At first I suspected an affair – but my husband was a gambling addict. I wish I’d seen the signs

I didn’t understand the arguments that flared up like touchpaper. He was short-tempered and angry. I became impatient and cold

Your support helps us to tell the story

From reproductive rights to climate change to Big Tech, The Independent is on the ground when the story is developing. Whether it's investigating the financials of Elon Musk's pro-Trump PAC or producing our latest documentary, 'The A Word', which shines a light on the American women fighting for reproductive rights, we know how important it is to parse out the facts from the messaging.

At such a critical moment in US history, we need reporters on the ground. Your donation allows us to keep sending journalists to speak to both sides of the story.

The Independent is trusted by Americans across the entire political spectrum. And unlike many other quality news outlets, we choose not to lock Americans out of our reporting and analysis with paywalls. We believe quality journalism should be available to everyone, paid for by those who can afford it.

Your support makes all the difference.My husband gambled. Looking at the list of gambling reforms recently set out by the government’s white paper, I’m underwhelmed.

I don’t live very far from my old house, the first home I ever bought, my marital home. It’s where I became a stepmum to a son, then mum to a daughter. When my husband and I moved in, I was pregnant – and gambling was still a leisure activity for him; something we did at Christmas with scratchcards, or the occasional point-to-point horse races.

But over time, what started as fun took a greater hold on him. How and why that happened is his story to tell, not mine. But what I can say is how gambling affected me.

Over the five years when my husband was hiding his online gambling, I was mystified as to why we always seemed to be struggling with money. I didn’t understand the arguments that flared up like touchpaper. He was short-tempered and angry. I became impatient and cold.

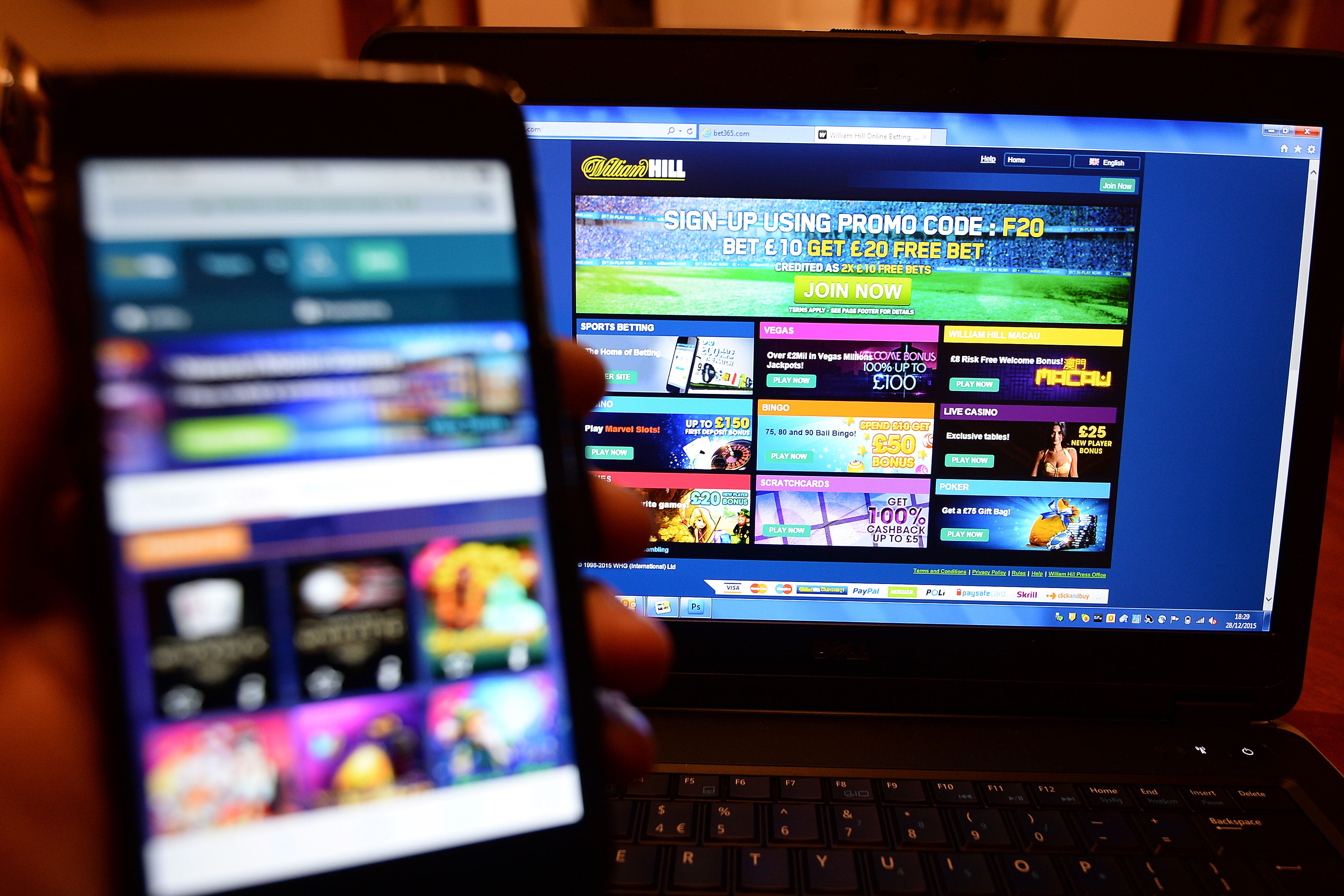

When he started hiding his phone whenever I entered the room, I suspected an affair – even though much of our time together was happy. The losses mounted, unbeknownst to me, until I eventually stumbled across a credit card bill he hadn’t intercepted that showed multiple large cash advances paid to a popular gambling website.

He tried to explain it away … before eventually coming clean. He told me about the gambling. What did I do? I laughed.

Gambling? What on earth did he mean? He didn’t fit the image I had of a “problem gambler”. He didn’t hang about the high street betting shop or walk round with a racing form, obsessing over the horses.

But it wasn’t a laughing matter. And it wasn’t hundreds or thousands of pounds he gambled away. It was tens of thousands. He’d been doing it in secret for years. Wins occasionally covered some losses. Loans from friends, overdrafts and credit cards covered others.

It’s a story we hear increasingly often. Husbands running up tens of thousands of pounds of debt on their partner’s credit cards. One person unable to stop gambling, while the other debates whether staying or leaving is better for the kids. Families desperately trying to stick together while the smartphone buzzes with 24-hour opportunities to bet more, play more, win more. Lose more.

The long-awaited arrival of the gambling white paper is a relief to the millions of families – like mine – who have been affected by problem gambling and gambling addiction.

At last, the government review that’s been in the works since 2020 is here and it’s going to take action on an addiction that affects millions of families. But looking at the list of proposals, I can’t help but feel underwhelmed.

Would the “financial vulnerability check” after losing £125 or more in a day have affected my husband? No, because he’d never previously declared bankruptcy or had a county court judgement against him.

Would the “affordability check” on those who make losses of £1,000 in a day, have made a difference? I doubt it. My husband had a healthy income and borrowed from lots of sources, paying off one debt here, another debt there, to keep our heads above water.

None of the recommended actions actually address the pervasive presence of gambling with ads online, on TV and at every conceivable sports event.

The white paper measures also ignore the addictive nature of the games themselves, designed to get players hooked like virtual opium dens. And probably most importantly, there’s the mental health and financial reasons why people start to gamble and why they continue doing it. Take for example what the head of GambleAware has said about women’s motivations for gambling: “to escape the pressure of everyday life”.

Considering what “everyday life” consists of for most women these days, it’s not a surprise to me that the number of women gambling has doubled in five years.

Looking back at what was happening to my family, with my ex-husband’s mental health collapsing while our finances were hollowed out, none of these proposals would have touched the sides.

The 1 per cent mandatory levy on industry revenues? That’s a good start – after all, these firms make billions every year. But plans for a gambling ombudsman? Er … OK. I’ll fax them when they’re up and running.

Let’s just look at the cost of not doing more. How much does it cost in productivity at work? The cost to the overstretched NHS mental health services? The social cost as the number of people affected balloons? The human cost, tallied up in hospital admissions and victims of suicide? Things need to change – now.

When my ex was in the grip of his addiction, nobody was really helping him. Not the apps promising more “fun” and online bonuses. Not the gambling firms, including one who sent a luxury gift basket of jams and chutneys to our house with a note that said, “We miss you!”

Not his friends and family and not even me. I was trying, but I felt so out of my depth, as well as confused, angry, desperate. Gambling addiction is complex. Our response to it must be complex as well.

Since our lives imploded, my ex has gotten treatment for the gambling addiction that was a constant presence in the last years of our marriage. We’re divorced but still friends, and we spend family time together with the kids. I’ve begun to understand better what happened. Still, I avoid driving down my old road, as I can’t bear to look at my former family home.

Friends sometimes ask, “do you ever think what things would be like if that hadn’t all happened?” Sometimes. But often it’s too painful to think about what we – as a family – lost compared with what the gambling industry continues to gain.

Jennifer Howze is editorial director of Netmums

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies

Comments