George Osborne should shelve his planned tax credit cuts, influential group of MPs says

The Work and Pensions Select Committee wants a broader debate about the nature of the in-work benefits system

Your support helps us to tell the story

From reproductive rights to climate change to Big Tech, The Independent is on the ground when the story is developing. Whether it's investigating the financials of Elon Musk's pro-Trump PAC or producing our latest documentary, 'The A Word', which shines a light on the American women fighting for reproductive rights, we know how important it is to parse out the facts from the messaging.

At such a critical moment in US history, we need reporters on the ground. Your donation allows us to keep sending journalists to speak to both sides of the story.

The Independent is trusted by Americans across the entire political spectrum. And unlike many other quality news outlets, we choose not to lock Americans out of our reporting and analysis with paywalls. We believe quality journalism should be available to everyone, paid for by those who can afford it.

Your support makes all the difference.George Osborne should postpone his planned cuts to tax credits and instead launch a wider review about reforming in-work benefits, an influential committee of MPs has said.

The cross-party Work and Pensions Select Committee said the Chancellor’s £4.4bn tax credit programme announced in the summer Budget should be shelved.

“We recommend that, if these major changes cannot be satisfactorily mitigated now, it would be better to pause any major reforms until 2017-18,” the committee’s report said.

“This would enable a necessary and ambitious debate about the future of working age benefits, and their position in a sustainable welfare system. This Report starts that debate.”

The committee warned that the Government’s aim of improving work incentives, making budget savings, and protecting incomes would be impossible to achieve all at once – and that one of them “has to give”.

The MPs say the cuts will leave more than three-quarters of families receiving the in-work benefit worse off by 2020-21.

They called for a broader debate about how the in-work benefit system functions, and also criticised the Treasury for refusing to engage with MPs’ requests for information to make their inquiries.

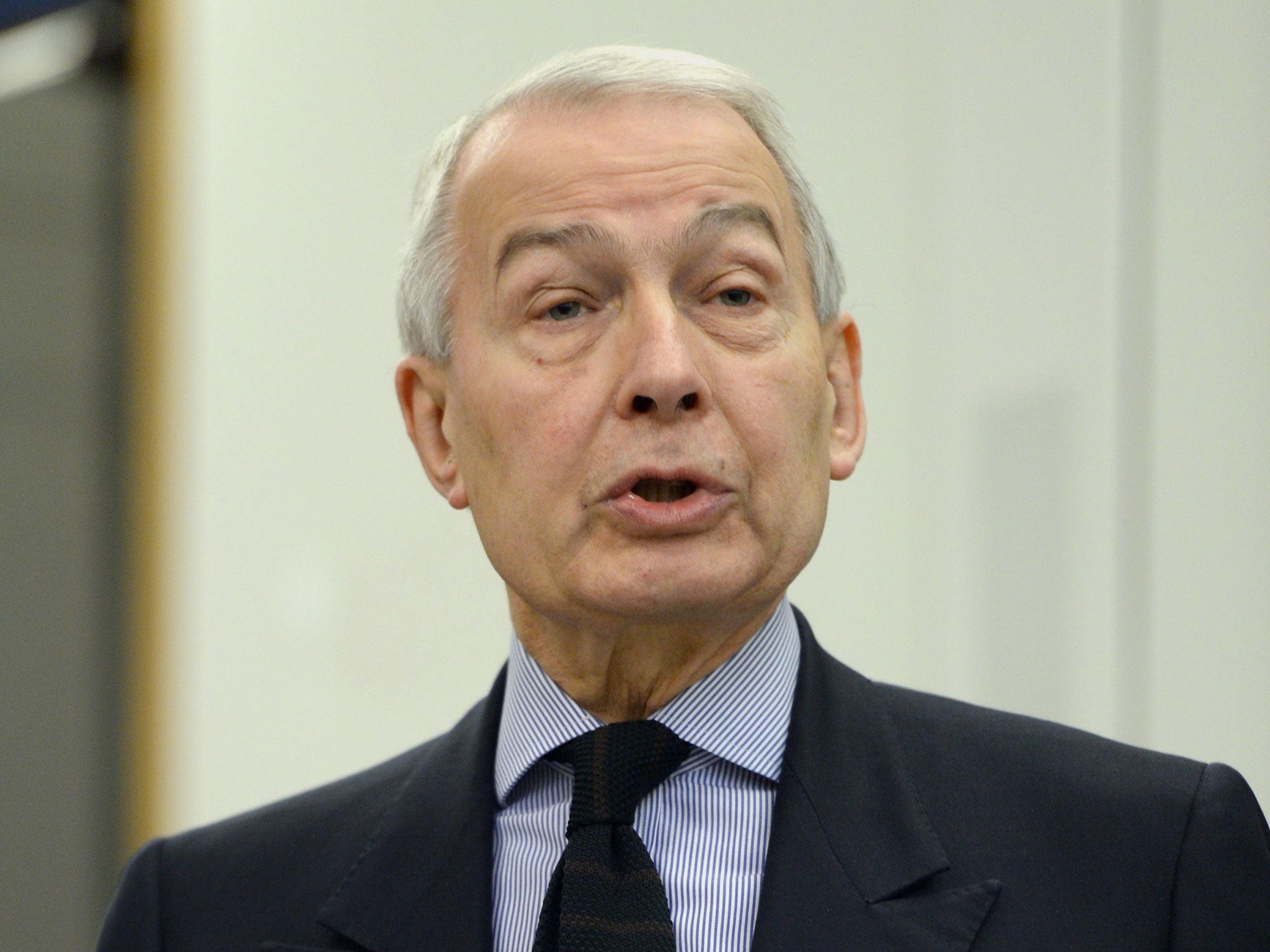

Committee chair Frank Field said: “No one has been able to provide the Committee with a satisfactory series of mitigating policies to combat the impact of cuts in tax credits.

“My advice to the Chancellor would be to pause and use the next 18 months to bring forward a major overhaul to abolish tax credits as we know them.

“A new system could come in fully by 2020 when the Chancellor’s National Living Wage will be paying a wage of £16,000 per year.

“This would allow him to question whether a reformed tax credit system shouldn’t be remodelled to help only lower earning families with children.”

The Government’s new Universal Credit benefits system will absorb most of the functions of tax credits if and when it eventually comes into effect.

It has however been subject to long delays and is currently behind schedule.

After the government was defeated in the House of Lords last month George Osborne pledged to return with new policies to mitigate the effect of his tax credits cuts.

He did not say what these changes would involve, however, and David Cameron has refused to confirm that people would not be worse off after the cuts were applied.

The Institute for Fiscal Studies says a concurrent rise in the minimum wage would come “nowhere near” to mitigating the impact of the cuts, while the Resolution Foundation said 200,000 children would be put into poverty overnight by the changes, with 600,000 by 2020.

The cuts are part of £12bn cuts to the social security budget that the Government is to make – specifics of which it refused to announce before the election.

Subscribe to Independent Premium to bookmark this article

Want to bookmark your favourite articles and stories to read or reference later? Start your Independent Premium subscription today.

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies

Comments