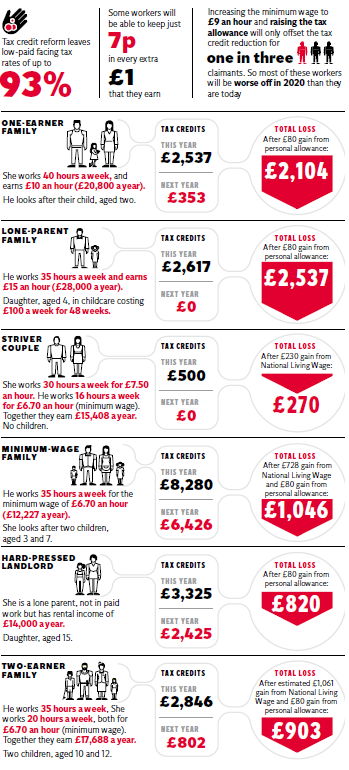

The one chart that shows how tax credit cuts will actually affect you

How different families will lose out from the changes

Your support helps us to tell the story

From reproductive rights to climate change to Big Tech, The Independent is on the ground when the story is developing. Whether it's investigating the financials of Elon Musk's pro-Trump PAC or producing our latest documentary, 'The A Word', which shines a light on the American women fighting for reproductive rights, we know how important it is to parse out the facts from the messaging.

At such a critical moment in US history, we need reporters on the ground. Your donation allows us to keep sending journalists to speak to both sides of the story.

The Independent is trusted by Americans across the entire political spectrum. And unlike many other quality news outlets, we choose not to lock Americans out of our reporting and analysis with paywalls. We believe quality journalism should be available to everyone, paid for by those who can afford it.

Your support makes all the difference.The Government's proposed tax credit changes have been criticised by groups as dirverse as the Resolution Foundation, Conservative backbenchers, the Adam Smith Institute, and the Institute for Fiscal Studies.

The tax credit system is complicated and it can be difficult to work how how you will be affected by the tax credit changes.

This chart shows the how different families or individuals might lose out from George Osborne's original proposals.

After his defeat in the House of Lords on Monday the Chancellor has said he will listen to criticism and row back on some of the changes.

Those changes are due in the Autumn Statement, which is usually in early December or late November.

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies

Comments