Interest rates live: Bank of England holds interest rates at 4.75% in latest blow for Labour

The Office for National Statistics revealed that inflation had risen to 2.6 per cent from 2.3 per cent, pushed higher by pricier petrol and clothing

Your support helps us to tell the story

From reproductive rights to climate change to Big Tech, The Independent is on the ground when the story is developing. Whether it's investigating the financials of Elon Musk's pro-Trump PAC or producing our latest documentary, 'The A Word', which shines a light on the American women fighting for reproductive rights, we know how important it is to parse out the facts from the messaging.

At such a critical moment in US history, we need reporters on the ground. Your donation allows us to keep sending journalists to speak to both sides of the story.

The Independent is trusted by Americans across the entire political spectrum. And unlike many other quality news outlets, we choose not to lock Americans out of our reporting and analysis with paywalls. We believe quality journalism should be available to everyone, paid for by those who can afford it.

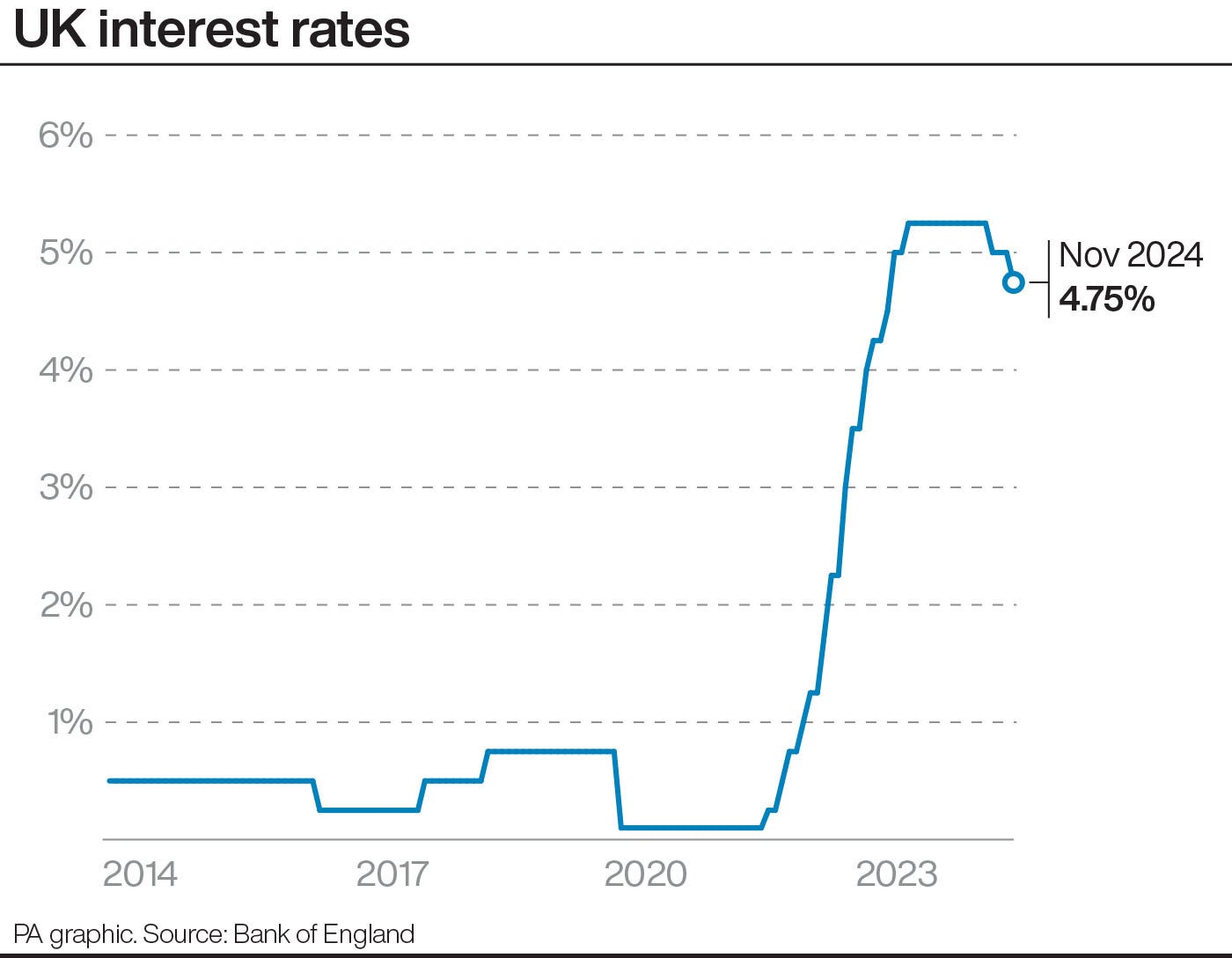

Your support makes all the difference.The Bank of England held interest rates steady at 4.75 per cent on Thursday after it was revealed that inflation in November rose to 2.6 per cent, above the central bank’s target.

The move keeps borrowing costs high for mortgage holders and also the government.

The Office for National Statistics revealed inflation had risen to 2.6 per cent from 2.3 per cent, pushed higher by pricier petrol and clothing.

The central bank uses higher interest rates as a tool to try and tame inflation, forcing families to spend more on borrowing rather than pushing up the prices of goods.

Another pressure on inflation comes from rising wages. Pay packets are now growing at 5.2 per cent, up from 4.9 per cent three months ago, according to data from the Office for National Statistics released earlier this week.

Money market traders have pushed back their expectation of a rate cut to May. Previous market activity suggested that a cut could have come in March.

Commercial lenders like high street banks and building societies use the bank base rate as a guide on how much to charge borrowers and how much to reward savers.

The Bank of England said that its Monetary Policy Committee voted by a majority of 6–3 to maintain Bank Rate at 4.75 per cent. Three members preferred to reduce Bank Rate by 0.25 percentage points, to 4.5 per cent. It said: “Since the MPC’s previous meeting, twelve-month CPI inflation has increased to 2.6% in November from 1.7% in September. This was slightly higher than previous expectations, owing in large part to stronger inflation in core goods and food. Services consumer price inflation has remained elevated. Headline CPI inflation is expected to continue to rise slightly in the near term. Although household inflation expectations have largely normalised, some indicators have increased recently.”

The Bank of England has held interest rates steady at 4.75 per cent.

Traders are busy unwinding bets of a Bank of England rate cut in February, which would be the next time policymakers meet to set rates.

It’s now evenly balanced after traders’ bets indicated an 80 per cent likelihood only a week ago.

Meanwhile, the pound has regained some ground against the dollar. Sterling climbed 0.7 per cent to $1.26.

The FTSE 100 has had a wobble ahead of the looming interest rate decision, due in a little under an hour. It has slid 1.4 per cent to 8,085.82. The index of 100 biggest companies listed in London has been on a downslide for the last month.

Government borrowing costs have also climbed. The Labour government does have some skin in this game, since the BoE’s decision will inform how much the Treasury will have to pay to borrow. Yields - the interest available should you buy a bond in the secondary market right now - have risen to 4.604 per cent. At the start of the month they were closer to 4.2 per cent.

Before the big announcement - and to cover our backs in case rates do go up or down - here is an excellent chart from the Financial Times’ Alphaville blog, charting expectations from the markets on what rates will do in the US and what they actually did.

This is for US interest rates, but you bet that Bank of England predictions are similarly fallible.

Wall Street had a minor meltdown yesterday after that rate decision, with the S&P500 ending the day down 2.95 per cent. The slow down in interest rare cuts was well flagged, said Russ Mould, investment director at stockbroker AJ Bell

“Markets are normally good at reading the signs, but the sell-off on Wall Street last night would suggest investors had started on the Christmas sherry a bit early and were caught out by the Fed’s announcement about where rates might go in 2025,” says Mr Mould.

“The prospect of a slowdown in interest rate cuts was front and centre days before the Fed’s latest update, but investors seemed to miss the signs.

“The US economy has been holding up well and Donald Trump’s policies are inflationary, meaning the Fed has no reason to keep snipping away on a regular basis.

The Federal Reserve, which is the US central bank, decided to cut rates yesterday,. The Fed uses a range, and cut its range by 0.25 percentage points to 4.24-4.5 per cent.

Pushpin Singh, Senior Economist, Centre for Economics and Business Research said: “The Federal Reserve (the Fed) opted to cut interest rates for the third consecutive meeting, by 25 basis points, yesterday evening. The decision was accompanied by the Federal Open Market Committee’s (FOMC) publication of its latest projections.

The Fed said it expects the US economy to grow by more than expected and that inflation may also be higher than thought. Rate cuts may not come as thick and fast as previously thought.

“ The central bank now expects only 50 basis points worth of cuts next year, down from the 100 basis points in its last projection, signalling a hawkish stance on monetary policy and underscoring concerns of lingering inflationary pressure more broadly.”

Most City-watchers are convinced interest rates will be held at 4.75 per cent today, but what about after that?

Analysts at investment bank Goldman Sachs said that the Bank is likely to cut interest rates every three months, “given firmer near-term inflation numbers and uncertainty around the impact of the employer national insurance hike”.

Nomura analysts think rates will settle in the longer term at about 3-3.5 per cent.

Rates have been on a merry journey since the financial crisis, when borrowing was close to free for some debtors, including various governments.

The record high was 17 per cent in November 1979, which remained the rate until July 1980.

The record low was 0.1 per cent in March 2020 in the wake of Covid.

From 1719 to 1822 rates were fixed at 5 per cent.

If you are just joining us, we are counting down to noon, to see which way the Bank of England will go on interest rates. Centre for Economics and Business Research Senior Economist Charlie Cornes thinks they will be held at 4.75 per cent.

Mr Cornes said: “CPI inflation in the UK rose for a second consecutive month in November, to 2.6 per cent, driven by higher prices for motor fuels and clothing. Meanwhile, core and services inflation, both indicators carefully monitored by the Bank of England (BoE) as measures of underlying price pressure, remain elevated, at 3.5 per cent and 5.0 per cent respectively. He said recent wage growth data are “all signs are pointing towards the BoE holding off on cutting interest rates.” “Instead, Cebr maintains that the next rate cut will be in Q1 2025.”

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies

Comments