John Rentoul answers your spring Budget questions - from national insurance cuts to Tory poll numbers

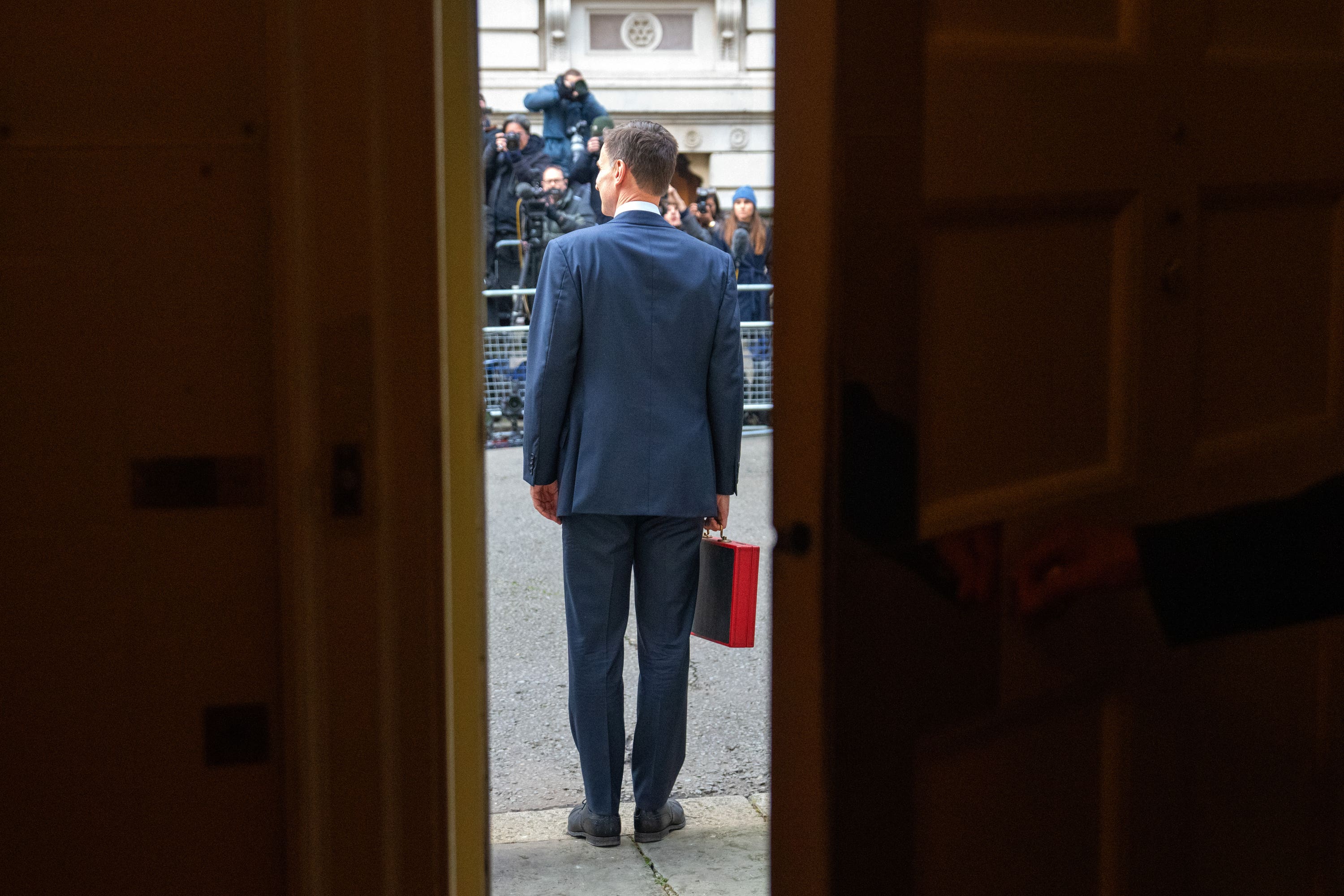

As we heard Jeremy Hunt deliver the final budget from Rishi Sunak’s current government, John Rentoul has been turning over questions from readers

Your support helps us to tell the story

From reproductive rights to climate change to Big Tech, The Independent is on the ground when the story is developing. Whether it's investigating the financials of Elon Musk's pro-Trump PAC or producing our latest documentary, 'The A Word', which shines a light on the American women fighting for reproductive rights, we know how important it is to parse out the facts from the messaging.

At such a critical moment in US history, we need reporters on the ground. Your donation allows us to keep sending journalists to speak to both sides of the story.

The Independent is trusted by Americans across the entire political spectrum. And unlike many other quality news outlets, we choose not to lock Americans out of our reporting and analysis with paywalls. We believe quality journalism should be available to everyone, paid for by those who can afford it.

Your support makes all the difference.The big news, but not the big surprise, from Jeremy Hunt’s spring Budget was that millions of workers are set to benefit from an additional 2p cut in national insurance.

The chancellor announced the measures in an attempt to ease the tax burden ahead of next year’s general election.

He also confirmed a new levy on vaping, an abolition of the non-dom tax status and another extension of the fuel duty freeze - meaning motorists will continue to save on petrol prices.

As we heard Mr Hunt deliver the final budget from Rishi Sunak’s current government, I’ve been answering questions from readers about the spring statement - from the intricacies of national insurance cuts to Tory poll numbers.

Here are nine questions from Independent readers – and my answers from the “Ask Me Anything” event.

Q: Can the Tories afford to win the General Election now they have set so many economic traps for Labour?

Slightly Tipsy Max

A: Good question. Neither party can afford to win the election. Whoever is the next government will face tough decisions about the public finances. It would obviously be easier for Labour to deal with those choices, because public opinion would be more inclined to give a new government the benefit of the doubt – for a few months at least.

Q: How does a cut in NI create more jobs as Hunt claims?

Jeceris

A:At the most basic level of economic theory, if you reduce the price of something it increases demand. Cutting NI has the effect of reducing the price of labour and makes it slightly cheaper for employers to hire people. Hunt claimed the Office for Budget Responsibility modelling shows a job-creating effect, and I assume this is true.

Q: Who is double checking all the good news? He does not mention the fact UK’s economy has been destroyed and many businesses have left and are still leaving, if not closing down. Listening to Hunt, the UK could not have been doing better ever. Reality is very different though! The UK is not supporting its businesses or population in any way.

Responsible

A: As with most chancellors in most Budget speeches, Jeremy Hunt was selective in the figures he quoted. This or that was the best in the G7, whereas a more balanced presentation would be that the UK’s economic record and outlook are not terrible but nothing special.I don’t think it is fair to say that the government is not supporting the population in any way, though. Many of Hunt’s fiscal problems have been made more challenging by the furlough scheme and business support during the pandemic, and the energy price subsidy since.

Q: John, why can those who are of retirement age not pay national insurance? There is a lot of talk about generational unfairness but this would seem sensible, may even fund universal social care and an increased state pension.

Mrpipesf

A: The split between income tax and national insurance is one of many illogical features of the British tax system. Jeremy Hunt seems to be pursuing one route to ending the unfairness, by gradually abolishing national insurance contributions. But we should point out that these cuts (2p in the £ in Jan, another 2p in Apr) are to employee contribution rates only – employers continue to pay a large, and largely invisible tax in employer contributions.

In an ideal world, income tax and national insurance should be merged, which would mean older people on higher incomes would pay more. But no politician is willing to lose those votes.

Q: Is it correct that a 2% cut in NI means someone on £25,000 gets a tax cut of £248, while someone on £50,000 gets three times as much, £748?

Neil Lamputt

A: I think it is more than that. Today’s cut is worth £435 a year to someone on £25k a year, and £1,310 to someone on £50k. That is my objection to it, and the previous cut: they are worth more in cash terms to people on higher incomes. Norman Lamont’s election-winning Budget in 1992 shot Labour’s fox by cutting income tax for people on lower incomes, which would have been a better idea.

Q: Could anything he said make any difference to Tory poll numbers?

Mark Burns

A: I don’t think anything Hunt said will make a difference to Tory poll numbers, mainly because it was all already in the public domain, but that doesn’t mean that he *couldn’t* have said anything that would move the numbers.

Q: How can the speaker get the government to announce stuff in parliament before briefing the papers? (And does it matter)

Ali Hughes

A: In the old days there were weeks of “purdah” before a Budget, when the Treasury would go dark and journalists really were just speculating, mostly wrongly, about what might be announced.

In Gordon Brown’s time in particular, the Treasury became a much more communications-conscious department, and would leak or formally announce measures in advance to try to create a wave of news stories to prepare the way for the one remaining theatrical surprise on the day. Now it is all pre-announced and there is no surprise on the day.

I imagine Hunt wanted the 2p national insurance cut to be a surprise, but news seeped out because MPs were warned in advance that extra legislation would be needed (which it would be for NICs but not for income tax changes), and it is almost impossible to keep a government secret these days.

The speaker can try to order the tide to retreat, but he will have no luck.

Q: What are the risks with further tax cuts in the current UK fiscal and economic environment?

old dane

A: A very good question! At several moments in Hunt's speech I thought it was "Trussonomics by stealth". He and Rishi Sunak are treading a fine line between, on the one hand, reassuring the markets that they have a grip on the public finances, and on the other, having to do irresponsible things in a desperate attempt to win the election.

The markets want to be fooled, and so accept unrealistic future public spending plans as long as the Office for Budget Responsibility continues to grumble rather than rebel.

But as I say, really taxes should be going up, not down.

Q: If the Tories believe that there is no hope at the next election are they mean enough to salt the earth in the next budget for the next government making it even harder to begin to clear up before the election after that? If so what could the Chancellor do?

fistfulloffishes

A: I’m not sure that Sunak and Hunt are deliberately “salting the earth”. That implies that they have given up and simply want to make life difficult for their opponents. But politicians always delude themselves that they can win – remember that Sunak, for example, thought his career was over when Liz Truss won the leadership election, only to find himself in No 10 at short notice.

These questions and answers were part of an ‘Ask Me Anything’ hosted by John Rentoul at 3pm GMT on Wednesday 6 March. Some of the questions and answers have been edited for this article. You can read the full discussion in the comments section of the original article.

John also sends a weekly Commons Confidential newsletter exclusive to Independent Premium subscribers, taking you behind the curtain of Westminster. If this sounds like something you would be interested in, head here to find out more.

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies

Comments