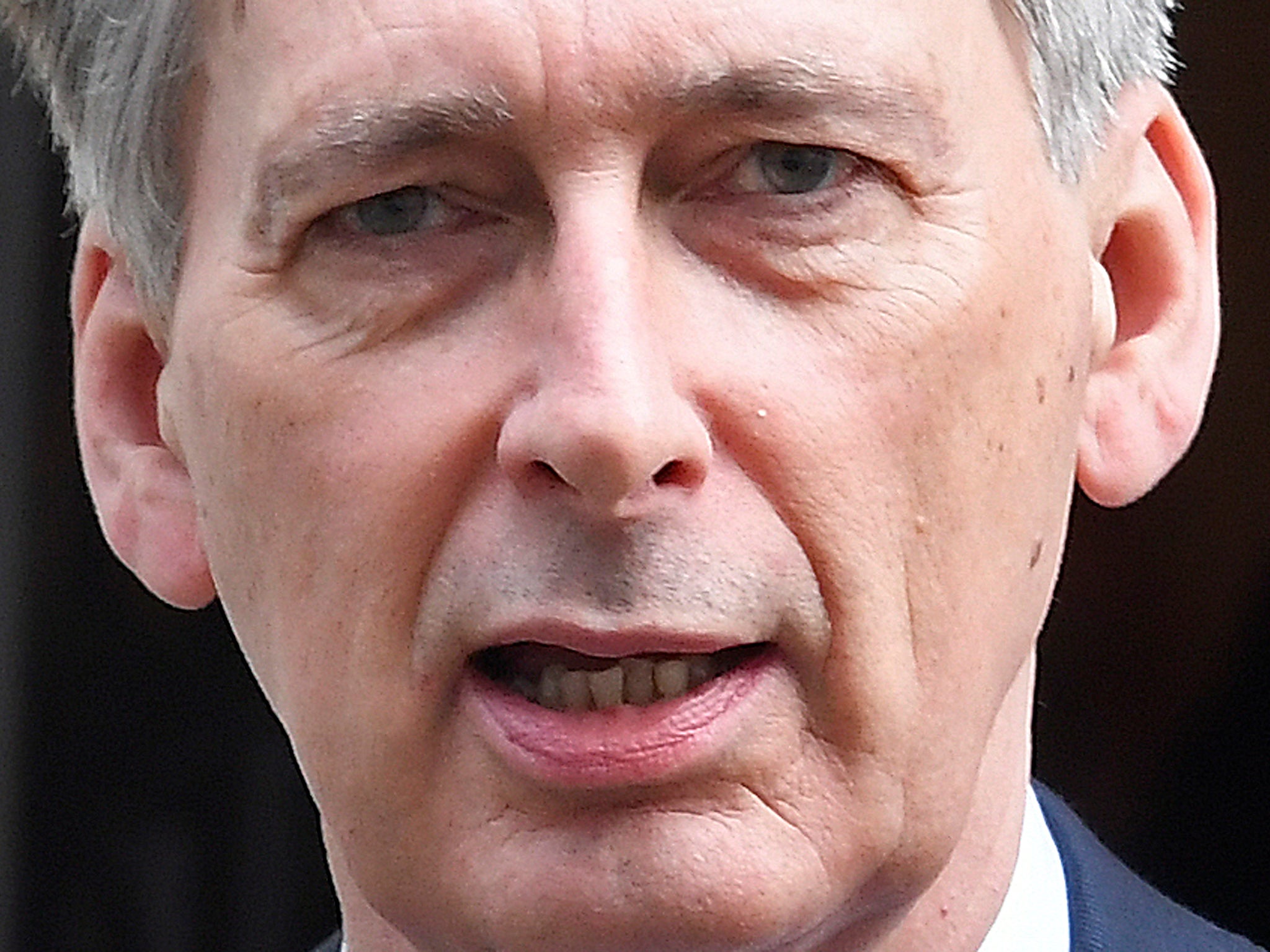

There won't be much to look forward to in Philip Hammond's Budget

The Chancellor shows no sign of cancelling or postponing the cuts in corporation tax planned for this year so that the money can be devoted to the health service – something the public now demands

Your support helps us to tell the story

From reproductive rights to climate change to Big Tech, The Independent is on the ground when the story is developing. Whether it's investigating the financials of Elon Musk's pro-Trump PAC or producing our latest documentary, 'The A Word', which shines a light on the American women fighting for reproductive rights, we know how important it is to parse out the facts from the messaging.

At such a critical moment in US history, we need reporters on the ground. Your donation allows us to keep sending journalists to speak to both sides of the story.

The Independent is trusted by Americans across the entire political spectrum. And unlike many other quality news outlets, we choose not to lock Americans out of our reporting and analysis with paywalls. We believe quality journalism should be available to everyone, paid for by those who can afford it.

Your support makes all the difference.Fond of his cars, the Chancellor has already given an appropriate metaphor for what to expect in the Budget and, indeed, all budgets for the foreseeable future: he wants to put some “gas in the tank” to cope with Brexit. Quite an admission, that, about the likely financial costs of leaving the European Union.

Almost alone among Theresa May’s ministers, Philip Hammond has avoided the sort of buccaneering language and Tudor-age imagery favoured by the more romantic Brexiteers in Government. Instead, Mr Hammond has seen as his role, in Cabinet, in his party and towards the wider nation, as a voice of sober and sobering reason. As he remarked to the Conservative conference last autumn, “the British people did not vote on 23 June to become poorer, or less secure”. It is Mr Hammond’s impossible task to ensure that Brexit will not in fact suffer those unpalatable results. Hence the caution.

He is right to be fearful, given that so many of his colleagues on the Conservative benches are dead set on leaving the EU whatever the economic price. The dilemmas facing the British economy have been underlined most recently by Peugeot SA’s acquisition of Vauxhall’s operations. Because of Brexit, the jobs of thousands that rely directly and indirectly on the plants in Ellesmere Port and Luton have been placed in jeopardy. If they fail, then we lose skills, families will lose their livelihoods, communities will be devastated and, closer to the Treasury’s concerns, tax revenues and national insurance payments will disappear, unemployment benefit payments will rise and the balance of trade will be worsened to the tune of many billions of pounds.

That is the sort of near-future shock that the Treasury can see coming as a hard Brexit approaches at breakneck speed, and replicated across every region, town and city in the land. That is why they feel they need a reserve to cope with the probable disruption to the public finances. Like all chancellors, Mr Hammond has a duty to ensure that the UK is still able to fund its public services and borrow in world markets without some sort of Greek-style crisis. For that he needs “gas in the tank”.

It would, of course, be much better if Britain did not have to cope with the threat of such entirely avoidable economic disasters. But, as the saying goes, we are where we are. It is a poignant thought that the funds the Treasury feels obliged to squirrel away now could instead be devoted to rescuing the NHS from its strains, making a more convincing start to reforming social and mental health care, and investing in schools and other infrastructure. Conservative backbenchers can reflect, if they dare, on the tax cuts for their constituents and hard-pressed small businesses that could have been dished out this year had things turned out differently last June. Instead they will have to justify tax rises to their voters. They might also wonder if Mr Hammond’s predecessor, George Osborne, pursued austerity to the point where it actively undermined the productive potential of the economy.

All that said, the Chancellor will need to address the crises in health and social care, and, given the fiscal constraints, that means an increase in taxation on those best able to bear the burden. There are encouraging signs that he will make these adjustments – but too timidly to make the real difference the crisis demands. Crucially, he shows no sign of cancelling or postponing the cuts in corporation tax planned for this year so that the money can be devoted to the health service – something the public now demands, and as evidenced in our poll. The proposed boost to grammar schools funding is the worst possible use of public money, in effect entrenching a middle-class racket with little net improvement in the human capital stock of the nation.

Mr Hammond is sensible, as is rumoured, to revisit the business rates revision, and he would be entirely justified in phasing some of the increases in to avoid an unpredictable shock to high streets. For the long term he should also reform business taxation to make “bricks and mortar” and online retail businesses compete on a level playing field.

Broadly, then, we will have little to celebrate in this spring Budget, and not much more to look forward to the one due this autumn and in subsequent years as Britain grinds its way to the EU’s exit door on the worst possible terms. Tough, tight, cheerless Budgets will be the pattern as the fiscal realities of exiting the EU crystallise in the months and years ahead. As Mr Hammond, and more and more of the electorate might well ask, is that what we voted for last June?

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies

Comments