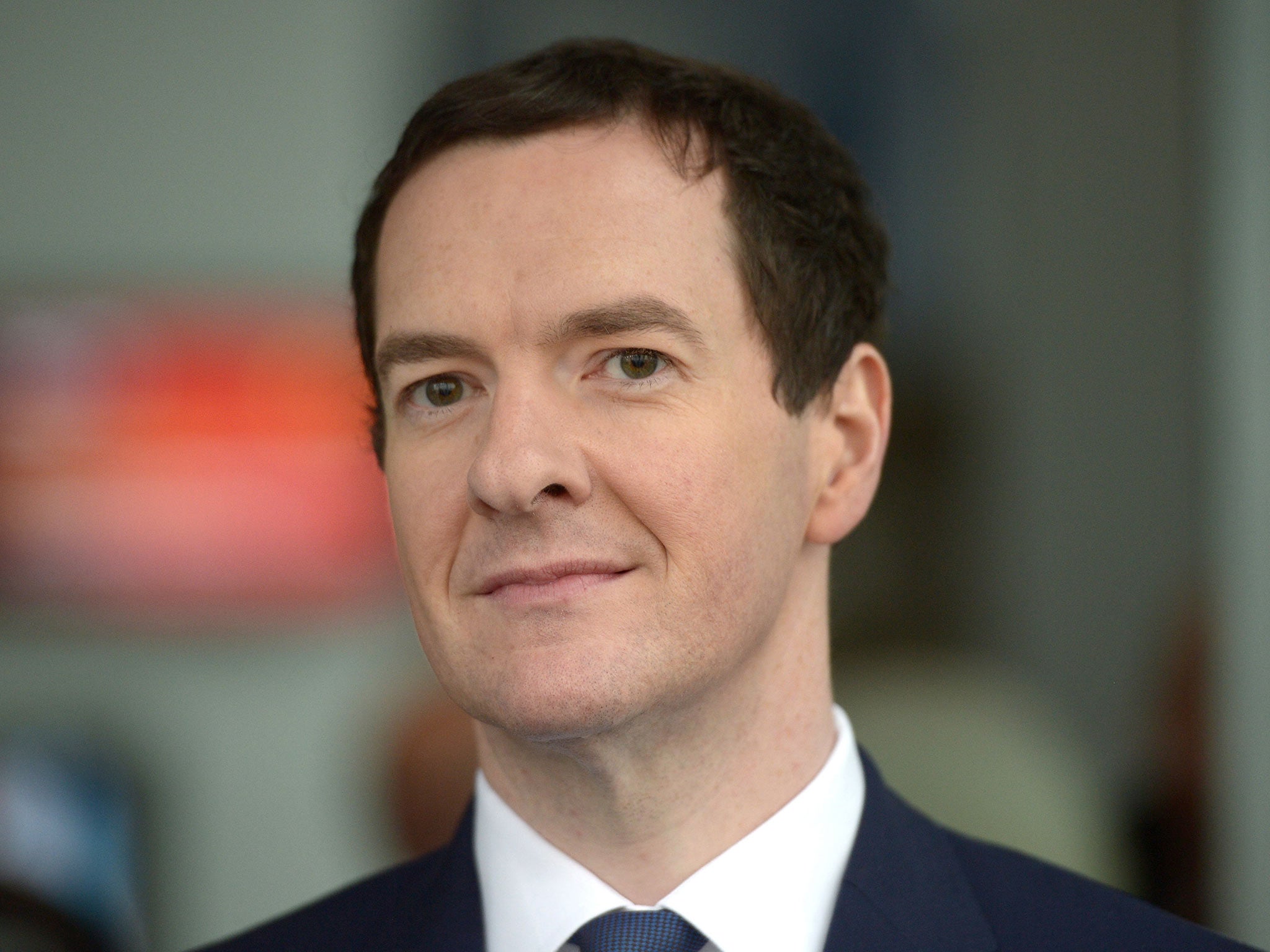

The coming months will require judicious action by George Osborne as the world faces fresh financial turmoil

Mr Osborne might do some good at little financial cost by indicating as strongly as he can that he supports Britain remaining in the EU

Your support helps us to tell the story

From reproductive rights to climate change to Big Tech, The Independent is on the ground when the story is developing. Whether it's investigating the financials of Elon Musk's pro-Trump PAC or producing our latest documentary, 'The A Word', which shines a light on the American women fighting for reproductive rights, we know how important it is to parse out the facts from the messaging.

At such a critical moment in US history, we need reporters on the ground. Your donation allows us to keep sending journalists to speak to both sides of the story.

The Independent is trusted by Americans across the entire political spectrum. And unlike many other quality news outlets, we choose not to lock Americans out of our reporting and analysis with paywalls. We believe quality journalism should be available to everyone, paid for by those who can afford it.

Your support makes all the difference.World markets were in turmoil for a second day on 9 February, prompting urgent questions for economists and governments about the chances of another devastating global recession. There are, as we report, some reasons for optimism and yet others for deep concern. Whatever follows may prove to be the most significant test yet in George Osborne’s career.

Young as he is, Mr Osborne has already completed a longer term as Chancellor of the Exchequer than many of his predecessors. He has been more successful than many, too. But on the central challenge that the Coalition and now this majority Government set themselves – to restore the public finances – the Chancellor has missed his targets and the job remains at best half-done. There are plenty of explanations and excuses for that record, including the eurozone’s perennial crises.

Conversely, Mr Osborne has sometimes enjoyed better luck, as when that window of opportunity opened last year through which he could throw out his ill-starred plan to reduce tax credits. The low oil price may also offer more room for manoeuvre. Now, however, the choices are getting starker and have been highlighted by the Institute for Fiscal Studies. It points out that if growth is indeed lower than forecast this year (as the Bank of England has indicated is likely) then tax receipts will be depressed. There is a wider question here about why the UK’s tax yield is low and how its tax base came to be so narrow, so that even record jobs growth hasn’t fed through as powerfully into healthier public finances. In the short term, the Chancellor faces choices every bit as tough as he did when he first walked into No 11 in 2010.

We already have a fair idea about what Mr Osborne will be tempted to do in a tight corner. He has floated the idea of restricting higher-rate tax relief on pension pots, a measure that will hit the Conservatives’ natural supporters hard, as well as sending all the wrong messages about saving for later. That Mr Osborne is even thinking about such a raid is proof of the difficult position he finds himself in. He might also turn his attentions again to social security, which is about to undergo fundamental and potentially hazardous reform under the universal credit programme. He will also attempt to offload more tough choices on to local authorities by devolving spending and funding responsibilities. Maybe all are unavoidable but he might be better advised to use the weakness in the oil price to push the cost of fuel higher, in a sort of stabilising move, one that would also be good for the environment and public finances.

One option the Chancellor ought not to be tempted by is to trim his infrastructure spending plans. These represent a kind of best hope for lifting the long-term growth rate of the economy. There have been stealthy reductions here in the past, despite the hoo-ha about Crossrail, HS2 and the rest, but, if the Government is serious about the long-term economic well-being of the nation, it really has little choice but to stick to those plans.

Mr Osborne might do some good at little financial cost by indicating as strongly as he can that he supports Britain remaining in the European Union. He might not love the EU, but as the best way to secure investment, protect manufacturing jobs and the status of the City of London, a broad hint in the next few weeks that that is where he sees Britain’s future would do much to reassure business and investors. Unlike many of the other things he will need to decide in his Budget in a few weeks, that should not be a tough choice to take.

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies

Comments