The exact moment in court Sam Bankman-Fried realized the enormity of his charges

Sam Bankman-Fried was the wolf in Gen Z clothes, whose disarming cloak of naivete belied a stone cold cynicism.

With his conviction on seven counts of fraud, conspiracy and money laundering, Sam Bankman-Fried now joins the ranks of America’s worst fraudsters.

He systematically stole billions of dollars from the crypto-curious, the all-knowing Silicon Valley tech bros and the teachers of Ontario alike, while playing off, and paying off, lawmakers and regulators against one another.

SBF was the wolf in Gen Z clothes whose disarming cloak of naivete belied a stone cold cynicism.

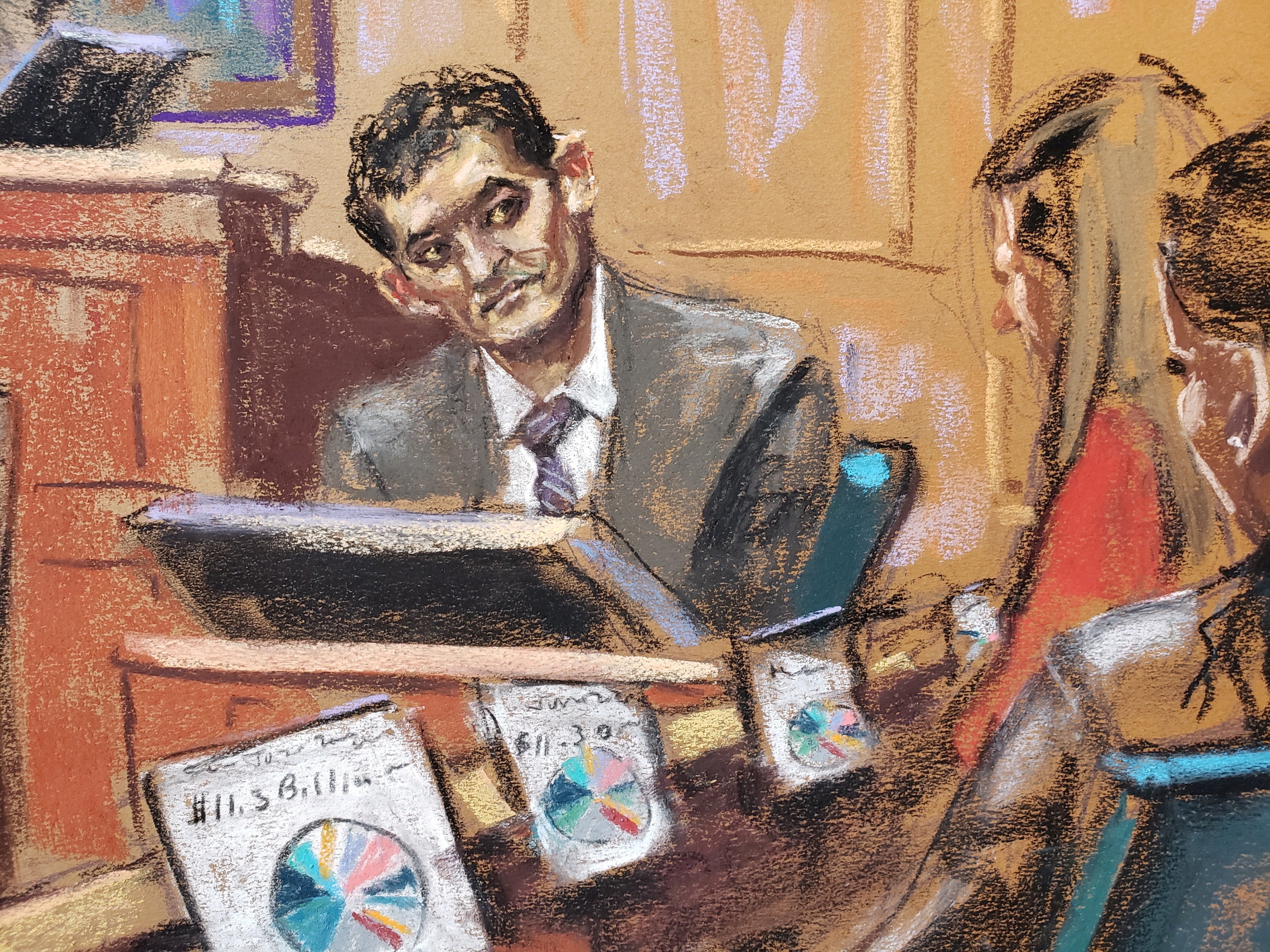

During two days on the stand, his eyes darted nervously around the courtroom. He answered assistant US attorney Danielle Sassoon’s surgical interrogation with insincere evasiveness.

Even as prosecutors unveiled their watertight case and it became obvious that he would be convicted, he showed little contrition or awareness of his predicament, let alone empathy for his victims.

It was only when his lawyer Mark Cohen wrapped up closing arguments that the enormity of the situation seemed to dawn on Bankman-Fried as he appeared on the verge of tears.

The lightning speed with which the jury returned unanimous guilty verdicts in a complex case revealed how emphatically they rejected his defence as a “math nerd” who got in over his head.

His many faces had been exposed.

It was impossible watching the 31-year-old fidget in the witness box without wondering how this tragi-comic figure was ever able to achieve such a dramatic narrative arc.

Sure, he had the MIT degree in physics, the Wall St connections and plenty of smarts.

He spotted an opportunity, realised he could make easy money through an anomaly in global Bitcoin prices, and rode the wave of blind confidence in a nascent digital currency to extreme wealth.

He showered celebrities, scientists and politicians in cash, believing that laundering his money would insulate him from accountability.

His downfall should lead to a period of soul-searching among the grifters and enablers who eagerly accepted his digital lucre. But that seems unlikely.

The crypto industry, which some credibly argue is rotten to its core, has its new scapegoat.

And with Bitcoin at an 18-month high, investors will shrug off SBF’s conviction as they chase speculative profits.

One might also ask: where his parents were in all of this?

Well, Joseph Bankman and Barbara Fried, both Stanford law professors, were allegedly assisting him with his endeavours.

Mr Bankman was on the payroll as a “de facto officer, director, and/or manager”, while Ms Fried was “the single most influential advisor” for FTX’s political contributions, according to a pending civil lawsuit.

They were handsomely rewarded. When Mr Bankman was unhappy with his $200,000 salary, his son wired a $10m cash gift to his parents, FTX’s lawyers allege.

While bailed to his parent’s Palo Alto home, Bankman-Fried consistently thumbed his nose at the court-ordered release conditions and embarked on a disastrous strategy to try to intimidate the former FTX executives who had admitted their part in the scandal.

Their son now faces the prospect of spending at least 1,000 Scaramuccis confined in a penal system that will care little about his vegan dietary requirements and internet addiction.

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies

Comments