Interest rates – live: Economic growth subdued as rate hold will bring ‘little relief’ to Britons

The BoE expects economic growth to be ‘broadly flat’ through 2024

Your support helps us to tell the story

From reproductive rights to climate change to Big Tech, The Independent is on the ground when the story is developing. Whether it's investigating the financials of Elon Musk's pro-Trump PAC or producing our latest documentary, 'The A Word', which shines a light on the American women fighting for reproductive rights, we know how important it is to parse out the facts from the messaging.

At such a critical moment in US history, we need reporters on the ground. Your donation allows us to keep sending journalists to speak to both sides of the story.

The Independent is trusted by Americans across the entire political spectrum. And unlike many other quality news outlets, we choose not to lock Americans out of our reporting and analysis with paywalls. We believe quality journalism should be available to everyone, paid for by those who can afford it.

Your support makes all the difference.The Bank of England‘s governor Andrew Bailey has described economic growth in the UK as “subdued”, as a major charity has warned that keeping interest rates unchanged at 5.25 per cent will bring ‘little relief’ to Britons.

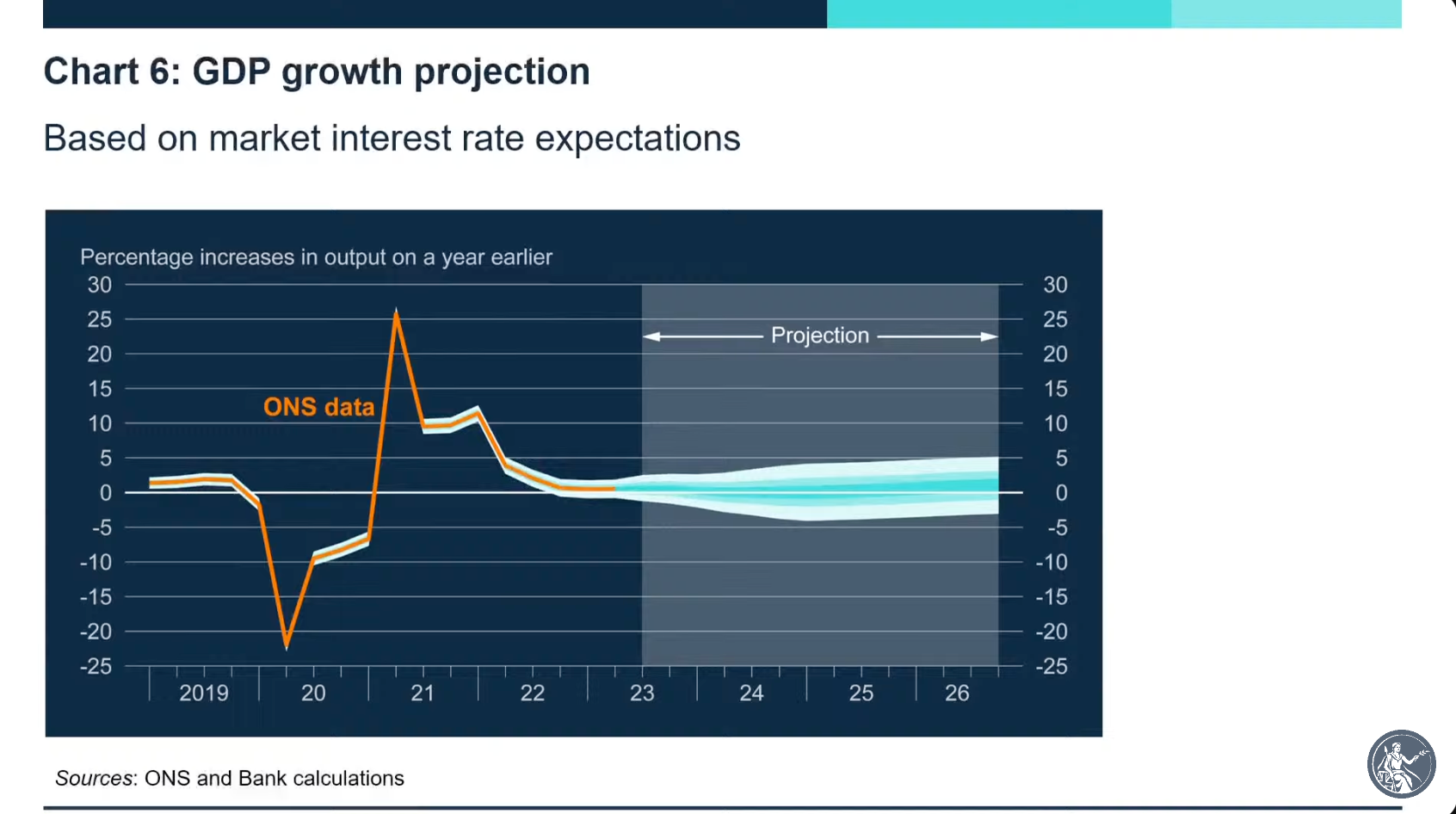

At a press conference Mr Bailey said that economic growth will remain “broadly flat” through 2024 and then recover as we approach 2026.

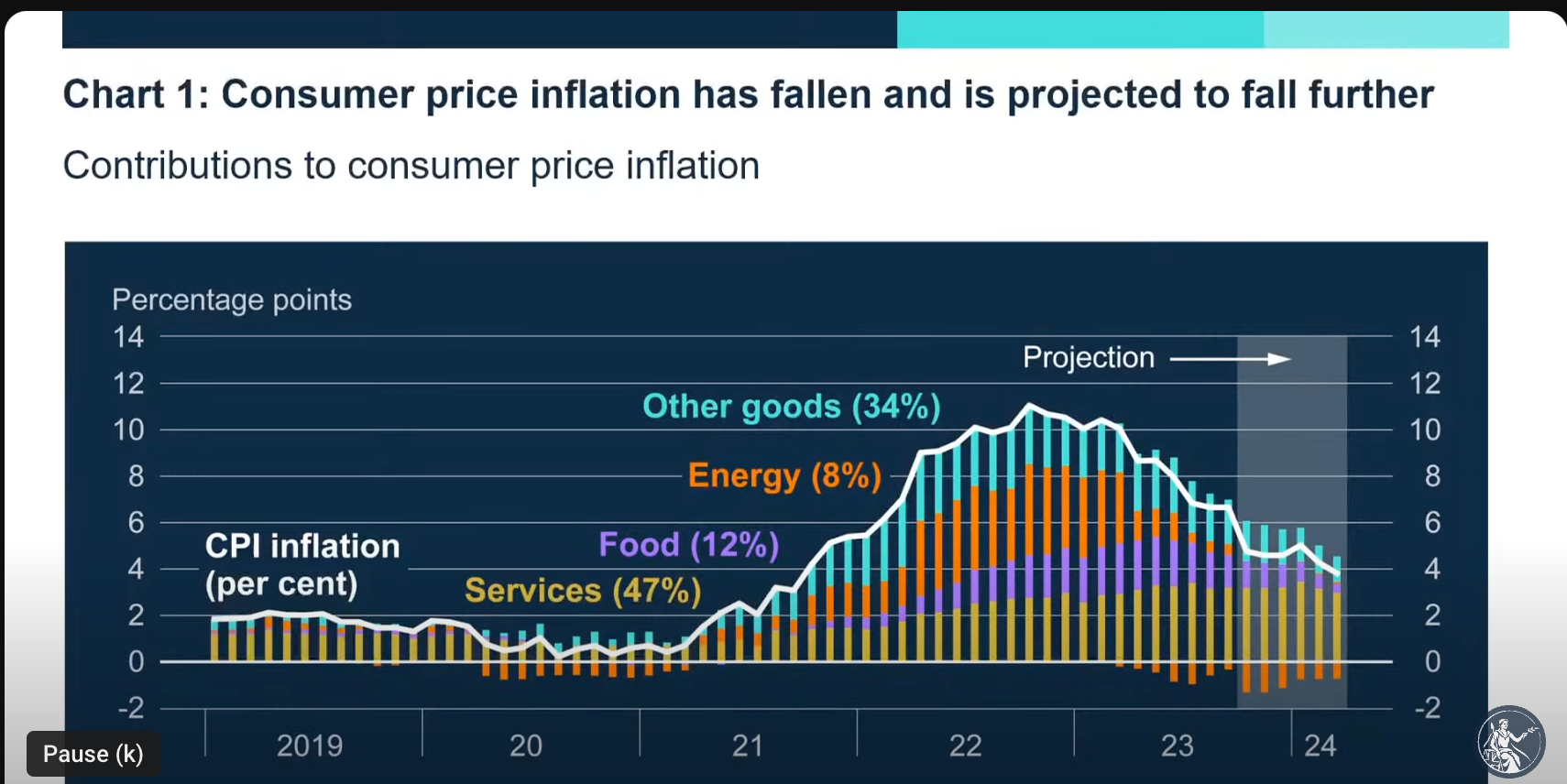

He added: “Inflation is falling, and we expect it to keep falling this year and next. Our increases in interest rates are working to bring inflation back to the 2% target. So today we have voted to maintain Bank Rate at 5.25%.”

Amid calls in some quarters for the BoE to cut interest rates he said they will not be reduced for “quite some time yet” and that they need to “squeeze inflation out of the system.”

He added: “There’s been no discussion on the committee about cutting interest rates.”

The Joseph Rowntree Foundation (JDF) said the interest rate hold will bring “little relief to millions of families already struggling” with high prices, the rising costs of debt and a sharp increase in unemployment.

Bank of England is likely to ‘sit tight’ on interest rates, says investment firm boss

Alex Brazier, who works for asset management firm Blackrock, has told Bloomberg that the Bank of England is likely to “sit tight” on interest rates.

He added that cuts in late 2024 could be “plausible” as the BoE does need to bring down inflation.

The Bank of England has left interest rates unchanged at 5.25 per cent

The Bank of England has left interest rates unchanged at 5.25 per cent, a 15-year high.

It is the second consective meeting the BoE has done this after 14 increases from December 2021 to August this year.

Interest rate hold is ‘brief respite for borrowers’, says personal finance expert

Lily Megson, policy director at My Pension Expert, said: “Today’s decision is but a brief respite for borrowers; the status quo falls far short of meeting consumer expectations for a stable financial landscape.

“Inflation continues to bulldoze consumer’s purchasing power and savings. Meanwhile, ongoing discussions about the triple lock and broader economic uncertainties have left many in retirement planning feeling apprehensive.

“And as we approach the holiday season, the pressure to manage finances intensifies. High interest and inflation may prompt some to rethink their holiday spending plans, while others might feel they have no choice but to take on debt.”

Reaction: Interest rates staying at 5.25 per cent ‘extremely positive’ for housing industry

Sam Mitchell, CEO of Purplebricks, an online estate agent, said the decision to hold rates was good news for the sector following a housing price rise in October.

They said: “The Bank of England’s decision to keep interest rates at the same level is extremely positive for the housing industry, meaning that estate agents and customers alike can be optimistic about the state of the sector after a difficult year.

The decision to hold interest rates is more good news for the sector following a rise in prices during October, which is reflected in the increasingly competitive rates banks are offering to consumers. This has meant an increase in activity which, while perhaps too late to affect this year’s data dramatically, bodes well for a good start to 2024.

However, as we gear up to the General Election, any political noise about potential stamp duty cuts has the potential to destabilise the market. If people think there is a chance that rates might be cut then this could wrongly and unnecessarily delay their purchasing decisions.”

BoE’s economic forecasts ‘damning indictment’ of Tory economic failure, says Reeves

Labour’s shadow chancellor Rachel Reeves has said the Bank of England’s downgraded economic forecasts are a “damning indictment” of Tory economic failure.

The BoE expects GDP to grow by 0.5% this year, unchanged from its last forecast, but downgraded its outlook for 2024 from 0.5% to 0%.

Responding to today’s announcement, she said: “These forecasts are damning indictment of 13 years of economic failure that has left working people worse off. At the start of the year, Rishi Sunak and Jeremy Hunt promised to get the economy growing.

“These figures show we are going in the wrong direction. We are forecast to have gone from low growth to no growth, with working people paying the price.

“Labour’s plans for growth will make working people better off by getting Britain building again, cutting energy bills, and creating good jobs across the country.”

Chancellor Jeremy Hunt upbeat over ‘resilient’ UK economy

Chancellor Jeremy Hunt has struck a more positive tone than his opposition counterpart and despite the negative Bank of England forecasts thinks the UK economy has been more resilient than many expected.

He said: “Inflation is falling, wages are rising and the economy is growing. The UK has been far more resilient than many expected, but the best way to deliver prosperity is through sustainable growth.

“The Autumn Statement will set out how we will boost economic growth by unlocking private investment, getting more Brits back to work, and delivering a more productive British state.”

Andrew Bailey has started his press conference...

The governor of the Bank of England Andrew Bailey has said that inflation is falling and policymakers are still trying to bring it down to the 2 per cent target.

In reference to the 5.25 per cent rate staying the same he said that it is “too early” to think about rate cuts.

He said: “Let me be clear, there is absolutely no room for complacency. Inflation is still too high.

“We will keep interest rates high enough for long enough to make sure we get inflation all the way back to the 2% target.

“We will be watching closely to see if further increases in interest rates are needed. But even if they are not, it is much too early to be thinking about rate cuts.”

GDP to remain ‘broadly flat’ through 2024

Andrew Bailey said that gross domestic product (GDP) would remain “broadly flat” throughout 2024 before recovering as we approach 2026.

He said: “It remains below historical averages, however, reflecting both restrictive monetary policy and subdued potential supply growth.”

Interest rates will remain restrictive for ‘quite some time yet’, says Bailey

Bank of England governor Andrew Bailey said interest rates will remain restrictive for “quite some time yet” but that the BoE has to be “mindful of the balance of risks” of doing too little or too much.

“Monetary policy is currently restrictive in the sense that, if we maintain this stance for long enough, we will squeeze inflation out of the system,” he said.

“That is what we will do. This also means being on watch for further signs of inflation persistence that may require interest rates to rise again.

“But we should not keep monetary policy restrictive for excessively long. We have to be mindful of the balance of risks between doing too little and doing too much.

“How long a restrictive stance will be needed will ultimately depend on what the incoming data tell us about the outlook for inflation over the medium term.

“The MPC’s latest projections indicate that monetary policy is likely to need to be restrictive for quite some time yet.”

Israel-Palestine conflict creates risk of higher energy prices, says Bailey

Bank of England Governor Andrew Bailey said the war between Israel and Hamas is creating economic uncertainty.

He said: “The events in the Middle East are tragic in terms of the human cost. We have to view it through the economic lens.

“It does create uncertainty, it does I think create a risk of higher energy prices.

“So far, I would say, that hasn’t happened and that’s obviously encouraging, but the risk remains.”

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies

Comments