UK set for biggest fall in living standards since records began, as inflation eats into GDP growth

The chancellor may face mounting pressure to increase help for households in the months ahead with an £830 rise in energy bills in October, the Office for Budget Responsibility has warned

Your support helps us to tell the story

From reproductive rights to climate change to Big Tech, The Independent is on the ground when the story is developing. Whether it's investigating the financials of Elon Musk's pro-Trump PAC or producing our latest documentary, 'The A Word', which shines a light on the American women fighting for reproductive rights, we know how important it is to parse out the facts from the messaging.

At such a critical moment in US history, we need reporters on the ground. Your donation allows us to keep sending journalists to speak to both sides of the story.

The Independent is trusted by Americans across the entire political spectrum. And unlike many other quality news outlets, we choose not to lock Americans out of our reporting and analysis with paywalls. We believe quality journalism should be available to everyone, paid for by those who can afford it.

Your support makes all the difference.Brits are set for the biggest fall in living standards on record as inflation eats into household’s buying power and crimps economic growth, spending watchdog, the Office for Budget Responsibility (OBR) said on Wednesday.

The body, tasked with checking the chancellor’s maths, warned that inflation, the pace of price growth in the economy, will average 7.4 per cent over the next year and reach close to 9 per cent, a 40 year high, in October. Inflation already hit a new 30-year high in the 12-months to February, according to official figures.

Using a forecast of future energy prices, its first since the Russian invasion of Ukraine, the watchdog now expects the price cap on energy bills will rise by a further £830 in October.

This, and other factors, mean that the cash households have after paying for essentials will drop by 2.2 per cent, the OBR said, the largest fall in living standards in a single financial year since records began in 1956.

The official forecaster’s grim view tallies with similar figures from the Bank of England issued earlier this year, and might force the chancellor into greater action to ease the pain for consumers in the months ahead.

Pressure will build to “provide further support for households in the event of another large rise in the energy price cap in October” - something the OBR already expects. There will be ongoing calls for the chancellor to address a real terms fall of 5 per cent to benefits or to cancel next year’s pencilled-in increase to fuel duty of 6 per cent, it said.

For now, the cut to fuel duty, the energy bill rebate and raising the threshold for National Insurance Contributions - so that earners will keep an extra £3,000 before they pay the levy - will only offset half the cost of rising energy bills.

Meanwhile, by raising the threshold by £3000, the chancellor has raised questions over how enough funds will be generated to address the chronic NHS backlog and tackle the social care needs of an ageing population.

The Independent understands that the £12bn a year the levy was meant to raise will be ringfenced by the Treasury up to 2024-25, the end of the spending review period. It is not yet clear what will happen after that time.

But there are other, non-energy, inflationary pressures on consumers, too, including food, goods and services. These account for over half of total inflation. This means the government’s efforts will only offset a third of this overall fall in living standards, the watchdog said.

The economic shock is so severe that inflation will dampen consumers’ appetites to buy goods and services, eating into economic output.

“Higher inflation will erode real incomes and consumption, cutting GDP growth this year,” the body said.

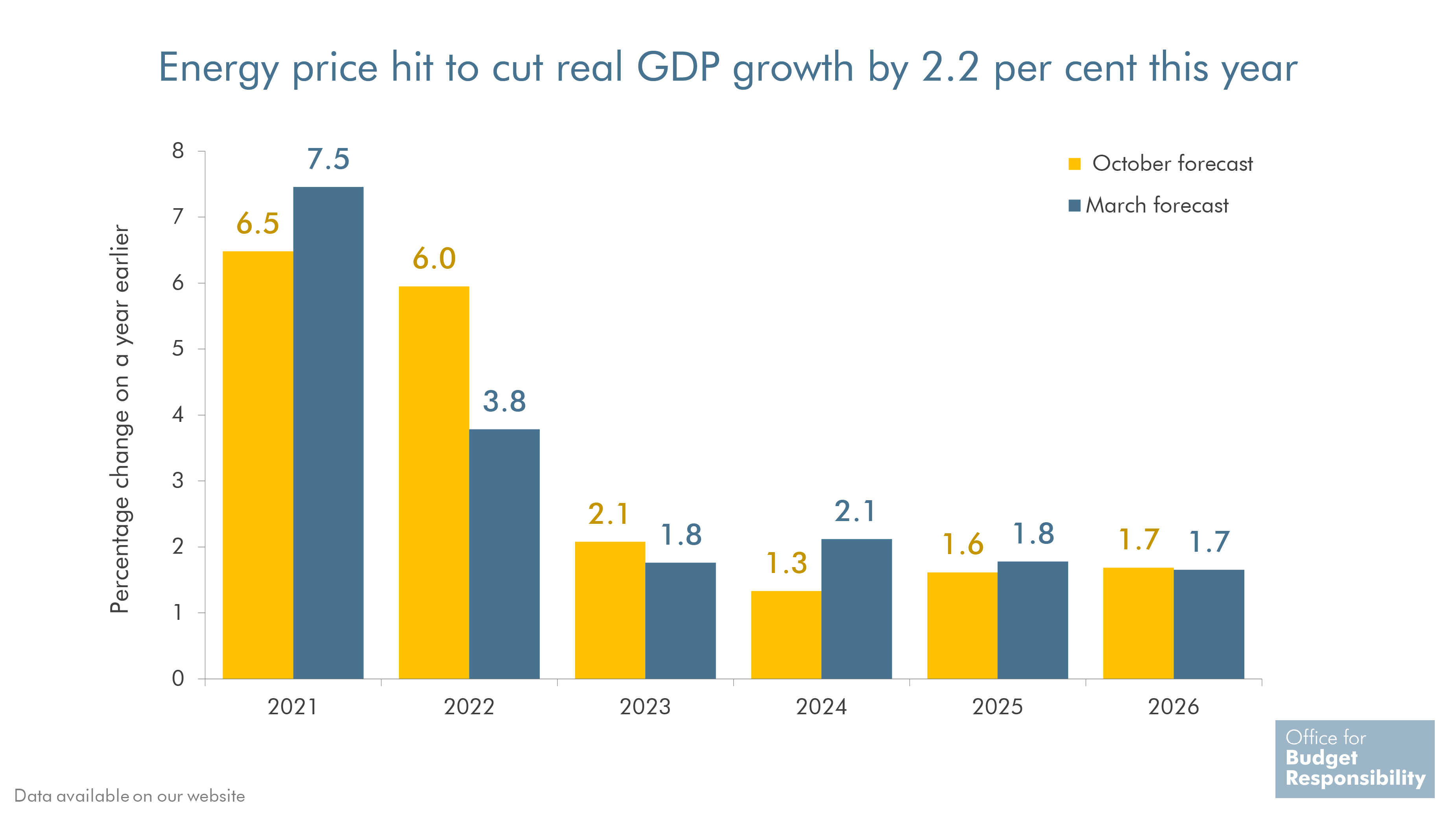

It trimmed its forecast for economic output 2022 from 6 per cent at the Budget least year, to 3.8 per cent. The pattern continues next year, too, with expectations dropping from 2.1 per cent, to 1.8 per cent growth in 2023, as “the cost of living squeeze continues, some fiscal support is withdrawn, and monetary policy tightens further,” it said.

While the chancellor emphasised the role of Russia’s violent invasion of Ukraine in driving up energy costs, the spending watchdog noted that the bumpy economic recovery from the pandemic had already driven up inflationary pressures. Russia’s actions had added to the uncertainty facing the UK’s fragile recovery from the pandemic, Mr Sunak said.

“We should be prepared for the economy and public finances to worsen, potentially significantly,” he added.“The conflict also has major repercussions for the global economy, whose recovery from the worst of the pandemic was already being buffeted by Omicron, supply bottlenecks, and rising inflation,” the OBR said.

The forecaster also stood firm on its predictions of the hit to British trade as a result of Brexit saying it saw “little evidence” to revise its assumption about the negative impact on trade flows from quitting the European Union. This is also unlikely to be offset by fresh trade deals, it suggested.

It added: “...we continue to forecast little growth in export and import volumes and a fall in the trade intensity of the economy over the medium term.”

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies

Comments