Bitcoin price resurgence revives ‘digital gold’ comparisons

Analysts say crypto’s comeback boosts credentials as safe-haven asset

Bitcoin’s recent price revival has once again bolstered the cryptocurrency’s reputation as a form of “digital gold” among some analysts, who claim it serves as a safe-haven asset during times of geopolitical and economic crisis.

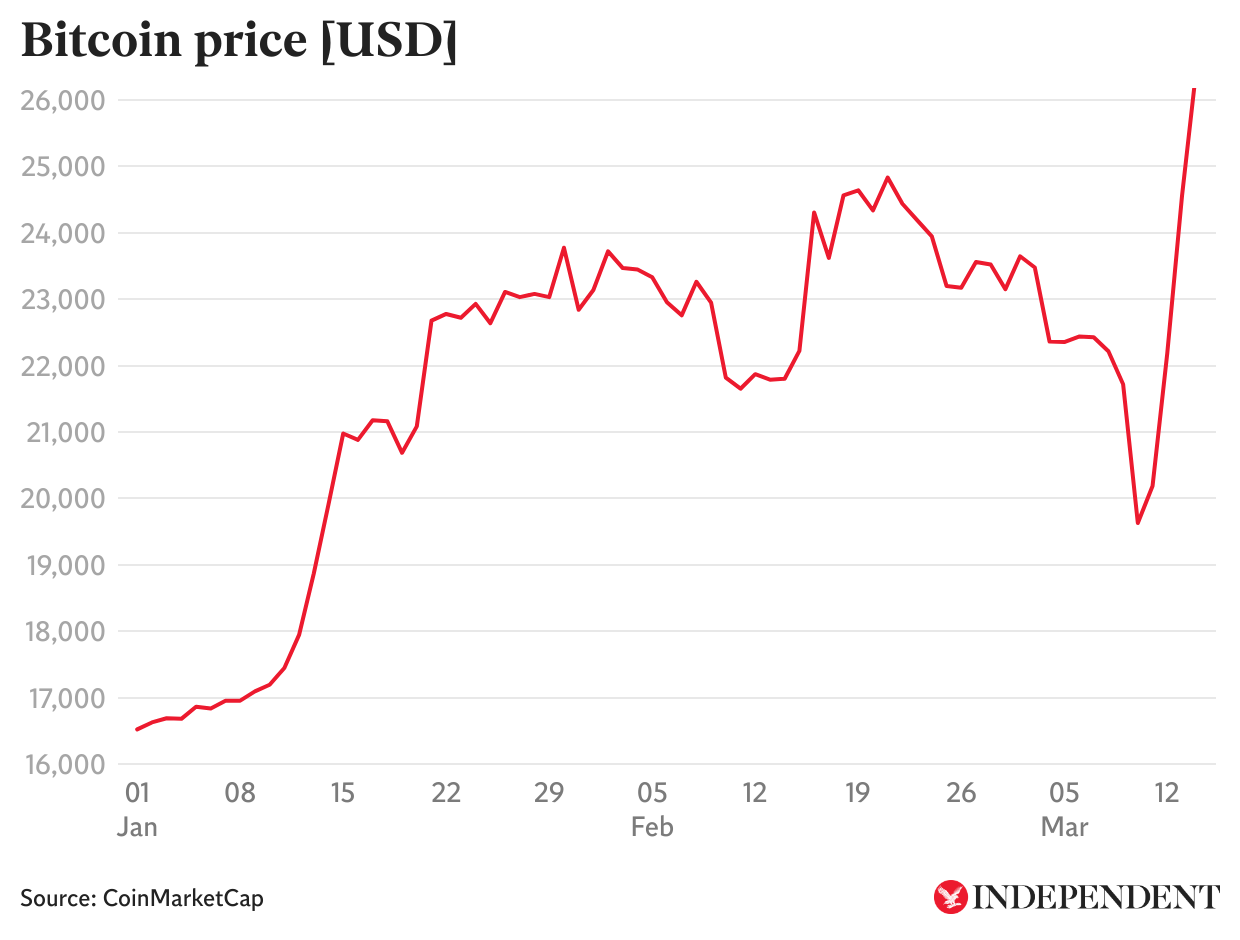

The world’s leading cryptocurrency is up more than 10 per cent over the last week, despite turmoil among the banking and tech sector.

Bitcoin’s price trajectory actually mirrored that of gold’s during the collapse of Silicon Valley Bank (SVB) earlier this week, having previously followed a similar path to stocks.

Crypto analyst and author Glen Goodman said it was “fascinating to see bitcoin break away from its correlation with stocks... and instead align itself with gold.”

He added: “Has the ‘BTC is a store of value, its digital gold’ narrative returned? Clearly [the SVB collapse] has shaken faith in traditional banks.”

Nigel Green, CEO of financial consultancy firm deVere Group, said that long-term inflation of the US dollar and other fiat currencies could also see bitcoin’s function as a stable store of value – it has a fixed supply of 21 million coins – continue to be realised over the coming years.

“Investors are looking for alternative currencies, such as cryptocurrencies,” he said. “Moving forward, these will increasingly compete with traditional, fiat ones, and this will help trigger the decreasing dominance of currently leading international currencies.”

While those within the crypto industry blamed the banking problems on issues with centralised financial systems, others blamed the banks’ involvement with digital assets.

“As the impact of FTX’s collapse continues to ripple outward, today we are seeing what can happen when a bank is over-reliant on a risky, volatile sector like cryptocurrencies,” said Senator Sherrod Brown, chair of the Senate Banking Committee.

“As the bank of choice for crypto, Silvergate Bank’s failure is disappointing but predictable.”

Crypto figures disuputed this assessment, claiming that the bank’s collapse was a result of not having enough cash to back up depositors demands.

Marcus Sotiriou, a market analyst at the publicly listed digital asset broker GlobalBlock, said Silvergate’s demise “was not a crypto problem”, claiming that there was bias among some politicians towards the traditional financial sector.

“There is a clear agenda, in my opinion, against all crypto businesses from US politicians,” he said.

“We could well see companies that provide digital asset trading infrastructure move offshore because of this stance.”

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies

Comments