Liz Truss tax cuts could see interest rates hit 7 per cent, her own economic adviser admits

The Cardiff University professor also said he advocates ‘thinning out’ workers’ rights

Liz Truss’s pledge to immediately reverse tax increases that were implemented by Boris Johnson’s government could result in interest rates as high as 7 per cent, according to her own economic adviser.

The Tory leadership hopeful’s plans to undo hikes to national insurance (NI) and corporation tax would increase interest rates, Professor Patrick Minford said – who insisted that this would be “a good thing”.

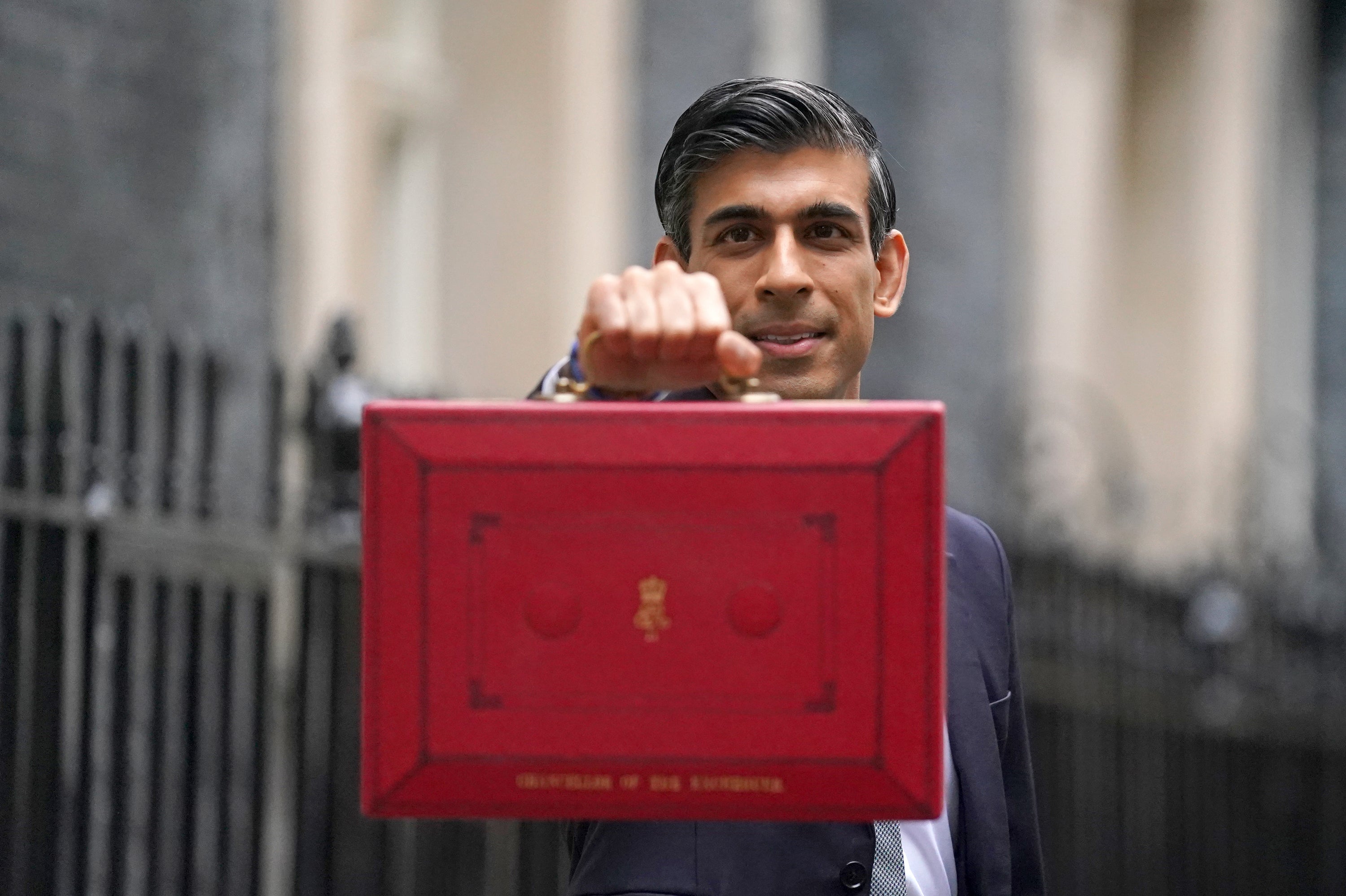

Foreign secretary Ms Truss is going head to head with former chancellor Rishi Sunak in the race to become the next prime minister after Mr Johnson was forced to resign following a mass exodus of his government.

When her rival Mr Sunak was chancellor, he brought in increases to NI that came into force in April this year and an increase in corporation tax – from 19 to 25 per cent – that is to take effect in 2023.

This week, during Ms Truss’s push to present herself as the best candidate out of the two to succeed Mr Johnson, she insisted that her proposed £30bn fiscal plan – that would see the undoing of the tax hikes – would be affordable and essential to avoid a recession.

In contrast, Mr Sunak is reportedly not planning to cut taxes until at least autumn 2023 – to come into force around April 2024 – to avoid fuelling runaway inflation, which has hit a 40-year-high of 9.4 per cent.

Ms Truss has said that it would be “wrong” to increase personal taxes amid a cost-of-living crisis partly exacerbated by sky-high fuel costs caused by the Russian invasion of Ukraine.

In an interview with The Times, Prof Minford of Cardiff University said higher interest rates as a result of Ms Truss’s plans would be welcome.

The pro-Brexit economist said that they would protect savings and purge the economy of “zombie companies” that have been “surviving because it costs them nothing to borrow”.

He added: “It’s right that a healthy economy should have a decent interest rate. That’s certainly one thing I want to see.”

Interest rates currently stand at 1.25 per cent. While the Bank of England is likely to raise them by 0.5 per cent next month, there are concerns that too much of an increase could contribute to the start of a recession.

Prof Minford argued that cutting taxes would counter this risk and “make it safe” for the bank to raise rates higher.

He told the newspaper: “The key to growth is not having high taxes. We’re not talking about cutting them, we’re just talking about not putting them up to a catastrophic level.”

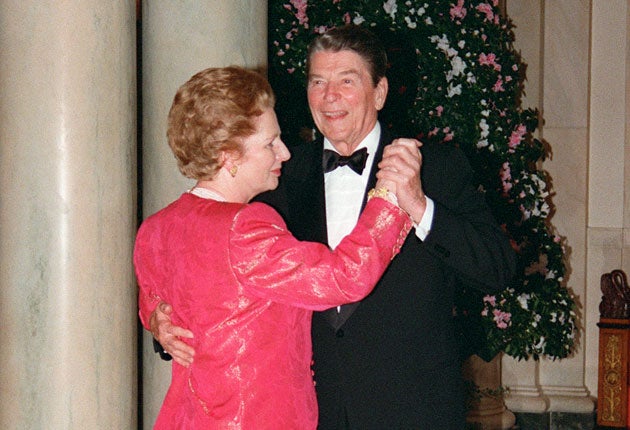

Prof Minford was an adviser to Margaret Thatcher and has long argued that tax cuts encourage innovation and help stimulate economic growth.

Mark Harper, former Tory chief whip and a supporter of Mr Sunak, told The Independent: “Prof Minford is the economist that Liz Truss has prayed in aid of her plans.

“Now he has said that Liz Truss’s tax cuts could mean interest rates going up to 7 per cent. He seems to think that’s a good thing, but I’m not sure that view will be widely shared among Conservative members or the electorate more widely.

“The fundamental difference in this contest is similar to the difference between Margaret Thatcher and Ronald Reagan.

“They both thought you had to deliver tax cuts, but Reagan’s view was that you could cut taxes and let borrowing rip, while Thatcher thought that you needed to get inflation under control first and then cut taxes while keeping a lid on borrowing.

“Rishi is effectively the Thatcherite here – deal with inflation but be sensible with tax cuts.

“Liz is the Reaganite version – cut taxes and hope it will sort itself out. That’s the debate our members are going to have to consider over the coming weeks and see which of those versions they prefer.”

In response to Ms Truss’s plans to borrow, energy minister Greg Hands said that her “Leftist” plan to go on a “borrowing and spending spree” would be “the wrong thing to do at the moment”.

In dismissing concerns about borrowing, Prof Minford said: “If we raise corporation tax, we’ll kill off growth ... Borrowing is actually something that allows you to pursue the right policies and not be blown off course by temporary shocks.

“Borrowing allows you to keep taxes constant even if you’re not funding it on annual basis ... What matters is that you’re solvent in the long run.”

In an interview with BBC Radio 4’s Today programme, Prof Minford said that increasing NI was “very bad” as it “raises the cost of labour” for employers while taking money out of workers’ pockets.

But he also told The Times that he also advocates “thinning out” labour market regulations – such as trade union powers, EU limits on working hours, and employee consultation rights – even if it “upsets a lot of pressure groups”.

Prof Minford claimed it made “no sense at all” that Mr Johnson’s government had “refused to touch the labour market”.

He said: “Getting rid of a lot of regulations will upset a lot of pressure groups. But it all really starts in Whitehall and the first thing [Truss] has got to do is get Treasury into line.”

The Tory leadership race will run until a vote of the party’s membership of about 160,000 people in September. Ms Truss is currently the favourite among the party members, according to a poll by YouGov.

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies

Comments