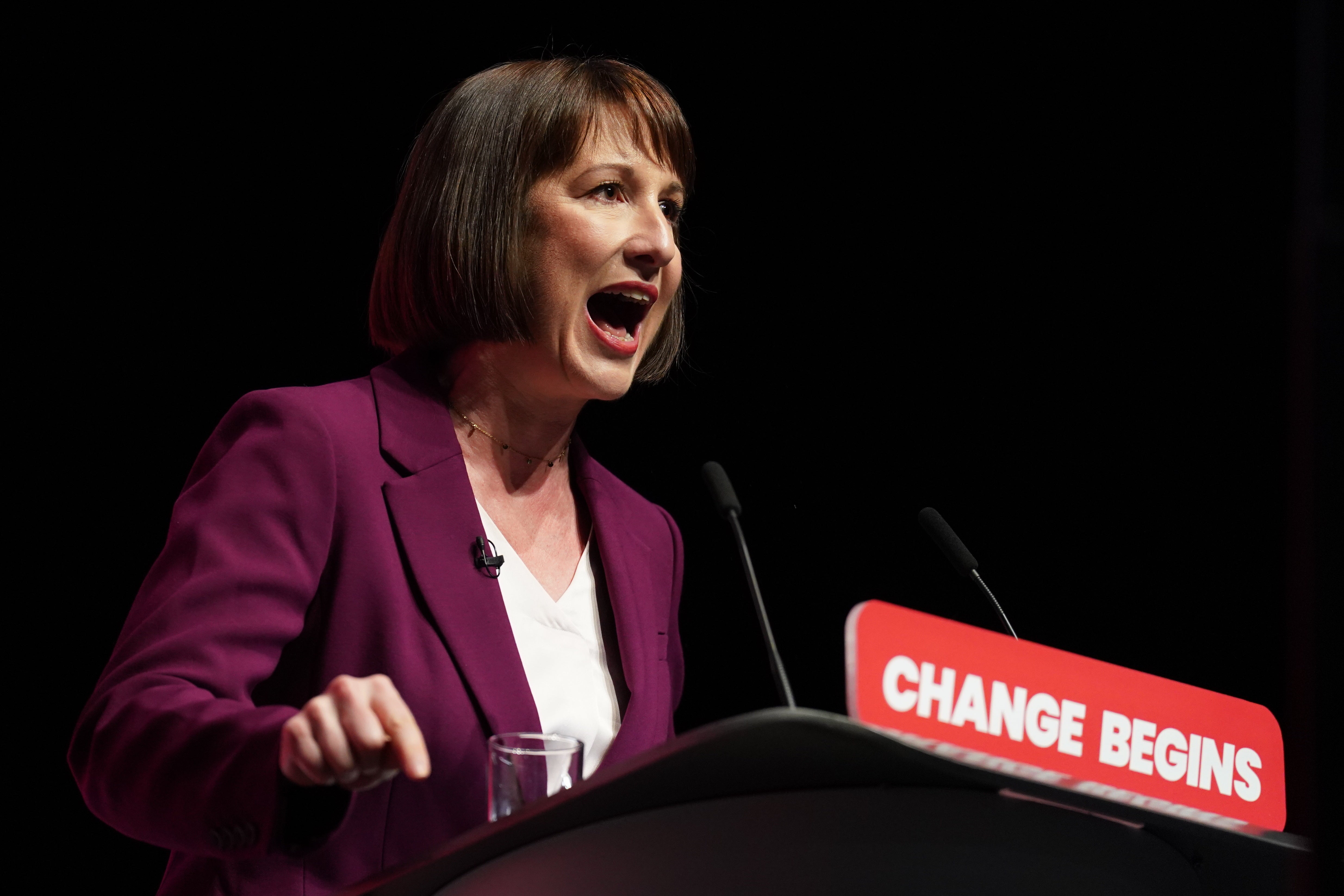

Will Rachel Reeves’s upbeat speech ring true with the global investors she wants to woo?

In a conference speech briefly interrupted by heckles and a stand-up protest, the chancellor hammered home the need for greater investment. Has she proven the government’s doom-mongers wrong? James Moore unpicks...

There was plenty to dissect in Rachel Reeves’ keynote speech at the Labour Party conference – from the pro-Palestine protesters interrupting her mid-flow, to the jeering from the crowd when she touched on the controversial scrapping of the winter fuel allowance.

But from all the surrounding chaos, one prominent theme emerged: investment – and rightly so, ahead of a much ballyhooed “international summit” next week, designed to sell the UK as a destination to investors from around the world.

Reeves wants to turn Britain into a powerhouse, having correctly identified under-investment as a persistent thorn in the side of UK plc, a failing of both the public and the private sectors.

That needs to change if she is to secure her ambition of boosting economic growth at a time when things look particularly limp; it flatlined in July for the second month in a row.

Perhaps more striking than her promise to “budget for investment”, however, was the markedly different tone to the one that has characterised her early weeks in office. We have repeatedly been told that her first Budget next month will feel like a trip to a dentist without anaesthetic, and so this address was a much-needed gear shift – and not just for a weary domestic audience.

A recent government missive touted the attendance of the likes of Blackstone, a private equity firm, financial services giant BNY Mellon and data centre operator CyrusOne, which operates data centres, at the summit.

Their top executives are no mugs and they have people on the ground here. They can read. They will have heard the relentlessly downbeat prounouncements from Reeves and Keir Starmer. One question they might very well be inclined to ask over the champagne and canapés served at these events is: “If it’s as bad as you say, why should we invest any of our funds with you?”

Maybe the formulation will be a little more diplomatic. But maybe it won’t be. These are men and women who can be quite blunt when it comes to these matters – I’ve met some of them and I’ve heard them speak. Their primary concern is the bottom line and the returns they can deliver for people who hand over their hard-earned money to be managed. They want to hear not what they can do for Britain but what Britain can do for them.

To this end, Reeves has made great play of the the economoic stability she is committed to offering. She inevitably contrasted this with the short and chaotic premiership of Liz Truss, an open goal Labour will be shooting at for months if not years.

However, she also promised not to raise corporation tax and to reform the nation’s “outdated” business rates. These are a persistent bugbear of the bricks and mortar retail sector, in particular, given the burden the system places on them when compared to the vast warehouses based in cheap locations favoured Amazon and online peers.

This is going to prove more challenging than Reeves would have us to believe. A replacement will need to be revenue-neutral without skewering other businesses in sectors she wants to encourage.

Labour has also repeatedly promised action on a failed Brexit deal. Anything that helps to remove some of the suffocating red tape currently strangling British exporters is to be welcome. But this requires a delicate dance with an EU, which may be disinclined to take the floor.

The UK has historically done well with international investors thanks, in no small part, to its membership of the European single market. Investors liked this country as a comparatively business-friendly base they could use to access it. That advantage is gone.

Both the CBI and the City of London Corporation nonetheless gave the speech a cautious welcome, which isn’t terribly surprising. It’s smart to make nice in the early days of a new administration – and they certainly liked the chancellor’s more upbeat tone.

But they, and the international investors Reeves hopes to lure, will demand action to back it up before opening their wallets. Only time will tell if Reeves can deliver.

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies

Comments