysts, including the OBR, are rather sceptical of the chancellor’s ability to deliver that, given he has budgeted for no further public spending increases, despite the huge pressure on public spending created by and also revealed by the pandemic.

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies

Comments