Trussonomics is in big trouble – and it hasn’t even begun

The new PM needs a practical plan rather than booster-style slogans, and needs it fast, writes Hamish McRae

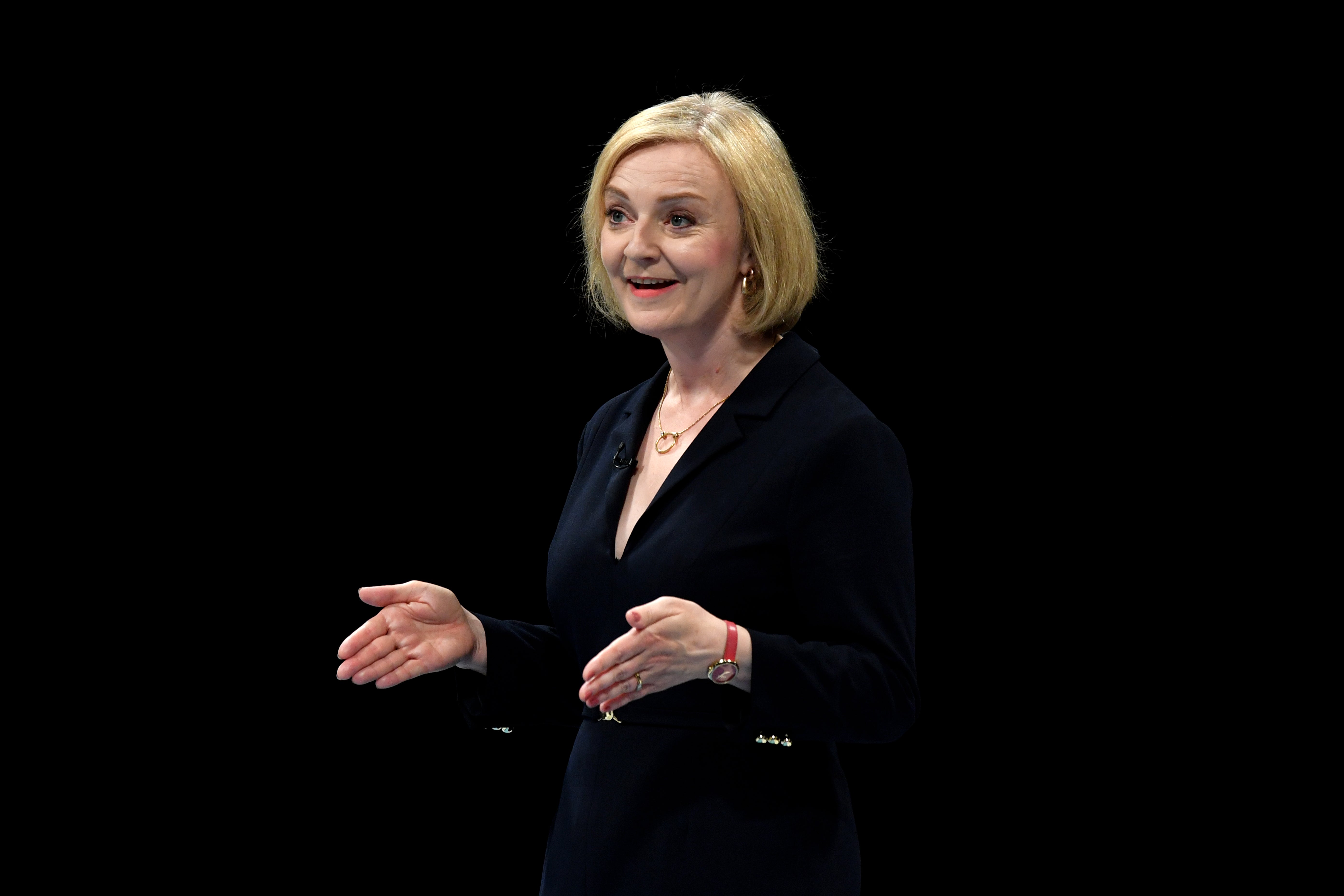

There is such a wall of problems facing the new prime minister next week – and let’s assume it is indeed Liz Truss in the chair – that it is hard not to feel a sense of foreboding about the autumn and winter ahead. Whatever your politics, the economics remain the same, and we are all going to hit that wall. It will be one of those periods where views don’t matter; what matters is what will happen.

So what should we expect? The easiest way to get our minds around all this is to break the problems down into bite-sized chunks, and make an assessment of each.

First, there is the cost and security of energy supplies. For the UK and especially Europe, this is about gas. Oil supplies are OK, and the price at a little over $100 a barrel has come down more than 20 per cent from its peak. Gas is different, and both security of supply and the price are profound worries.

So there will be an emergency plan over and on top of what has already been announced in the next two or three weeks. Every European nation will be doing something similar and the question, therefore, will be how well the UK manages to cope. Obviously, the taxpayer will pay in one way or another, but the burden has to be pushed forward. This will be the first test of the new government’s competence – maybe the defining one.

Next, there is inflation in general. Global leadership comes from the US Federal Reserve. Last week its chair, Jay Powell, committed the Fed to increasing interest rates until it was clear that inflation was heading back to the 2 per cent target, even at the cost of economic pain. The UK has no option but to follow similar policies, and while the government is not responsible for monetary policy – that is what independence for the Bank of England means – it will inevitably be held to account for the consequences of whatever the Bank does. There are levers the government can pull, including direct action on energy prices, a large component of inflation.

Whatever the government does, however, interest rates will continue to climb. That will put pressure on home-buyers, for mortgage rates are already climbing. A two-year fix is now over 4 per cent. While almost all recent home-buyers will still be in profit, thanks to prices rising by more than 10 per cent a year, some purchasers will be squeezed and there will be pressure on the government to make sure that as few people as possible find their homes repossessed because they cannot service their mortgage. House prices are an intensely political issue that no government can duck, and the harsh reality is that voters as a whole like rising prices even if prospective home-buyers don’t.

Slightly longer term is the UK trade relationship with Europe. There is no point in getting back into the whole Brexit debate, and the issue is how to make it work. Keir Starmer laid out Labour’s plan last month. The new PM needs a practical plan rather than booster-style slogans, and needs it fast. This is one crucial element of its relationship with the British and Northern Irish business communities, and there are many others.

Overarching everything is the fiscal challenge. The new PM and chancellor face the prospect of the government’s budget deficit going up this financial year, not down. The combination of slower growth (maybe no growth), higher interest on the national debt, and the spending needed to help the vulnerable through the energy crisis looks like pushing the deficit this year above the £150bn level of last year. It was supposed to come down to £100bn.

To keep up to speed with all the latest opinions and comment, sign up to our free weekly Voices Dispatches newsletter by clicking here

There has to be an emergency budget and we are promised one. So let’s see what the Office for Budget Responsibility makes of the new government’s plans. The whole point of creating the OBR was to make sure that there was some reasonably independent scrutiny of the government’s spending plans. Actually the OBR has turned out to have been rather too pessimistic about public finances over the past couple of years but now that caution looks justified.

The new government can borrow more provided it has a credible long-term plan to get the deficit under control. Otherwise it risks paying even steeper interest on the national debt, and possibly a run on the already weak pound. This is not about politics. It is about maths.

And there’s the rub. This new government will be a prisoner of events. They have to realise that. If they do – and if Trussonomics turn out to be cautious and wise – then the winter will be less troubled. If not, the government gets damaged, but much more important, so do the rest of us.

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies

Comments