MyPillow CEO Mike Lindell’s financial woes are only getting more desperate

Exclusive: Lindell told The Independent his cash flow problems feel like “having a gun to your head,” before becoming incensed that his false claims of voting machine fraud aren’t making new headlines.

Your support helps us to tell the story

From reproductive rights to climate change to Big Tech, The Independent is on the ground when the story is developing. Whether it's investigating the financials of Elon Musk's pro-Trump PAC or producing our latest documentary, 'The A Word', which shines a light on the American women fighting for reproductive rights, we know how important it is to parse out the facts from the messaging.

At such a critical moment in US history, we need reporters on the ground. Your donation allows us to keep sending journalists to speak to both sides of the story.

The Independent is trusted by Americans across the entire political spectrum. And unlike many other quality news outlets, we choose not to lock Americans out of our reporting and analysis with paywalls. We believe quality journalism should be available to everyone, paid for by those who can afford it.

Your support makes all the difference.When MyPillow founder Mike Lindell recently found himself in a cash crunch, he grasped for the only financial lifeline he could — but the unrepentant voting machine conspiracist now insists in a lawsuit that he was duped into an extortionate “bait-and-switch” that could very well ruin him.

In the other corner, Lifetime Funding, a Long Island, New York, company that provides non-traditional financing to businesses unable to get bank loans, is suing Lindell for allegedly refusing to pay back his debt of nearly $600,000, claiming he has intentionally blocked them from ever collecting.

Reached by phone on Thursday, Lindell promised to expose what he insisted is “very illegal” conduct by Lifetime and similar outfits, before veering abruptly into a bitter litany of complaints about mainstream journalists and what he sees as their collective refusal to entertain his fully debunked allegations of a rigged 2020 presidential election.

“We’re doing a big investigation into why this industry is out there,” Lindell told The Independent. “It’s like having a gun to your head for your business. It’s very sad.”

As a heated Lindell continued to rail against the “unregulated” merchant cash advance industry, which fronts companies a lump sum in exchange for an inflated slice of their future receivables, he insisted that he just wants to “make awareness of this industry, because they’ve got to be held accountable.” Lindell then repeated false claims about voting machine companies and supposed fraud in the 2020 race for the White House.

After Lindell launched a one-man crusade to “prove” Joe Biden four years ago stole the presidency from Donald Trump, he has been dropped by his attorneys over millions in unpaid bills, seen his company evicted from its Minnesota warehouse over unpaid rent, and claimed to have been stripped of all worldly possessions but his house and pickup truck.

Lindell has also been ordered by a judge to pay $5 million to a computer programmer who disproved his outlandish accusations of voter fraud, had his commercial credit line cut by 90 percent, and continues to fight multibillion-dollar defamation suits by Dominion Voting Systems and Smartmatic, America’s largest voting machine companies, over his false allegations they aided and abetted massive electoral fraud. Last month, he was sued by a California vendor for allegedly skipping out on invoices in the mid-six-figures.

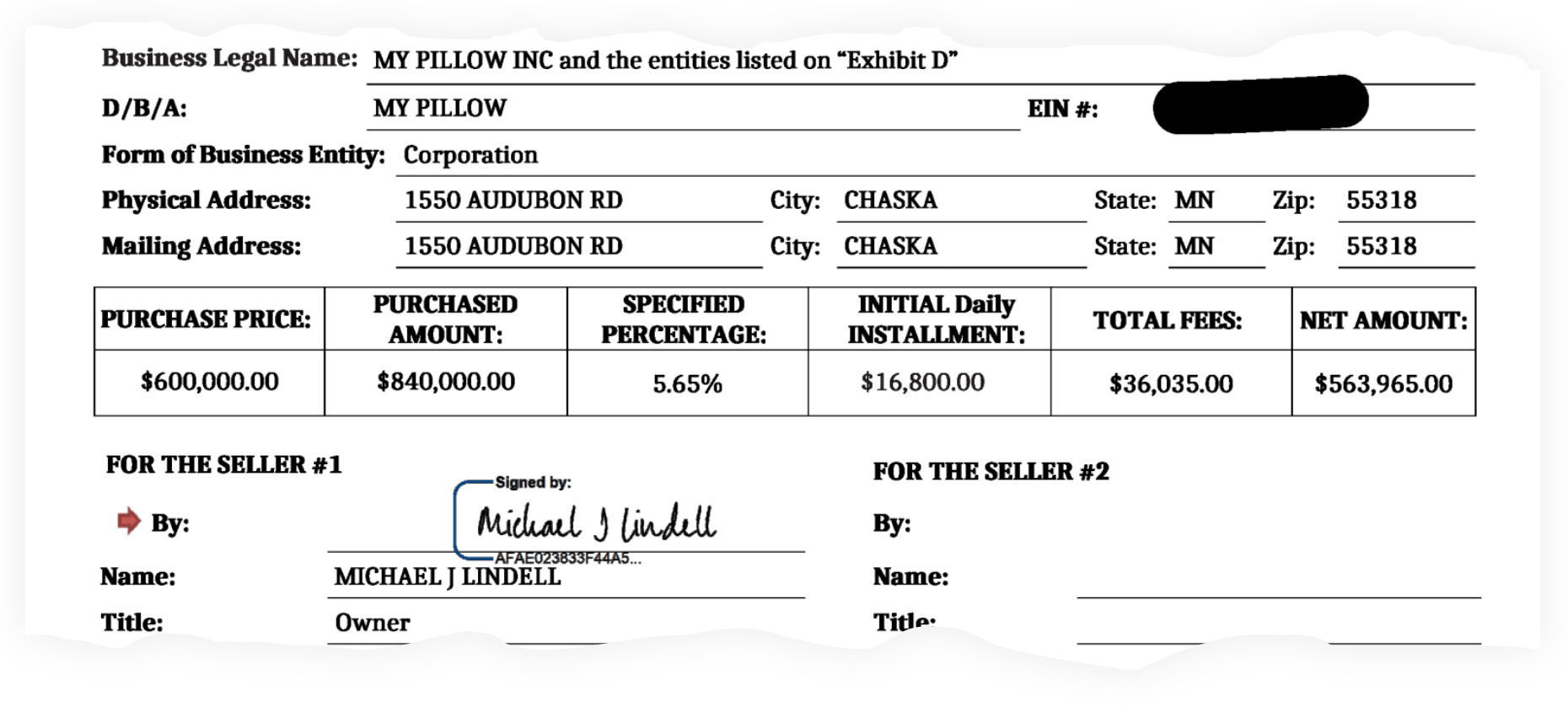

Lindell’s latest troubles began on September 19, when he personally guaranteed a $600,000 infusion from Lifetime Funding for $840,000 in future MyPillow receipts, according to a lawsuit Lifetime filed in New York State Supreme Court. It then began debiting MyPillow’s bank account, at a rate of $16,800 a day, which would continue until the $840,000 was paid off, the lawsuit goes on. It says Lindell promised, in writing, not to revoke Lifetime’s authorization to debit the account, or to “otherwise take any measure to interfere” with Lifetime’s ability to collect. However, on October 12, the lawsuit alleges, Lindell unilaterally placed a stop-payment order on the account that at once stopped all debits to Lifetime, according to the suit.

Although Lindell had already paid Lifetime $268,800 through October 11, the sudden move left $570,901 outstanding, which the company is now demanding Lindell fork over, plus interest and attorney’s fees.

In response, Lindell filed a lawsuit in Minnesota, where MyPillow is headquartered, against Lifetime and two other merchant cash advance providers, claiming they are, essentially, loan sharks who “prey upon the desperation of… businesses and their individual owners and are designed to conceal the fact that these transactions… are in reality usurious, illegal loans.”

Lindell, whose suit describes him as a current Texas resident, needed the money for a real estate purchase, according to the filing. Yet, it states, he never realized the effective interest rate on his repayment plan would come to a whopping 441 percent. The agreement is “one-sided and unconscionable,” and was designed to fail so Lindell would end up in default, to Lifetime’s own financial benefit, according to Lindell’s lawsuit. Lifetime, the suit argues, is coming for its money, “at grossly inflated rates[,] by hook or by crook.” (The agreement Lindell signed with Lifetime, which the company filed as an exhibit in court, shows an interest rate of 5.65 percent.)

Lifetime, for its part, argues that merchant cash advances are not loans, and that its practices are perfectly legal. Lindell, Lifetime’s suit alleges, is in default and he breached the agreement he willingly signed.

“We’re going after them,” Lindell told The Independent. “It’s all very illegal. There’s up to 1,000 percent interest, it breaks all kinds of laws.” (Merchant cash advances, also called “factoring” arrangements, are in fact not subject to usury laws.)

Lindell’s lawsuit accuses Lifetime of RICO violations and wire fraud, seeks to void the entire deal with Lifetime, and demands treble compensatory, direct, and consequential damages. Lifetime Funding officials and the attorney representing the company in its suit against Lindell, did not respond to requests for comment.