Budget 2024 live: Rachel Reeves reveals £40bn in tax hikes and boost to NHS spending in historic speech

Chancellor promises to ‘invest, invest, invest’ after months of bleak warnings over economy

Your support helps us to tell the story

This election is still a dead heat, according to most polls. In a fight with such wafer-thin margins, we need reporters on the ground talking to the people Trump and Harris are courting. Your support allows us to keep sending journalists to the story.

The Independent is trusted by 27 million Americans from across the entire political spectrum every month. Unlike many other quality news outlets, we choose not to lock you out of our reporting and analysis with paywalls. But quality journalism must still be paid for.

Help us keep bring these critical stories to light. Your support makes all the difference.

Rachel Reeves has announced tax hikes that will raise an eye-watering £40bn in her historic first Budget but revealed a boost to NHS spending.

Launching an attack on previous Tory governments, the chancellor said Labour had inherited a £22bn “black hole”, and would never again “allow a government to play fast and loose with public finances.

After months spent warning the public of “tough choices” ahead, Ms Reeves promised to “invest, invest, invest” in order to “fix public services” and announced a £22.6 billion increase in the day-to-day NHS health budget.

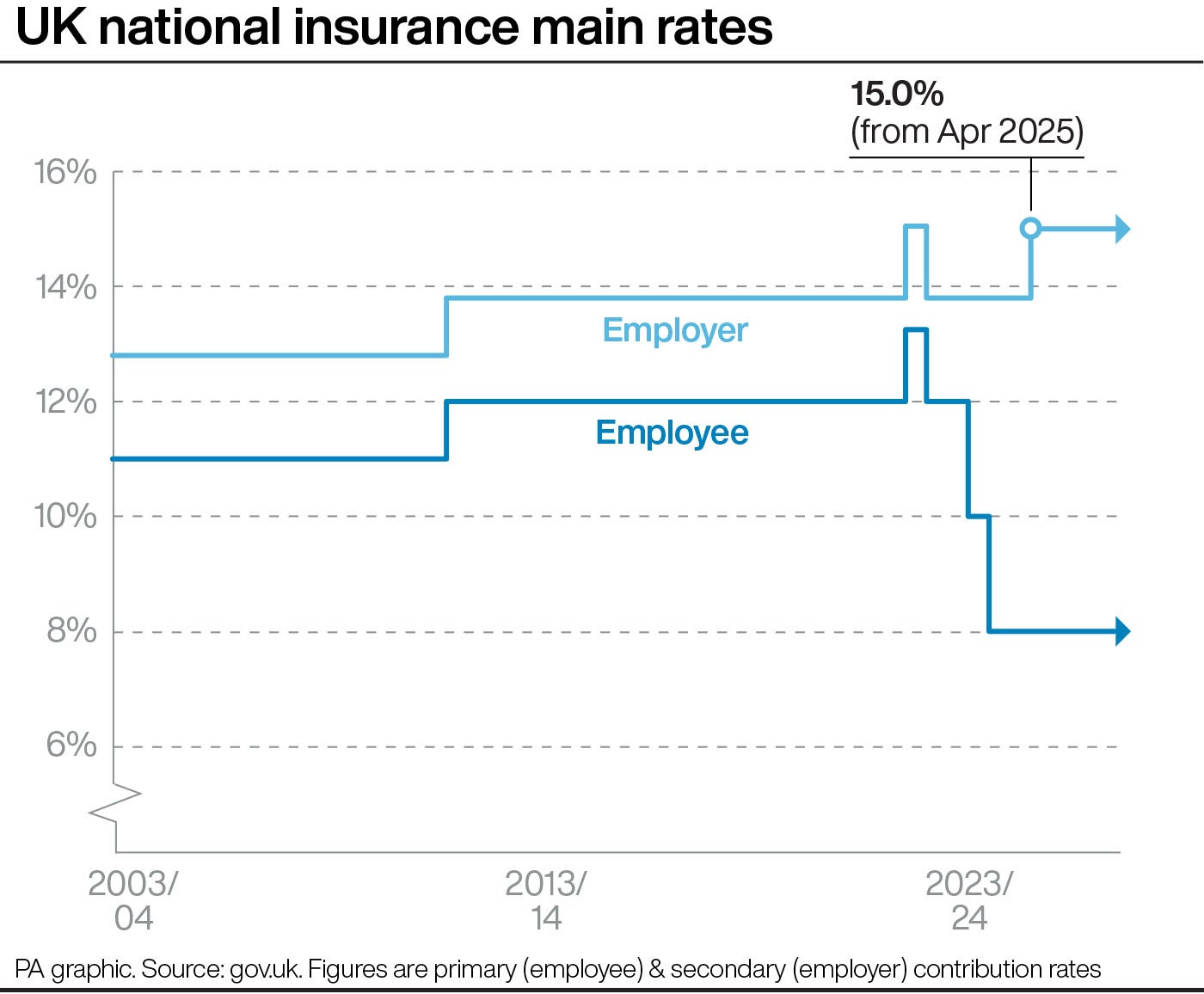

Increases to employers’ national insurance contributions, stamp duty on second homes and a scrapping of VAT exemption on private schools fees were all confirmed by the chancellor, as well as a new duty on vaping liquids.

However, there were surprise announcements that the freeze on income tax thresholds, often described as a “stealth tax”, would not be extended past 2028, while Ms Reeves has also decided against a hike in fuel duty.

Responding to the Budget, Rishi Sunak accused Ms Reeves of “fiddling the figures” and criticised the government for embarking on an “enormous borrowing spree”.

How will the employer National Insurance rise affect you?

Rachel Reeves has confirmed that employer national insurance contributions (NICs) will rise following an announcement at Labour’s first Budget.

The measure has caused strong political debate, focused on whether it would break Labour’s manifesto pledge to not raise taxes on “working people.”

Ministers and Treasury officials have indicated the government’s position is that the measure would not break their manifesto pledge. Meanwhile, Institute for Fiscal Studies director Paul Johnson has argued it would be a “straightforward breach.”

Here are the facts about the debate and how the measure could affect you:

How would raising employer national insurance in the Budget affect you?

One expert has called Labour’s rumoured plan a “straightforward breach” of its manifesto

Rishi Sunak is responding to Rachel Reeves Budget

The former prime minister Rishi Sunak is responding to Rachel Reeves Budget in the Commons.

Mr Sunak repeats a similar point he has been making for weeks and that Labour has raised taxes.

He said: “Well today, his actions speak for themselves with a Budget that contains broken promise after broken promise and reveals the simple truth that the Prime Minister and the Chancellor have not been straight with the British people.

“Time and again, time and again, we Conservatives warned Labour would tax, borrow and spend far beyond what they were telling the country. And time and again, they denied they had such plans.

“But today, the truth has come out, proof that they planned to do this all along, because today’s Budget sees the fiscal rules fiddled, borrowing increased by billions of pounds, inflation-busting handouts for the trade unions.”

Reeves announces £22.6bn increase in the day-to-day health budget and 10-year plan

Chancellor Rachel Reeves has announced a £22.6bn increase in the day-to-day health budget.

Announcing the government’s plans for the NHS, Ms Reeves told the Commons: “In the spring, we will publish a 10-year plan for the NHS to deliver a shift from hospital to community, from analogue to digital, and from sickness to prevention. Today, we are announcing a down payment on that plan to enable the NHS to deliver 2% productivity growth next year.”

She added: “Today, because of the difficult decision that I have taken on tax, welfare and spending, I can announce that I am providing a £22.6 billion increase in the day to-day health budget, and a £3.1 billion increase in the capital budget, over this year and next year.

“This is the largest real-terms growth in day-to-day NHS spending outside of Covid since 2010.”

£1.4bn to rebuild 500 schools

The Chancellor has announced £1.4 billion to rebuild more than 500 schools.

The move is part of a 19 per cent real-terms increase in the Department for Education’s capital budget, along with £2.1 billion for school maintenance.

HS2 tunnel to be built to London Euston

The Chancellor has announced that the government is “committing the funding required” to begin tunnelling work to bring HS2 to London Euston station.

The announcement will be welcomed following speculation that the line could instead finish outside of London.

£5bn to be invested in housebuilding

Chancellor Rachel Reeves has announced “over £5 billion of Government investment” in housebuilding and £1 billion of funding to remove dangerous cladding next year.

The move is a boost to Labour’s cornerstone promise to build 1.5 million homes to address the housing crisis.

£500mn increase in funding to fix potholes

Rachel Reeves has announced a £500m increase in road maintenance budget in order to fix an additional one million potholes each year.

£650m of local transport funding will also be spent to improve connections.

‘Significant real-terms funding increase’ for local government, Reeves says

Rachel Reeves said there would be a “significant real-terms funding increase” for local government next year, noting this included £1.3 billion of additional grant funding to deliver “essential services”.

The Chancellor said there would be at least £600 million in grant funding for social care and £230 million to tackle homelessness and rough sleeping.

Ms Reeves also said: “We are today confirming that Greater Manchester and the West Midlands will be the first mayoral authorities to receive integrated settlements from next year, giving mayors meaningful control of the funding for their local areas.”

No extension on income tax threshold freeze beyond 2028

The Government will not extend the freeze on income tax and national insurance thresholds beyond 2027/28, the Chancellor has announced, saying it would “hurt working people” to keep thresholds frozen.

There was speculation Reeves would extend the freeze, in a move that would have been criticised as a way for the Treasury to boost revenue from income tax without increasing its rates. Since 2021, the personal allowance has been frozen at £12,570. This is the amount that can be paid before income tax deductions begin.

The three rates of income tax have also remained frozen during this time. Although an extension isn’t an income tax rise per se, it would have meanr more workers paying more income tax in effect.

Subscribe to Independent Premium to bookmark this article

Want to bookmark your favourite articles and stories to read or reference later? Start your Independent Premium subscription today.

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies

Comments