Europe buying Russian oil via India at record rates in 2023 despite Ukraine war

India is benefiting from importing cut-price Russian oil amid European sanctions – and also selling that same oil to EU markets at full price once it has been refined

Your support helps us to tell the story

From reproductive rights to climate change to Big Tech, The Independent is on the ground when the story is developing. Whether it's investigating the financials of Elon Musk's pro-Trump PAC or producing our latest documentary, 'The A Word', which shines a light on the American women fighting for reproductive rights, we know how important it is to parse out the facts from the messaging.

At such a critical moment in US history, we need reporters on the ground. Your donation allows us to keep sending journalists to speak to both sides of the story.

The Independent is trusted by Americans across the entire political spectrum. And unlike many other quality news outlets, we choose not to lock Americans out of our reporting and analysis with paywalls. We believe quality journalism should be available to everyone, paid for by those who can afford it.

Your support makes all the difference.The EU’s imports of refined oil imports from India grew to record levels in 2023 at the same time as New Delhi’s imports of Russian crude oil more than doubled year on year.

It means consumers in Europe likely received unprecedented volumes of petrol, diesel, kerosene and other oil products that originate from Russia via India last year, in spite of the sanctions imposed after Vladimir Putin’s invasion of Ukraine.

India has made no secret of its willingness to buy Russian oil in spite of the Ukraine war, maintaining good ties with Moscow while it has also courted closer defence and trade partnerships with Western nations.

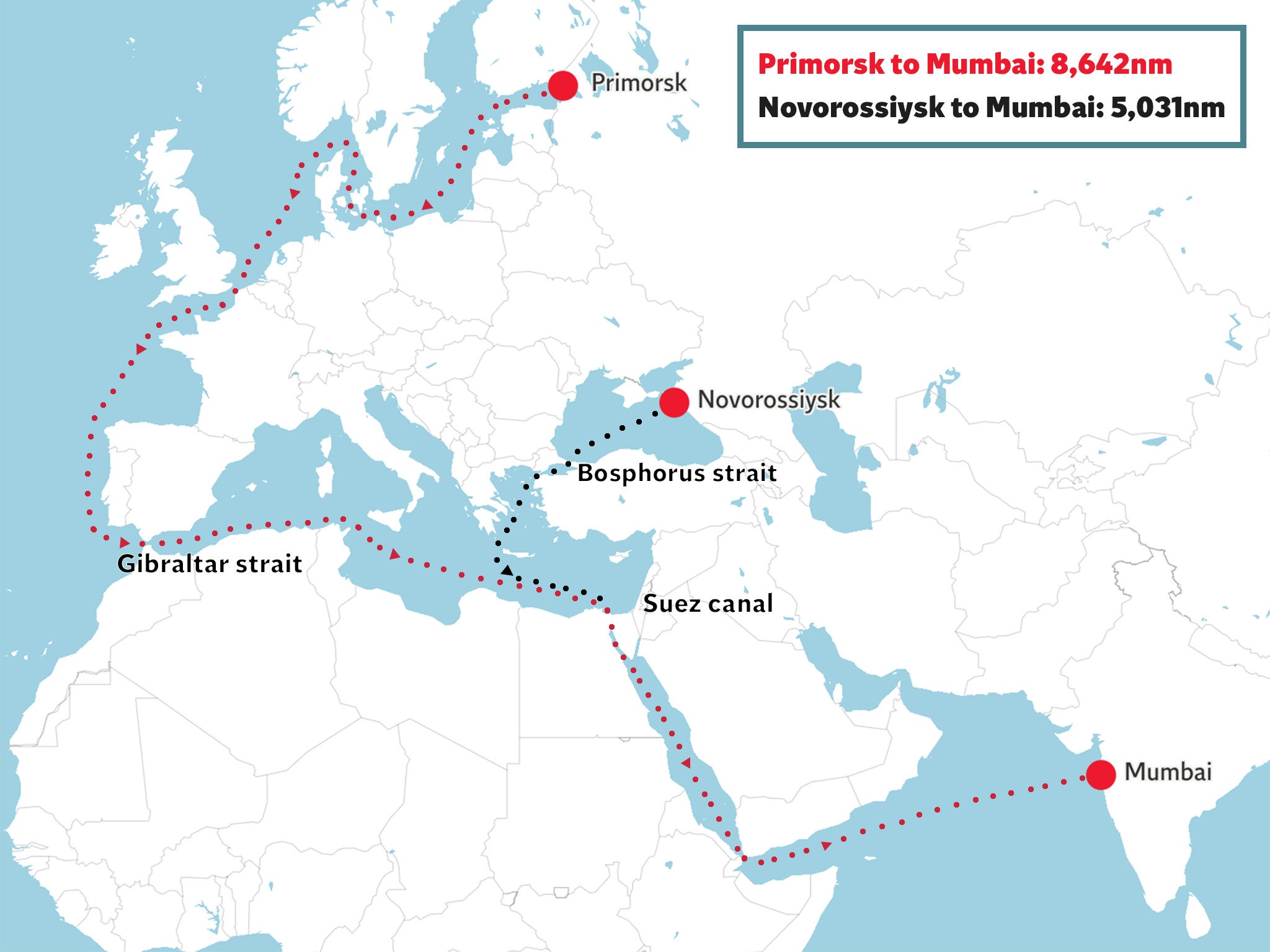

India became the world’s leading importer of Russian crude oil last year, according to Kpler market data analysed by The Independent, importing an average 1.75 million barrels per day at a 140 per cent increase on 2022.

At the same time, the European Union’s import of refined products from India soared by 115 per cent, from 111,000 barrels per day in 2022 to 231,800 barrels per day in 2023, the highest figures in the past seven years analysed by Kpler and most likely the highest ever.

“It has worked two-fold - India has been able to buy cheap oil for its refineries, then it has been able to refine that oil and sell the refined products at full price, and into a market (Europe) that is willing to pay up for them because it desperately needs to replace the loss of Russian material that it has applied sanctions on,” Kpler’s lead analyst Matt Smith, tells The Independent.

Oil revenues are the linchpin of the Russian economy, allowing Putin to fund his military and replenish defence budgets to sustain a war that is about to enter its third year.

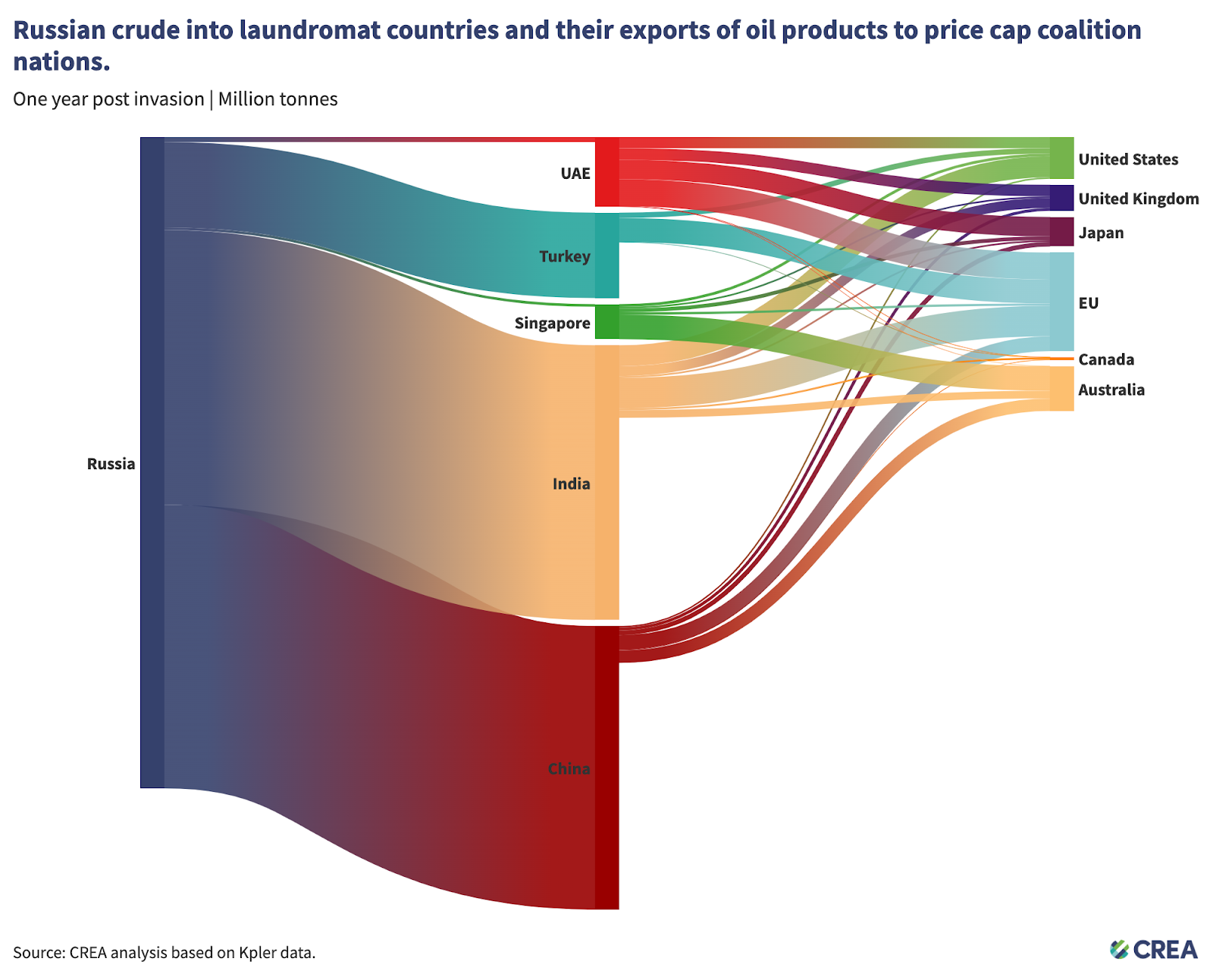

European countries, the G7 and Australia moved to try and prevent Putin using oil money to fill his war chest by enforcing tough sanctions on oil, including Russian refined oil products, and enforcing a $60 per barrel price cap on Russian sales to other countries using their ships and infrastructure.

The fact that barrels of oil originating in Russia are still rolling into Europe through a third market underscores the porousness of sanctions and the lack of robust enforcement measures.

Oil trade tracking companies say is impossible to distinguish which refined products originated from Russian materials once they have been refined in another country. But tracking the imports of crude oil and export destination of refined products from specific facilities can give a fair idea.

One such example was the Jamnagar Refinery in the Gulf of Kutch on India’s western coast, which is the leading destination for Russian crude arriving in India, according to Kpler.

The Reliance Industries-owned refinery accounted for 34 per cent of crude oil imports from Russia, receiving 400,000 barrels per day of, while it received 770,000 barrels per day from elsewhere.

And of the refinery’s exports in 2023, around 30 per cent headed to Europe.

“This is undermining sanctions, but it is also a grey area,” Mr Smith says.

“It is impossible to extricate Russian crude or products created from Russian material from the global market. Russia is also such a key player that the powers that the EU etc don’t want to completely eradicate Russian supply from the global market because it would cause prices to spike.“

Around 20 of the 27 EU countries imported refined products from India last year, with the Netherlands accounting for 24 per cent of the total volume.

It was followed by France which accounted for 23 per cent, Romania with 12 per cent and Italy and Spain with 11 per cent each. India also exported refined products like gasoline, jet fuel and diesel to Germany and Belgium with 7 per cent each.

Mr Smith says that the EU has been “walking a tightrope” between wanting to reduce funding to the Kremlin while making sure enough Russian supply is making its way onto the global market to avoid a price spike – which would be economically crippling for Western nations.

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies

Comments