Stock market news: Dow Jones erases 859 point loss as Wall Street fights back

Markets in turmoil after Putin sends in troop in dawn move

Your support helps us to tell the story

From reproductive rights to climate change to Big Tech, The Independent is on the ground when the story is developing. Whether it's investigating the financials of Elon Musk's pro-Trump PAC or producing our latest documentary, 'The A Word', which shines a light on the American women fighting for reproductive rights, we know how important it is to parse out the facts from the messaging.

At such a critical moment in US history, we need reporters on the ground. Your donation allows us to keep sending journalists to speak to both sides of the story.

The Independent is trusted by Americans across the entire political spectrum. And unlike many other quality news outlets, we choose not to lock Americans out of our reporting and analysis with paywalls. We believe quality journalism should be available to everyone, paid for by those who can afford it.

Your support makes all the difference.The Dow Jones erased an 859 point drop to stunningly end in positive territory at the close of the market on Thursday.

The major US indexes all rose after seeing sharp drops earlier in the day in the wake of Russia’s invasion of Ukraine.

The S&P 500 also ended the day 1.1 per cent higher, after dropping more than 2. per cent earlier in the day.

Investors seemingly took advantage of the market dip in tech, with Netflix ending up nearly five per cent, Microsoft up three per cent, and Alphabet and Meta rising by 2.5 per cent.

Earlier the price of oil has jumped to a seven-year high to nearly $105 (£78).

Brent crude is 6.6 per cent higher at $103.21 a barrel, the highest since August 2014, while US light crude has jumped 6.2 per cent to $97.75 a barrel.

Gas prices are also on the rise, up by 40 per cent, amid fears that the conflict will disrupt global supply chains.

Wall Street fell sharply at the opening on Thursday following the Russian invasion of Ukraine.

The Dow Jones Industrial Average plunged more than 800 points or approximately 2.5 per cent.

Panicked investors fled for the safety of fixed income assets as markets reacted to the worst case geopolitical scenario on the back of the impact of sky-high inflation.

In London, the FTSE 100 index plunged more than 200 points, or 2.7 per cent, upon opening on Thursday in reaction to Russia’s invasion of Ukraine, which US President Joe Biden described as “unprovoked and unjustified”.

Hello and welcome to The Independent’s live coverage of reaction to Russia’s invasion of Ukraine

FTSE 100 falls on opening following invasion

Russia’s invasion of Ukraine roiled global markets Thursday, with financial markets in Sydney, Hong Kong, Tokyo and Seoul falling upon opening.

The London Stock Exchange’s leading FTSE 100 index also plunged more than 200 points, or 2.7 per cent, within moments of opening in reaction to the news on Thursday.

Oil prices meanwhile have topped $100 a barrel for the first time since 2014, with consequences expected for consumers in Europe.

Anna Issac has more:

Russian attack on Ukraine hits global markets

Oil prices reached highest level in seven years following explosions in Ukraine, as investors fled to traditional safe havens

Cost-of-living crisis ‘driven by war’, says MP

A senior Conservative MP has warned that war between Russian and Ukraine will further worsen the UK’s cost-of-living crisis, and told the BBC’s Today Programme: “you can forget about petrol at £1.70 a litre, which is where it’s heading now.”

Tom Tugendhat, chair of the Foreign Affairs Committee, said that if European leaders did not take action against Vladimir Putin, consumers across the continent would suffer.

“10 per cent of the world’s wheat is grown in Ukraine and the idea that this year’s going to be a good crop, I’m afraid, is for the birds”, said Mr Tugendhat. “This is absolutely one of those moments where we’re going to see the cost-of-living crisis driven by war.”

Ben Champan has the details:

UK cost-of-living crisis will be ‘driven by war’ as petrol and prices soar

Petrol prices will surge well past £1.70 a litre unless Western leaders take action to stop Vladimir Putin, says Foreign Affairs Committee chair

Investors swap stocks for gas, oil and gold

Investors rushed towards assets other than stocks on Thursday as Russia ended speculation by invading Ukraine by land, air and sea.

Gold prices were up around 1.7 per cent earlier this morning – its highest level since early 2021 – while silver rose 2.3 per cent based on popularly traded futures contracts.

Oil prices are also higher than at anytime since 2014, with a barrel reaching $100 following Russia’s invasion.

Natural gas has also risen in price across Europe, an by as much as 30 per cent in some countries.

The region, including the EU’s largest economy, Germany, is highly dependent on Russian energy imports.

Kremlin: We have tools to survive ‘emotional’ market reaction

Russia has enough tools to survive what it described as an “emotional” reaction by markets to its move to invade Ukraine, the Kremlin has claimed.

Markets across the globe were rocked this morning after Russian Vladimir Putin launched attacks on his neighbours.

But Kremlin spokesman Dmitry Peskov has said Russia has created enough safety measures to ride out the market volatility.

Peskov added that all necessary measures were being taken to ensure that the market reaction was as brief as possible.

The rouble bounced off all-time lows on Thursday as the central bank announced FX interventions.

Several western countries have already announced sanctions against Russia and more are expected to follow later.

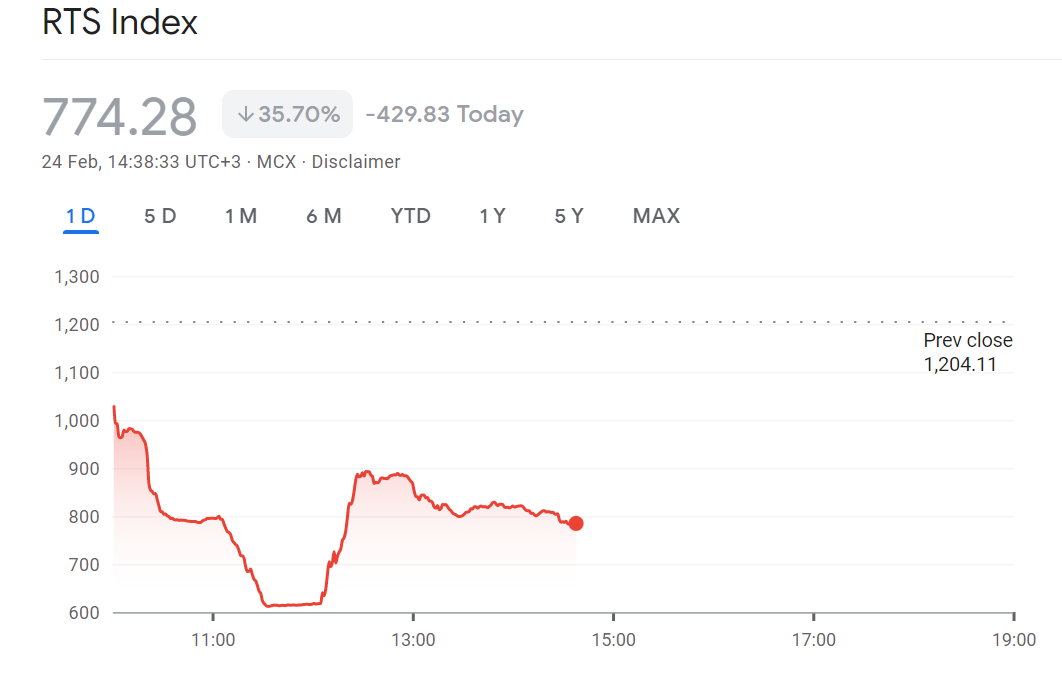

Russian stock market tumbles

Russia’s stock market has crashed dramatically as investors race to pull money out of the country.

The RTS index of large companies’ shares is down 35 per cent today and by 50 per cent this week.

Warning over petrol prices hitting £1.60 a litre as Russia invades Ukraine

Motorists are being warned over the possibility of petrol prices soaring to £1.60 a litre following Russia’s invasion of Ukraine.

The price of Brent crude oil hit its highest level in eight years after increasing by 6.3% to 102.90 US dollars per barrel shortly after 8am on Thursday.

Average fuel prices at UK forecourts are already at record highs, and the situation is expected to worsen as retailers pass on further rises in wholesale costs.

Neil Lancefield has more below:

Warning over petrol prices hitting £1.60 a litre as Russia invades Ukraine

Average fuel prices at UK forecourts are already at record highs, and the situation is expected to worsen.

‘Market getting hit very hard'

The markets are being “hit very hard” following Russia’s invasion of Ukraine, an analyst has warned.

“There are no buyers here for risk, and there are a lot of sellers out there,” which is affecting shares,” Chris Weston, head of research at broker Pepperstone, said.

Market reaction has gone ‘by the playbook’

Reaction from Seema Shah, chief global strategist, principal global investors, London:

“The market reaction has gone by the playbook.”

“Typically with geopolitical events, the response lasts for a while and then the focus shifts to the economic backdrop.”

“We think this is a short-lived rout and markets will come back.”

ICYMI: Oil prices surge past $100 a barrel as Putin declares war on Ukraine

Oil prices have topped more than $100 a barrel for the first time since 2014 after Vladimir Putin announced a Russian invasion of Ukraine.

Brent crude reached highs of $102.48 on Thursday morning, rising by more than 5 per cent as reports of explosions in Kiev and other major cities in the country filtered across the globe.

Russia is the world’s second-largest oil producer and conflict and is a major supplier to Europe. It is also the largest supplier of natural gas to the continent.

My colleague Eleanor Sly has more details below:

Oil prices surge past $100 a barrel as Putin declares war on Ukraine

Markets plunge after Moscow announces military action against Kiev

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies

Comments