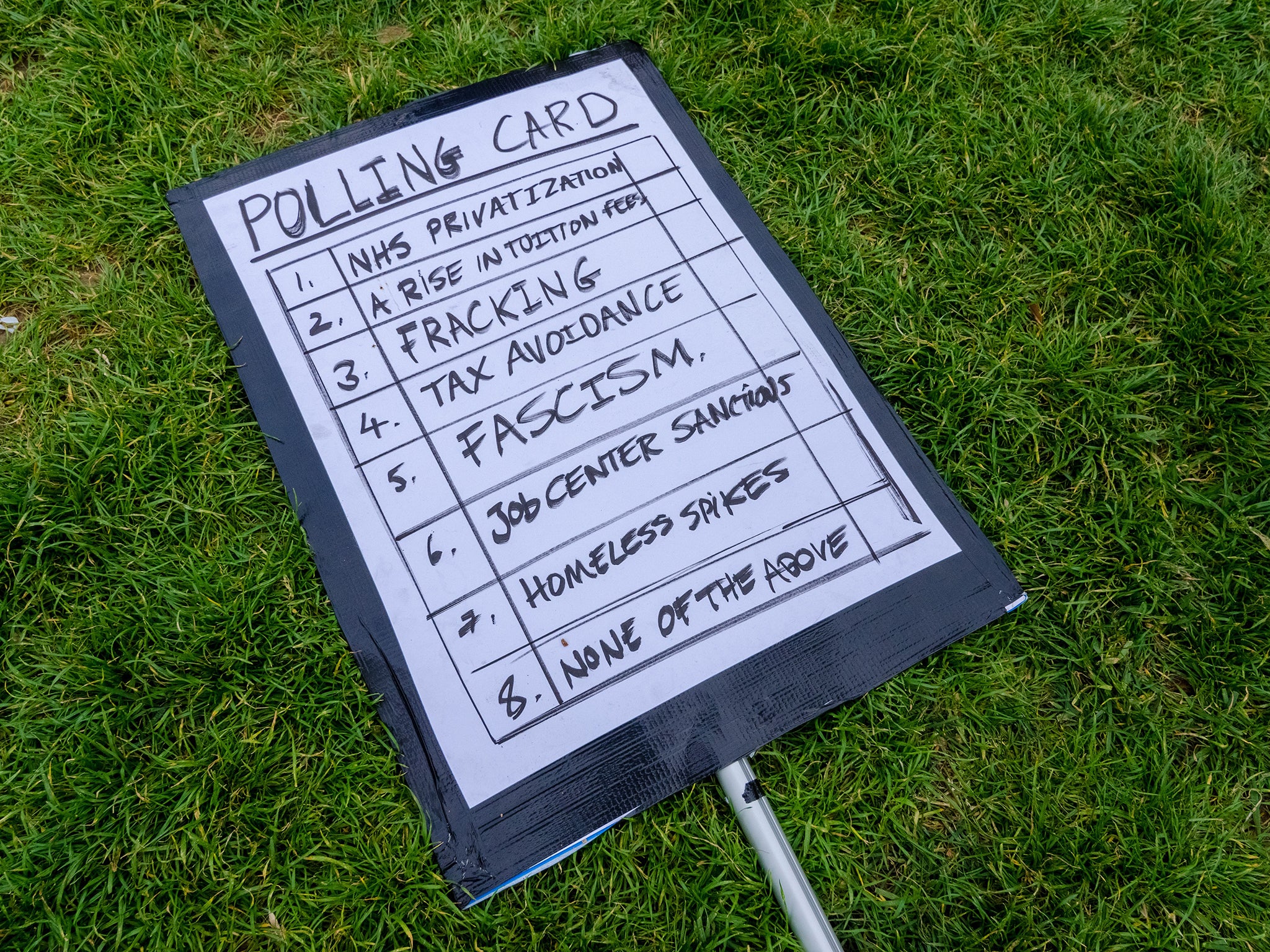

Tax avoiders should not be given NHS contracts

Tax avoidance may not, by the letter of the law, be a crime – but it is morally and ethically wrong

Your support helps us to tell the story

From reproductive rights to climate change to Big Tech, The Independent is on the ground when the story is developing. Whether it's investigating the financials of Elon Musk's pro-Trump PAC or producing our latest documentary, 'The A Word', which shines a light on the American women fighting for reproductive rights, we know how important it is to parse out the facts from the messaging.

At such a critical moment in US history, we need reporters on the ground. Your donation allows us to keep sending journalists to speak to both sides of the story.

The Independent is trusted by Americans across the entire political spectrum. And unlike many other quality news outlets, we choose not to lock Americans out of our reporting and analysis with paywalls. We believe quality journalism should be available to everyone, paid for by those who can afford it.

Your support makes all the difference.The private companies which profit from government NHS contracts should follow the same first principle that guides the doctors and nurses who work within it: do no harm. It is right to expect that profit-making organisations involved in the delivery of public services actively contribute to society. And it is right that those found to be doing detriment to society instead should be barred from being able to profit from it at the same time.

That is why, until recently, clinical commissioning groups (CCGs) – the groups of doctors responsible for awarding health contracts to private firms – blocked from the bidding those known to use aggressive, complex tax-avoidance strategies. But, as we report today, some CCGs are now removing this important clause from the bidding process for fear of lawsuits, after one large tax-avoiding group complained of being discriminated against when competing for NHS work in Bristol.

Though the reform of the NHS, allowing in larger numbers of private contractors, is driven in large part by Conservative political ideology, sheer necessity also plays a role. The pace of change has been speeded up by the Government amid rising demand and significant under-funding. Some hospitals are on the brink of insolvency; the health minister, Alistair Burt, revealed this week that Barts Health NHS Trust, which runs four hospitals in east London, is on course to run up a £134.9m deficit this year – the largest in NHS history.

Of course, ministers could choose to allocate more resources to the NHS and less elsewhere (on the renewal of Trident, for example), but if profit-making businesses operating in the UK paid their fair share of tax, the NHS would not be facing such a significant shortfall.

Tax avoidance may not, by the letter of the law, be a crime – but it is morally and ethically wrong. Those organisations whose greed is directly putting strain on the NHS should not be able to benefit from it.

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies

Comments