The consequences of the 0.75 percentage point interest-rate hike will be huge for those who are exposed to them – primarily the relatively small number of people on tracker mortgages, and those with businesses on tracker loans. Such a hike is likely to add £100 a month to a typical mortgage.

Thankfully, mortgages that track the Bank of England base rate are relatively rare. And those who will have to remortgage soon are likely to find that rates remain lower than just a month or so ago, when lenders had to take instant and severe action to mitigate against the consequences of one of the superficially cleverest chancellors in the country’s history – Kwasi Kwarteng – having delivered the most chaotic mini-Budget in living memory, at the very least.

But there are political consequences, too. At the same time as hiking interest rates, the Bank of England also forecast two long years of recession. It has been pointed out, many times, that rates are now the highest they have been since late 2008. That was when they were slashed to almost zero in response to the recession caused by the global banking crisis. Cutting rates is the standard response to recession. Jacking them up at the same time as predicting one is not.

It is true that the UK economy is in a terrible place. Politicians will seek to point to economic troubles all around the world; to rising interest rates in the US and the eurozone. But not all easy comparisons bear much scrutiny. In two weeks’ time, the new chancellor Jeremy Hunt will have to give a new Budget – the second, in effect, in as many months. He will have to demonstrate that the government is serious about managing the country’s finances, and that he has a plan to close the huge £50bn black hole in them.

To keep up to speed with all the latest opinions and comment sign up to our free weekly Voices Dispatches newsletter by clicking here

If he fails to do so, he will get the Kwarteng treatment. Lenders will decide once more that lending money to the UK is risky; the gilt rate will rise again and threaten widescale economic instability. And so, as Mr Hunt knows, he must announce policies to cut public spending and raise taxes – precisely the opposite of what is ordinarily done in the face of a recession, when the economy requires stimulating, not suppressing.

The best he can hope for economically is that, through his actions, the recession is shorter and less profound than it might well turn out to be. And the best that he can hope for politically is that the people don’t notice the reason this draconian action is required: that is, to face down not only global economic challenges, but to a great extent the wild actions of the previous Tory government, which lasted for less than six weeks.

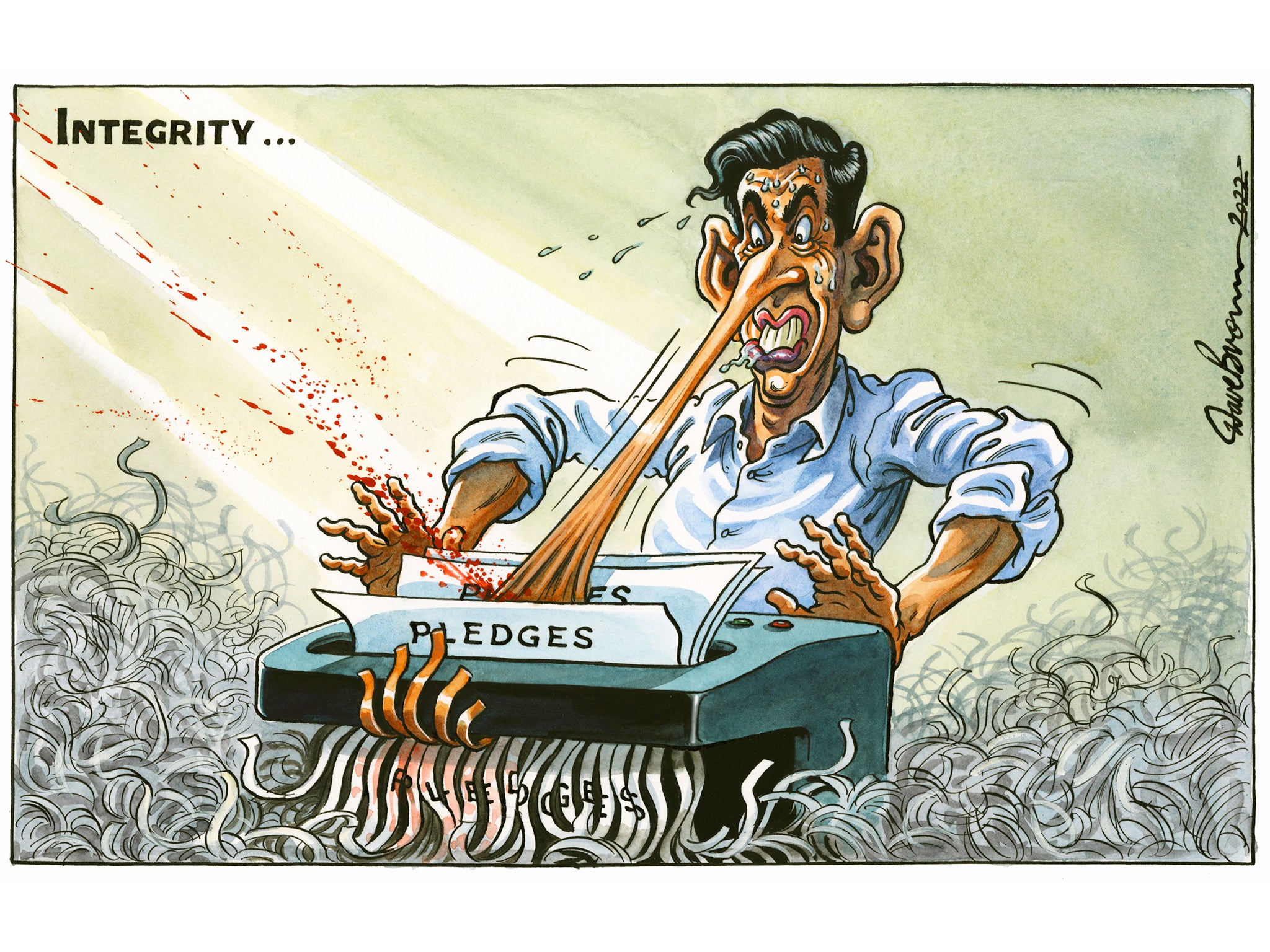

Mr Hunt and Rishi Sunak have one major economic task to accomplish: undo the damage of their predecessors. But a rate hike on this scale will make it hard – impossible even – for the large number of people with mortgages to renegotiate to forgive or forget that damage. They will not forgive because it is so very unforgivable.

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies

Comments