Mark Carney prepares ground for August interest rate hike from Bank of England with 'confident' economic view

‘The incoming data have given me greater confidence that the softness of UK activity in the first quarter was largely due to the weather, not the economic climate,’ he said

Your support helps us to tell the story

From reproductive rights to climate change to Big Tech, The Independent is on the ground when the story is developing. Whether it's investigating the financials of Elon Musk's pro-Trump PAC or producing our latest documentary, 'The A Word', which shines a light on the American women fighting for reproductive rights, we know how important it is to parse out the facts from the messaging.

At such a critical moment in US history, we need reporters on the ground. Your donation allows us to keep sending journalists to speak to both sides of the story.

The Independent is trusted by Americans across the entire political spectrum. And unlike many other quality news outlets, we choose not to lock Americans out of our reporting and analysis with paywalls. We believe quality journalism should be available to everyone, paid for by those who can afford it.

Your support makes all the difference.Mark Carney, the governor of the Bank of England, has set the stage for an August interest rate hike, by arguing that the first quarter UK growth slump was a temporary blip caused by the “Beast from East”.

The Bank’s Monetary Policy Committee held off from raising rates from 0.5 per cent to 0.75 per cent in May, saying it wanted to be sure that the dip in GDP growth to a five-year low was merely due to the bad weather.

Speaking in Newcastle, Mr Carney said he had been largely reassured.

“The incoming data have given me greater confidence that the softness of UK activity in the first quarter was largely due to the weather, not the economic climate,” he said, pointing to sentiment surveys, and jobs and pay growth.

“Overall, recent domestic data suggest the economy is evolving largely in line with the May Inflation Report projections, which see demand growing at rates slightly above those of supply and domestic cost pressures building.”

The nine member MPC voted by a majority of six to three to keep rates on hold last month, with chief economist Andy Haldane switching sides to vote for a hike.

The next meeting will be in August. Before Thursday’s speech by the governor, markets were already pricing in a roughly 60 per cent probability of a rate hike in August.

Sterling jumped to $1.3265 after his remarks were made public.

The Office for National Statistics had argued that the first quarter slowdown was due to more than just the weather. Yet the statistics agency has already revised up its first quarter growth estimate from 0.1 per cent to 0.2 per cent on the back of improved construction data.

The Bank has suggested that it will ultimately be revised up to 0.3 per cent and that growth in the second quarter of 2018 will come in at 0.4 per cent.

Mr Carney also issued a warning about the economic damage a full-blown trade war, instigated by Donald Trump, could do to the UK.

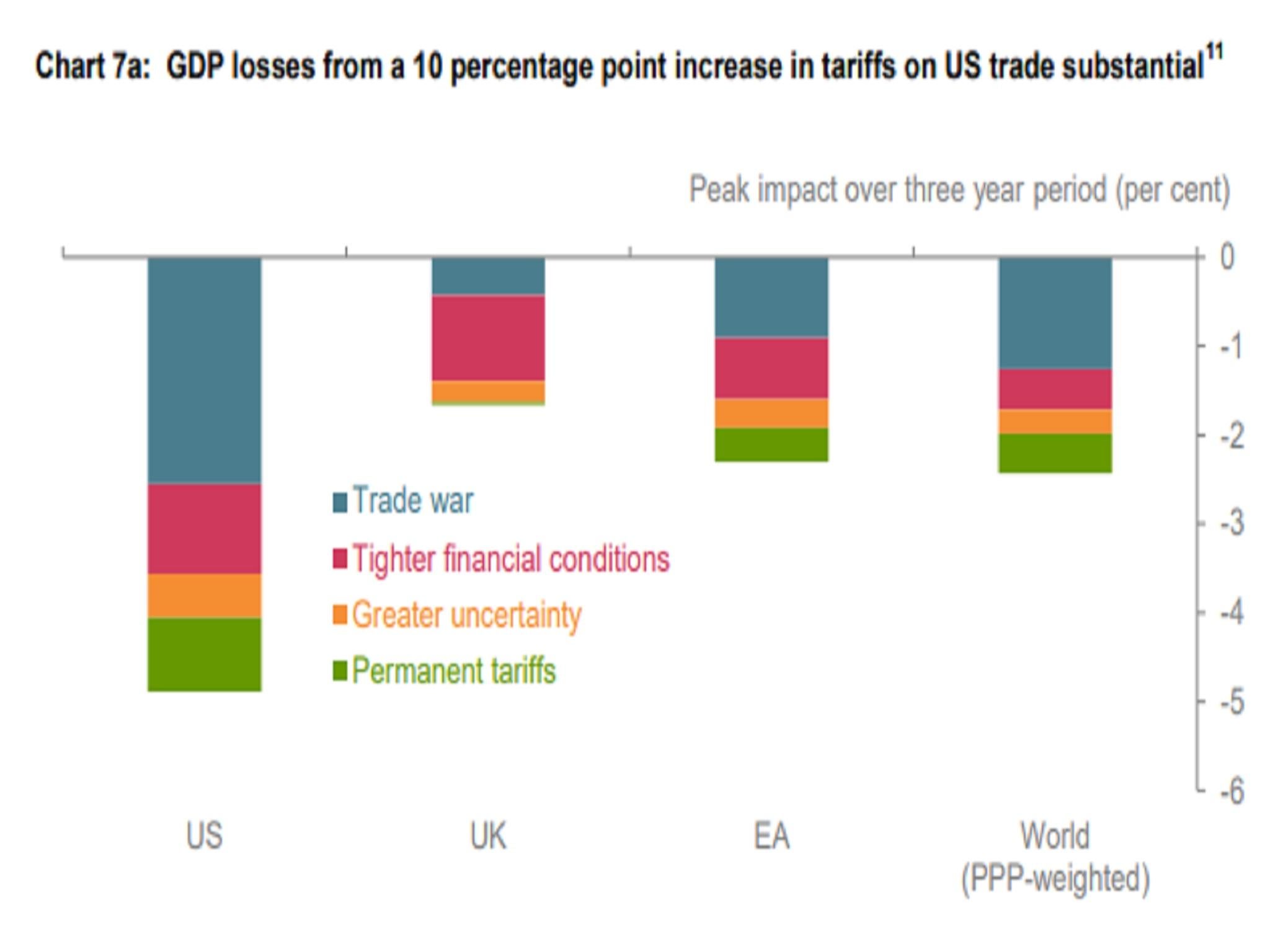

He unveiled Bank model simulations showing that a 10 percentage point hike in average US tariff rates could knock almost 2 per cent off UK GDP growth over three years through trade affects, tighter financial conditions and greater business uncertainty.

The impact on the US itself would be considerably greater at more than 5 per cent.

Trade war damage

The governor said the impact – and the challenge for monetary policymakers – would be similar to that posed by the Brexit vote in June 2016, which he said had hit UK GDP growth by between 1.75 and 2 per cent.

But he also pointed out that after the Brexit vote the economy had been supported by the Bank cutting interest rates.

“In a general trade war, it is unlikely that global financial conditions would prove as robust, or that monetary policy could be as supportive,” he warned.

On Brexit, Mr Carney said assertions from Brexiteers that any damage from the loss of trade with the continent from leaving the single market would be offset by new trade deals were unrealistic.

“Brexit will, for a period, be an example of deglobalisation because any reduction in openness with the EU is unlikely to be immediately compensated by new ties of a similar magnitude with other trade partners,” he said.

The governor has previously said that the 2 per cent of GDP hit from the Brexit vote has already cost each UK household about £900.

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies

Comments