UK recession – live: Reeves says Britain trapped in cycle of ‘decline’ as Sunak’s economy pledge ‘in tatters’

Figures confirm 0.3 per cent decline in bigger-than-expected year-end contraction

Your support helps us to tell the story

From reproductive rights to climate change to Big Tech, The Independent is on the ground when the story is developing. Whether it's investigating the financials of Elon Musk's pro-Trump PAC or producing our latest documentary, 'The A Word', which shines a light on the American women fighting for reproductive rights, we know how important it is to parse out the facts from the messaging.

At such a critical moment in US history, we need reporters on the ground. Your donation allows us to keep sending journalists to speak to both sides of the story.

The Independent is trusted by Americans across the entire political spectrum. And unlike many other quality news outlets, we choose not to lock Americans out of our reporting and analysis with paywalls. We believe quality journalism should be available to everyone, paid for by those who can afford it.

Your support makes all the difference.Britain is trapped in a cycle of decline and Rishi Sunak’s pledges to boost the economy are now “in tatters”, Labour’s shadow chancellor Rachel Reeves has warned, as the UK fell into recession.

The Office for National Statistics (ONS) revealed on Thursday a 0.3 per cent decline in gross domestic product (GDP) between October and December 2023.

The gloomy official figures mean the economy entered a technical recession, as defined by two or more quarters in a row of falling GDP, for the first time since amid the pandemic in the first half of 2020.

The news deals a blow to the prime minister, who has promised to grow the economy as one of his five priorities, especially after most economists were only forecasting a 0.1 per cent decline in GDP.

In comments Labour suggested were “out of touch”, chancellor Jeremy Hunt said low economic growth is “not a surprise”, but added that the UK must “stick to the plan – cutting taxes on work and business to build a stronger economy” despite tough times for many families.

UK technically in recession last year, statistics set to reveal

Welcome to our live blog on the UK economy.

The UK is believed to have slipped into recession at the end of last year after a weak December for the country’s economy, official figures are set to show.

The Office for National Statistics (ONS) is predicted to reveal that the UK economy contracted for the second quarter in a row in the final three months of 2023.

Most economists are forecasting a 0.1% decline in gross domestic product (GDP) between October and December.

This would follow a 0.1% contraction in the previous three months, after a downward revision against the zero growth initially estimated.

A contraction in the fourth quarter would mean the UK tipped into a technical recession, as defined by two or more quarters in a row of falling GDP.

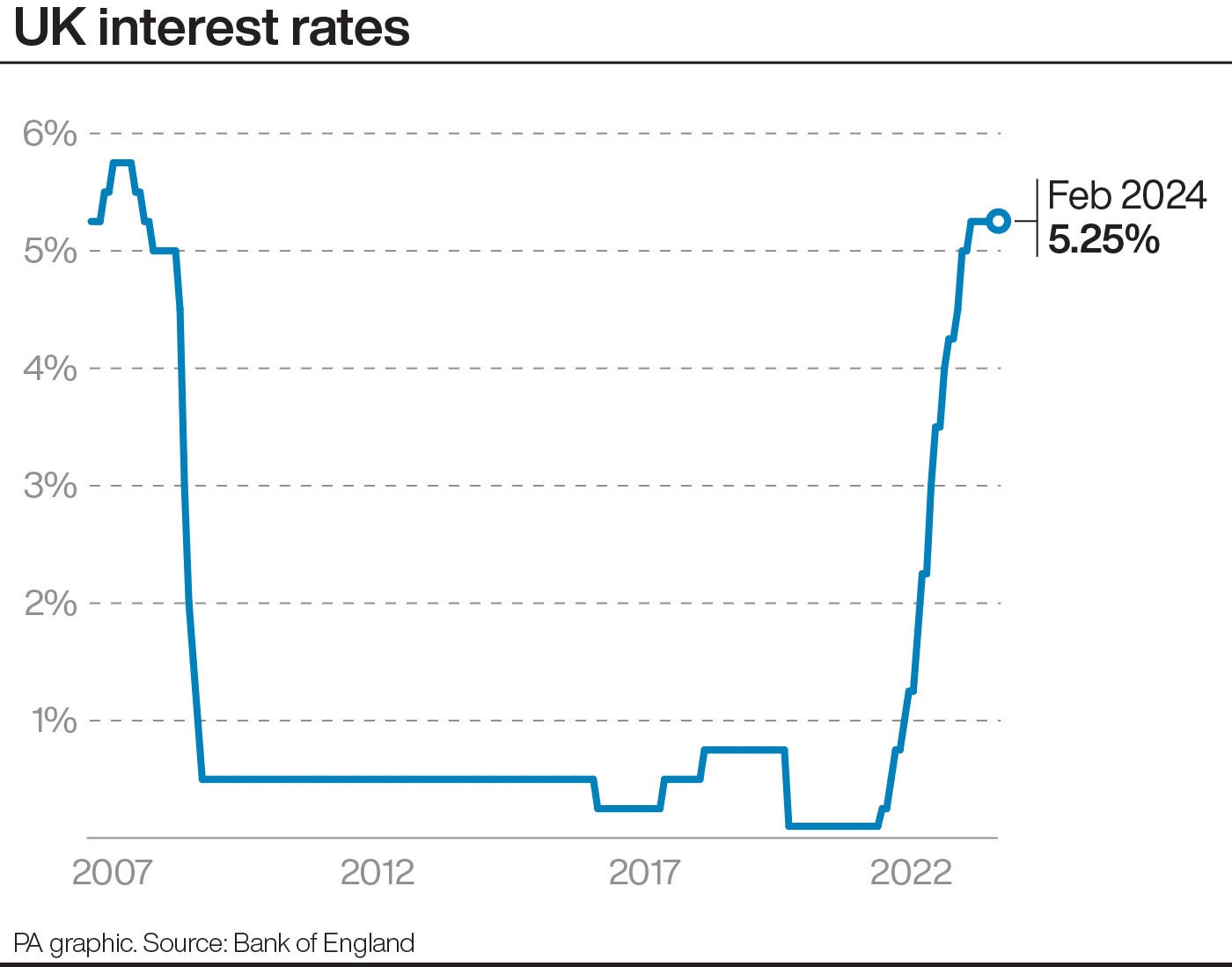

The Bank of England has held interest rates at 5.25% four times in a row.

Economy thought to have been weak last year

Official figures for the fourth quarter of last year are also expected to show that the economy was weak last year as a whole.

ONS estimates suggest it did not grow at all between April and June, before shrinking between July and September, which has left the UK at risk of recession in the final three months.

Economy is flat at best, says Bank chief

Bank of England governor Andrew Bailey has signalled that a recession, if confirmed, would be likely to be brief, telling a Lords committee on Wednesday the economy was beginning to pick up.

Mr Bailey told the House of Lords Economic Affairs Committee: “In our February Monetary Policy Report, it was in the balance – we didn’t have a recession in the forecast, but it is at best flat, in the view we took.

“It wouldn’t take much to tip it either way, frankly.

“Going forward – and I think this is in some ways more significant – we are now seeing some signs of the beginning of a pick-up in some of the surveys, for instance … we’ve got a modest pick-up this year which continues thereafter.”

Inflation surprises experts by holding steady

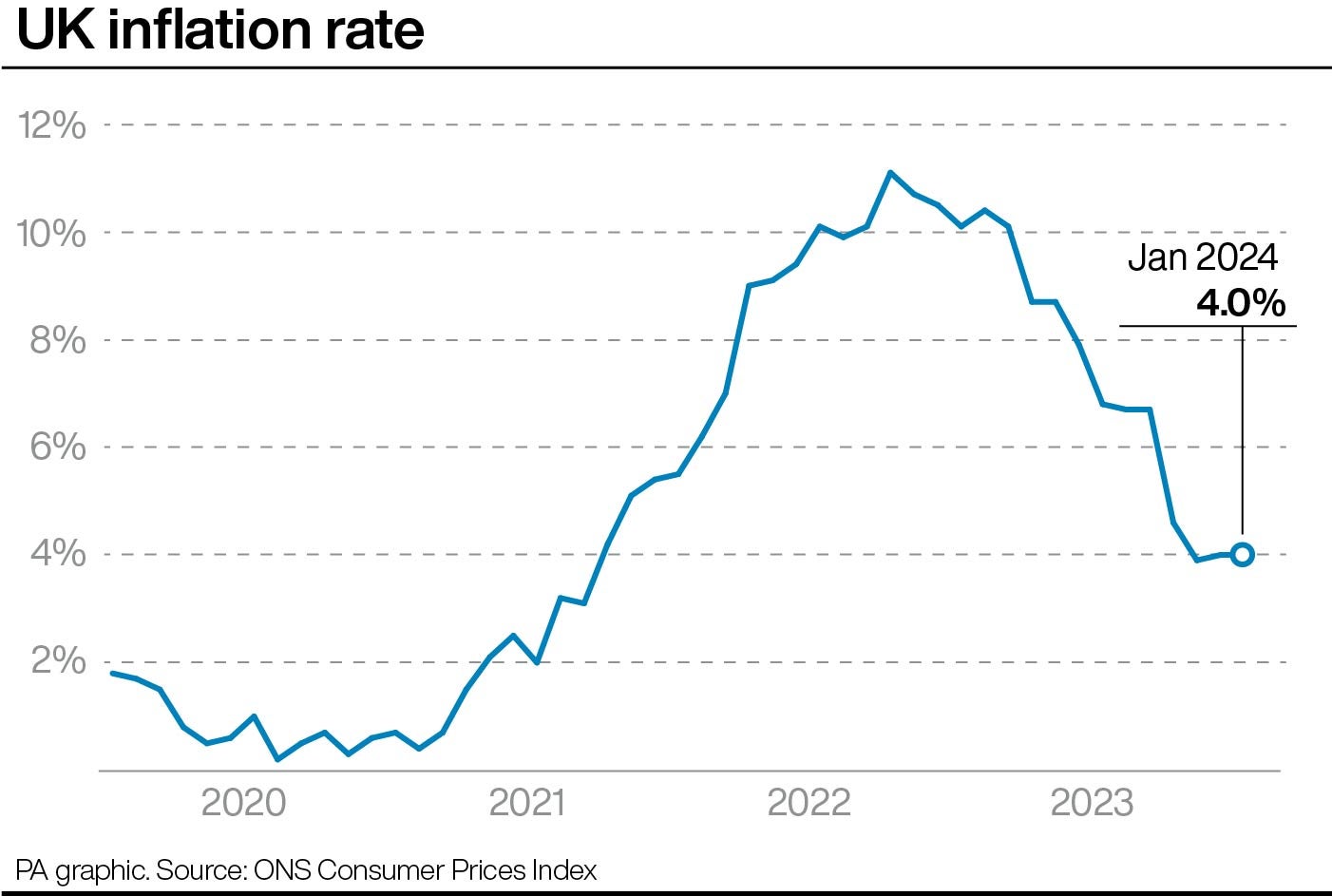

UK inflation defied expectations to hold steady at 4% in January as lower food prices helped offset increases in energy costs, official figures show. Economists had expected a rise to 4.2%:

UK inflation holds steady at 4% in January as lower food prices help offset higher energy costs

Inflation in the U.K. held steady at 4% in January as lower food prices helped offset an increase in energy costs

Workers ‘set to benefit from tax cut and wage growth'

Workers are likely to start feeling better off despite a short-lived recession, say experts.

Ellie Henderson, an economist at Investec said: “Our base case is that the economy probably did tip into a recession, although this would be in the mildest of senses: a better description of the trend might be stagnation.”

Investec is pencilling in a 0.1% contraction in the fourth quarter, with weak retail data dragging on the all-important services sector and leading to a 0.3% fall in output in December.

Ms Henderson added: “In all, we expect that it was a tough end to the year for the UK economy, but 2024 is likely to have got off to a better start as household budgets look to have loosened a little.

“Indeed, the decline in inflation combined with still high wage growth will continue to drive real household disposable incomes higher, a key factor behind the expected recovery this year.

“There will also be the added lift to post-tax incomes from the 2p cut to employees’ National Insurance Contributions, effective from January 6 – and, in all likelihood, more to come in the March Budget.”

London shares soar

Shares in London soared on Wednesday after new official inflation figures were lower than economists had expected, increasing the chance of a Bank of England rate cut in months to come.

The FTSE-100 rose 56.12 points, or 0.75%, ending the day at 7,568.4, as retailers and housebuilder Persimmon joined the bottler of Coca-Cola close to the top of the index.

The inflation rate was 4% in January, the same as the month before, but traders celebrated because economists had expected a rise to 4.2%.

“The past 24 hours have been full of surprises, and this morning’s UK inflation data certainly caught markets on the hop,” said Chris Beauchamp, chief market analyst at online trading platform IG.

“Rapid deceleration in price growth has hit the pound hard, as it seems a Bank of England rate cut has become a much more likely event in the first half of the year.

“This has helped the FTSE-100 to outperform other indices today, though of course it lags far behind on a longer-term view.”

UK likely to have slipped into recession, experts say

UK likely to have slipped into recession, experts say

Economists are forecasting a 0.1% decline in GDP between October and December

Britain to suffer highest inflation in G7, says OECD

Britain to suffer highest inflation in the G7 in 2024 and 2025, OECD

The Organisation for Economic Co-operation and Development revised down its forecasts for Britain’s economic growth this year

From inflation to growth, how Sunak is doing on his five pledges

From inflation to growth, how is Rishi Sunak doing on his five pledges

Rishi Sunak is this week facing a crucial test of some of economic promises he made as part of his five key priorities.

Inflation expected to drop, says Bank chief

A technical recession may further add to the case for an interest rate cut, with the Bank of England already indicating it is more a case of when, not if, a reduction will come.

Bank of England governor Andrew Bailey said that inflation remaining unchanged “leaves us broadly where we thought we were going to be”.

Asked whether he thought the UK could be stuck with inflation at its current 4% level, he reiterated that the rate was expected to return to the 2% target by the spring, according to its own forecasts.

“It looks like we’re going to have quite a leg down between now and April-May time,” he said.

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies

Comments