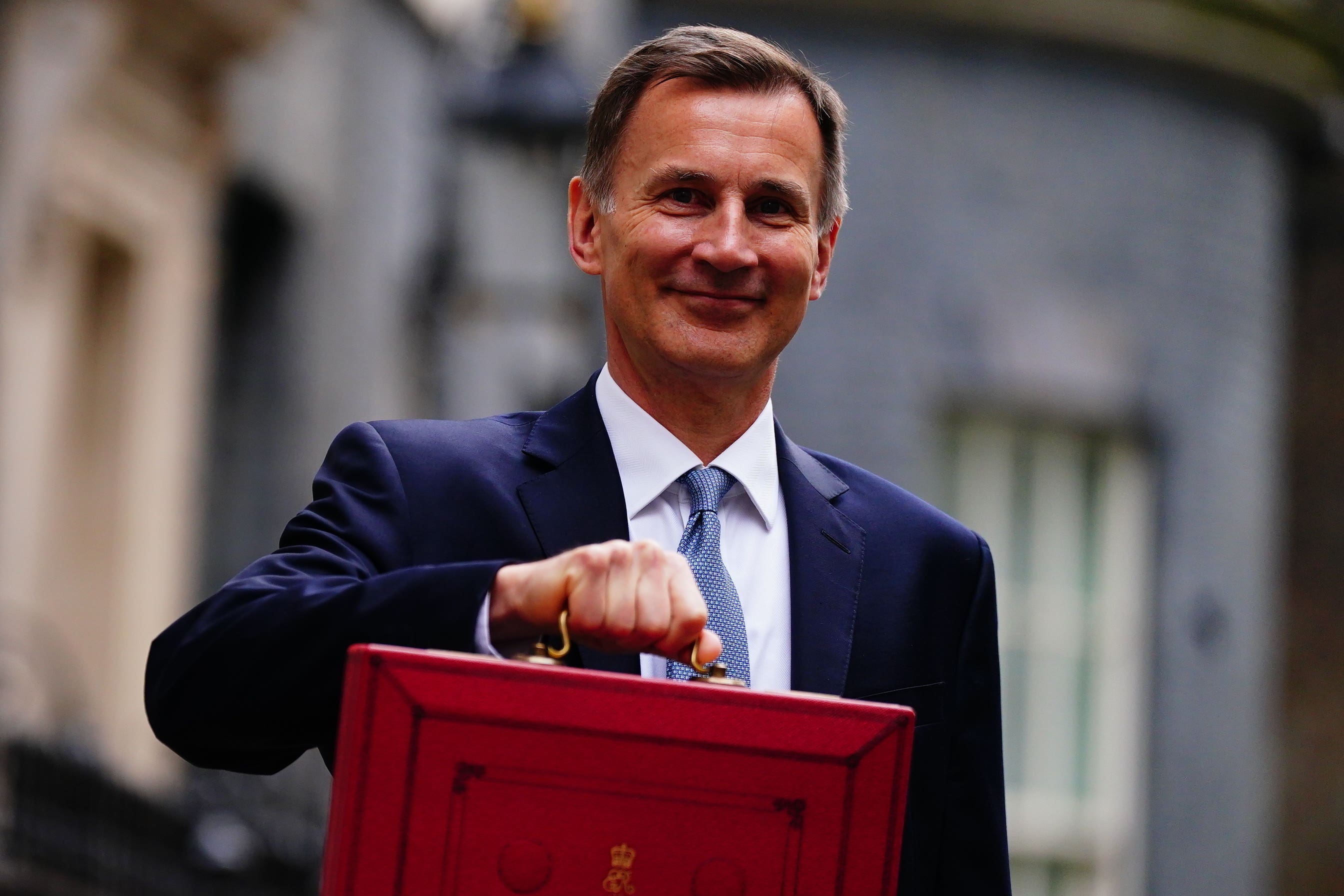

What Jeremy Hunt’s Budget got right – and what it got wrong

It was disappointing that the government didn’t address any of the underlying problems of the personal tax system, writes Nimesh Shah

Did we really need a Budget from the chancellor today? Arguably not, as there was very little he had to tell the country. Jeremy Hunt’s laboured Budget speech, lasting over an hour and double the length of his predecessor’s ill-fated mini-Budget told us nothing new – and that was after the various leaks over the past few days. In many ways, it was a Budget statement that characterised Jeremy Hunt himself – logical, solid but underwhelming in large parts.

Jeremy Hunt’s Budget can be broken down into three main areas of focus – addressing energy price inflation, incentives for a return to work for the “economically inactive” and enterprise (one of Hunt’s four Es).

The main announcement on energy was made over five hours before Hunt took to the Parliamentary lectern – that the government, with the help of Martin Lewis, would extend the current energy support for domestic households for a further three months, saving a typical household £160 and at a fairly modest cost of £3 billion to the Treasury.

However, households will still be worse-off during that three-month period, as the £400 energy bills discount comes to end this month. In what is now the annual custom, fuel duty was frozen, when it could have risen by 23 per cent. At a cost to the Treasury of £15 billion over the next 5 years, it would have been staggering if the government had done anything different.

To encourage the “economically inactive” back into work to address labour shortages, Jeremy Hunt offered two incentives. Firstly, for working parents, a significantly enhanced and generous free childcare package which will benefit all children under five-years-old by September 2025. For the over 50s, the chancellor surprisingly abolished the frustrating pensions lifetime allowance and increased the annual allowance to £60,000 (although it would be worth £8,000 more had it kept up with inflation).

The pensions changes were targeted at senior doctors who are discouraged to work in the NHS because of the punitive tax charges they face because of pension accruals. Hidden away in the detail of the Budget documents is the fact that an increase to the minimum tapered allowance to £10,000 will be worth an additional £2,700 of tax relief to someone earning over £360,000.

And finally “enterprise” – but entrepreneurs will be left disappointed. The 6 per cent increase to corporation tax to 25 per cent was never going to be reversed today. Business owners taking money out of their companies as dividends will see combined rates of corporation and dividend tax of up to 55 per cent, a 10 per cent hike since 2015.

The fanfare around an unlimited deduction for capital expenditure for a three year period will only cushion the corporation tax hit slightly and benefit only 10 per cent of the largest businesses. Hunt had already halved the dividend allowance to £1,000 from this April and will cut it again to £500 from April 2024. The days of the business owner paying themselves in dividends seem to be gone.

Back in 2020, Hunt’s now-boss, Rishi Sunak, slammed through a £900,000 capital gains tax hit on entrepreneurs in his first Budget as chancellor, when he cut the £10 million entrepreneurs’ relief lifetime to just £1 million. The CGT exemptions will fall to £3,000 next year – a 75 per cent cut from its current level and increasing the annual tax burden by over £2,600. At least CGT rates remain at 20 per cent (for now).

This Budget felt like a non-event – there was no change to income tax rates, tax bands or NICs, for example. It was disappointing that the government didn’t address any of the underlying problems of the personal tax system – the various spikes in marginal tax rates are a massive deterrent to work and progression which, if properly addressed, could have had a significant impact on the current workforce issues faced by the country.

We didn’t necessarily need a Budget yesterday, but the government will definitely need to step up their game at the next showing, which could be their last opportunity before a general election.

Unfreezing the personal tax allowances, reforming the non-domicile regime and incentives for business an investment should all be on the agenda, and the country will be expecting something more dramatic.

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies

Comments