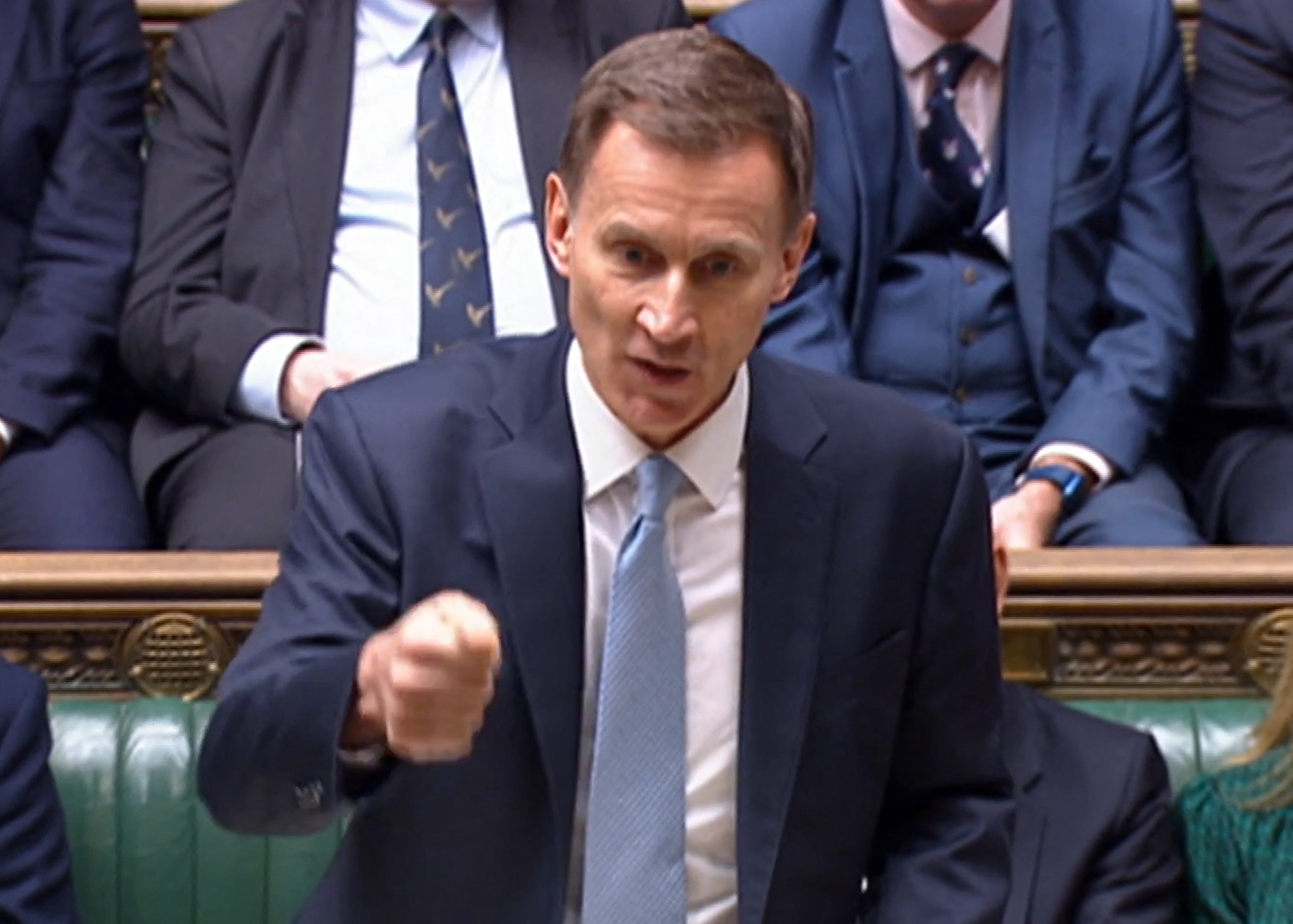

Non-dom tax status abolished in Jeremy Hunt’s 2024 Budget

Chancellor had previously spoken out against overhauling the tax break

Your support helps us to tell the story

From reproductive rights to climate change to Big Tech, The Independent is on the ground when the story is developing. Whether it's investigating the financials of Elon Musk's pro-Trump PAC or producing our latest documentary, 'The A Word', which shines a light on the American women fighting for reproductive rights, we know how important it is to parse out the facts from the messaging.

At such a critical moment in US history, we need reporters on the ground. Your donation allows us to keep sending journalists to speak to both sides of the story.

The Independent is trusted by Americans across the entire political spectrum. And unlike many other quality news outlets, we choose not to lock Americans out of our reporting and analysis with paywalls. We believe quality journalism should be available to everyone, paid for by those who can afford it.

Your support makes all the difference.Jeremy Hunt has reversed years of Tory orthodoxy by scrapping the non-domicile tax status in his spring Budget, in a bid to pile pressure on the Labour Party by adopting one of its key policies.

The chancellor confirmed he will abolish the system that lets foreign nationals avoid paying UK tax on money made overseas, replacing it with a “modern, simpler and fairer residency-based system”.

Click here for live updates from the budget and reaction

Sir Keir Starmer’s party has been relying on closing the loophole – which allows foreign nationals living in Britain to avoid paying tax on overseas earnings – to raise an estimated £2bn to fund many of the party’s spending pledges if it wins victory in this year’s general election.

But despite having previously argued that removing non-dom status would ultimately reduce tax revenues by encouraging wealthy foreign nationals to move elsewhere, Mr Hunt announced an overhaul of the tax scheme in the Commons on Wednesday.

Mr Hunt said: “Recognising the contribution many of these individuals have made to our economy, we will put in place transitional arrangements for those benefitting from the current regime.

“That will include a two-year period in which individuals will be encouraged to bring wealth earned overseas to the UK where it can be spent and invested here – a measure that will attract onshore an additional £15 billion of foreign income and generate more than £1 billion of extra tax.

“Overall abolishing non-dom status will raise £2.7 billion a year by the end of the forecast period, money the party opposite (Labour) planned to use for spending increases, but today a Conservative government makes a different choice. We use that revenue to help cut taxes on working families.”

Sir Keir welcomed the move following campaigning by Labour, telling Tory MPs: “For those opposite, now a little downbeat about another intellectual triumph for social democracy, I say ‘Get used to it’, because with this pair in charge it won’t be long before they ask you to defend the removal of private school tax relief as well.”

The chancellor made the announcement despite the Institute for Fiscal Studies urging him to “tread carefully” in amending the tax status, echoing Mr Hunt’s own warnings in the past – in a move that will leave Labour scrambling for new sources of cash to fund pledges on the NHS and school breakfast clubs.

There are some 37,000 people currently claiming non-dom tax status, paying £6bn collectively in income tax, national insurance and capital gains taxes, the IFS said.

The Independent revealed in 2022 that Rishi Sunak’s wife Akshata Murty had used the tax break to save potentially millions of pounds over several years.

Ms Murty, whose family business Infosys is estimated to be worth around £60bn, later said she would no longer claim the status on her worldwide earnings, saying at the time that she did not want her tax status to be a “distraction for my husband or to affect my family”.

With the UK in the grips of a technical recession, Britain’s sluggish economy and consequent reduction in predicted tax revenues will have impacted upon Mr Hunt’s Budget, with forecasts having become gloomier in recent weeks.

While the Office for Budget Responsibility said in November that Mr Hunt had £13bn of fiscal headroom, economists believe this may have increased to around £18bn due to recent falls in inflation. But this is less than predicted a few weeks ago when interest rate cuts appeared more imminent.

Mr Hunt has expressed a desire to move towards a “lower tax economy”, but stressed the need to do so in a “responsible” way. The chancellor also played down pleas to increase funding for Britain’s austerity-wracked public services, instead insisting that more “efficiency” was needed in how current funds are spent.

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies

Comments