If BP votes down a pay rise for the boss, the era of fat cat salaries could finally be over

It will be hard for defenders of boardroom excess to wield the 'pay for performance' defence ever again.

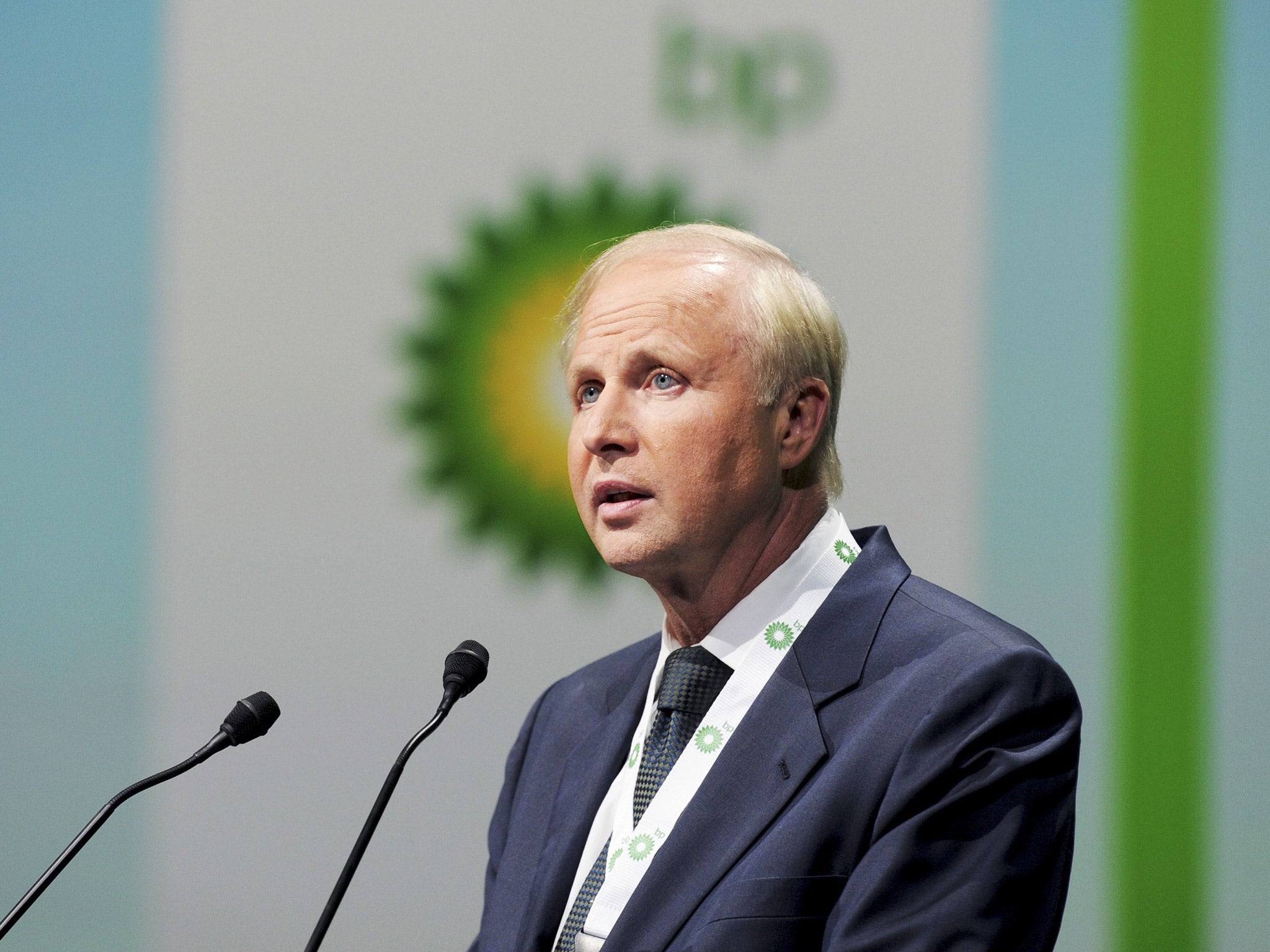

Pay for performance? The proposed award by the board of BP to its chief executive Bob Dudley for his work in 2015 plainly makes a mockery of the concept.

Dudley’s total remuneration package for 2015 is due to rise to just short of $20m, up from $16.3m in 2014. And this was a year in which BP itself reported a record $6.4bn loss and the oil giant’s share price plunged by 14 per cent. If anything it looks as if Dudley’s pay is inversely related to performance. One shudders to think how much his pay would have risen if the company had lost $12bn rather than $6bn.

BP responds that he managed the company well in difficult circumstances, with the global oil price still sliding. The trouble is Dudley’s pay rose very strongly in “easy” circumstances too when the oil price was high. His pay seems to go up whatever the wider business conditions. Nice work if you can get it.

Yet perhaps we should be grateful to BP. It will be harder for the defenders of boardroom excess to wield the “pay for performance” defence again after this egregious episode.

But don’t expect imminent victory in the battle to rein in out of control pay at the top of large companies. Yes, a reasonably wide array of shareholder advisory groups and some sizeable asset managers have said that they will vote against Dudley’s pay package today. Even the Institute of Directors has spoken out.

But today’s vote is only advisory. And there are major structural obstacles to shareholders compelling boards to change their approach to pay at the top. The large asset managers, who vote the shares held by ordinary people in pension funds and mutual funds, are excessively well remunerated themselves. The majority, sadly, have little interest in creating a row over pay. And many take the view that if they feel a board is paying too much to its bosses they will simply sell the shares, rather than try to push for reform. “Shareholder springs” are often hailed – but they never really blossom.

Yet BP aside, some claim things calmed down more broadly on the executive pay front. That was the implication of a report by the accountants Deloitte earlier this week which said “two in five FTSE 100 CEOs received a salary freeze this year” and talked of “continued restraint” by boards. But, of course, salary only accounts for a minor share of bosses’ remuneration these days. A new analysis by the High Pay Centre finds that total remuneration for the bosses of Britain’s largest companies – which includes cash bonuses and share awards – has actually increased by 6 per cent in aggregate for the 2015 financial year. And this was a year in which the FTSE100 index lost 5 per cent.

But perhaps the situation is not completely hopeless. Richard Pennycook, chief executive of the Co-op group – a large company owned by its own customers rather than shareholders – this month asked for, and received, a 60 per cent pay cut, taking Pennycook’s maximum potential pay from £3.9m to £1.5m a year.

One must hope that this is the first gust of a powerful wind of change when it comes to still grotesquely inflated executive remuneration.

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies

Comments