UK interest rates live: Bank of England holds at 5% after shock US Fed cut

Monetary Policy Committee votes to keep rates on hold

Your support helps us to tell the story

My recent work focusing on Latino voters in Arizona has shown me how crucial independent journalism is in giving voice to underrepresented communities.

Your support is what allows us to tell these stories, bringing attention to the issues that are often overlooked. Without your contributions, these voices might not be heard.

Every dollar you give helps us continue to shine a light on these critical issues in the run up to the election and beyond

Eric Garcia

Washington Bureau Chief

The Bank of England has voted against a further cut to interest rates, after the latest UK inflation figures remained stubbornly high.

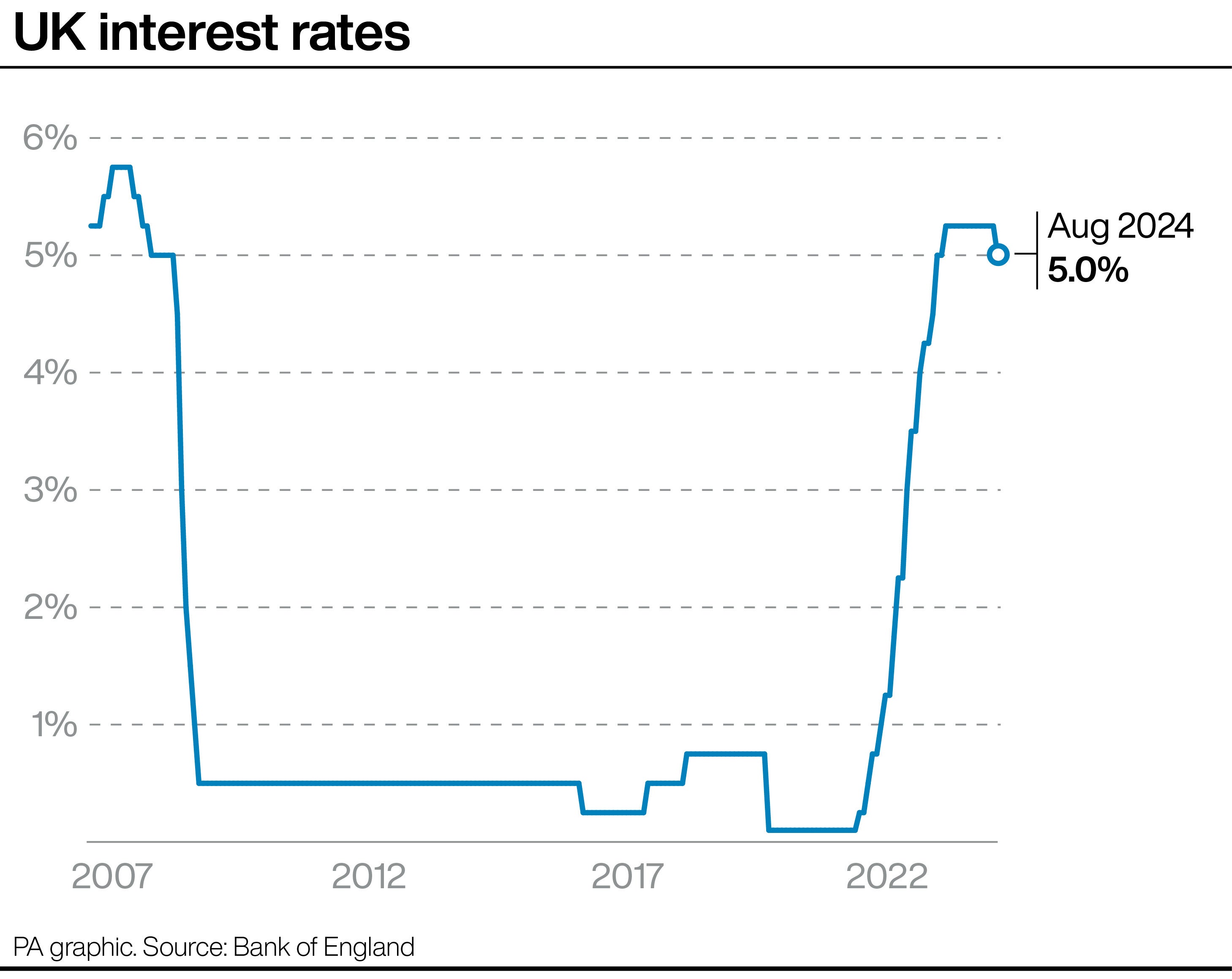

The nine rate-setters on the Bank’s Monetary Policy Committee (MPC) voted 8-1 to keep the base rate unchanged at 5 per cent, a level which – prior to last year – had last been seen in 2008 during the global financial crisis.

The Bank cut rates from 5.25 per cent last month – the first reduction since 2020, in a move welcomed by squeezed borrowers still suffering from the cost-of-living crisis. The move disappointed savers, however.

August’s inflation was unchanged at 2.2 per cent, which was higher than the Bank of England’s 2 per cent target but was below the 2.4 per cent the Bank itself had predicted at this stage.

Keeping the base rate on hold means mortgage repayments are unlikely to change.

The decision comes a day after the US Federal Reserve voted for a shock 0.5 per cent cut to US interest rates, marking the first drop in four years.

How UK interest rates have changed since 2007

Back-to-back cuts unlikely, analyst says

Matt Swannell, chief economic adviser at the EY Item Club, said the Bank of England had“sent a clear message that back-to-back rate cuts were unlikely” after last month’s reduction, unless subsequent economic data was weaker than expected.

He said the latest official data, which showed Consumer Prices Index (CPI) inflation remained at 2.2 per cent in August, would not be enough to prompt the Bank to start cutting rates more quickly.

Inflation figures won’t be enough to trigger rate cut, economist forecasts

Sanjay Raja, chief UK economist for Deutsche Bank, has predicted that the recent inflation figures of 2.2 per cent “won’t be enough to trigger a surprise rate cut” today.

“Instead, the MPC will likely take this as a positive sign that underlying price pressures are easing, and could warrant a further dial down of restrictive policy in November, when it conducts its next forecast update,” he said.

“The MPC will also have more information on the fiscal outlook, with the autumn Budget slated for 30 October.”

European Central Bank opt for consecutive rate cuts

The Bank of England’s rate-setters could take note of the European Central Bank’s (ECB) decision to cut interest rates in the Eurozone last week, marking the second reduction in a row.

The ECB’s rate-setting council lowered the main deposit rate from 3.75 per cent to 3.5 per cent at the meeting last week.

James Moore | What do this week’s inflation figures show?

In his latest column, The Independent’s chief business commentator James Moore writes:

Let’s start with the good news: August’s inflation number came in unchanged at 2.2 per cent. While that is higher than the Bank of England’s 2 per cent target, it is in line with City forecasts and beneath the 2.4 per cent the Bank itself had predicted at this stage. Compared to the double-figure price rises Britain was experiencing in the painful summer of 2023, it looks very good.

Food prices, a persistent bugbear, rose by just 1.3 per cent – down from 1.5 per cent. At the factory gate, an increase of just 0.2 per cent was recorded while the cost of raw materials actually fell, as did that of fuel.

There are a few buts coming. One thing to watch is the cost of services – from haircuts to handymen and everything in between; service prices rose by a headline rate of 5.6 per cent compared with this time last year, quite a bit worse than the previous month (5.2 per cent). The City had pencilled in 5.5 per cent.

The real villain of the piece was aviation. Air fares traditionally rise in summer, but they rose by an extraordinary 22 per cent between July and August alone. Falling restaurant and hotel bills helped offset that to some degree.

The Bank of England’s rate-setting Monetary Policy Committee has long been concerned about the cost of services, which represent by far the biggest part of the UK economy. This price tends to be closely linked to the cost of paying the staff who provide them. Wage settlements have been declining, to a two-year low 5.1 per cent in the three months to July compared with 5.4 per cent in the three months to May.

But the price consumers pay for services still represents an inflationary troll lurking under the bridge.

Inflation steady – but chances of another rate cut are slim

Price rises are below Bank of England forecasts, but problems remain – including the effect of high air fares – explains James Moore

US Federal Reserve cuts interest rates by half point for first time in four years

The US Federal Reserve has broken a four-year run and cut its benchmark interest rate by half a percentage point to 4.75-5.0 per cent.

This significant move signals that the US central bank believes it is winning the war on inflation and will now focus on preventing the job market from weakening.

One immediate effect should be lower borrowing costs for both consumers and businesses in the run-up to November’s presidential election.

Oliver O’Connell reports from New York:

Fed slashes interest rates for first time in years. Here’s what that means for you

The major move signals end to inflation fight while shoring up job market for ‘soft landing’ as borrowing to get cheaper

What has US Fed said after first interest rate cut in four years?

In a statement after cutting interest rates for the first time in four years, the US Federal Reserve’s Open Market Committee said: “The Committee seeks to achieve maximum employment and inflation at the rate of two percent over the longer run.

“The Committee has gained greater confidence that inflation is moving sustainably toward two percent, and judges that the risks to achieving its employment and inflation goals are roughly in balance. The economic outlook is uncertain, and the Committee is attentive to the risks to both sides of its dual mandate.”

Norway keeps interest rates at 16-year high

Hours after of the Bank of England’s interest rate decision, Norway’s central bank opted to keep its policy interest rate unchanged at a 16-year high of 4.5 per cent.

“The committee judges that a restrictive monetary policy is still needed to bring inflation down to target within a reasonable time horizon,” the central bank said in a statement.

It added: “The policy rate forecast in this report implies that the policy rate will remain at 4.5% to the end of 2024 before being gradually reduced from the first quarter of 2025.”

Markets suggest 21 per cent chance of rate cut

Trader bets suggest the markets believe there is a 21 per cent chance that the Bank of England will cut its base interest rate again today, Sky News reports.

Direct debit failure rate on mortgage payments rises 11% in a year, ONS says

As the Bank of England mulls whether to cut interest rates while seeking to keep inflation at bay, the Office for National Statistics has revealed that the rate of consumers defaulting on direct debits rose by 1 per cent in August – marking an increase of 12 per cent over the past year.

Compared with August 2023, the direct debit failure rate for electricity and gas payments rose by 43 per cent, while water payments rose 20 per cent and mortgages by 11 per cent.

Subscribe to Independent Premium to bookmark this article

Want to bookmark your favourite articles and stories to read or reference later? Start your Independent Premium subscription today.

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies

Comments