Sean O'Grady: Time to get real about our crazy taxation system

Your support helps us to tell the story

From reproductive rights to climate change to Big Tech, The Independent is on the ground when the story is developing. Whether it's investigating the financials of Elon Musk's pro-Trump PAC or producing our latest documentary, 'The A Word', which shines a light on the American women fighting for reproductive rights, we know how important it is to parse out the facts from the messaging.

At such a critical moment in US history, we need reporters on the ground. Your donation allows us to keep sending journalists to speak to both sides of the story.

The Independent is trusted by Americans across the entire political spectrum. And unlike many other quality news outlets, we choose not to lock Americans out of our reporting and analysis with paywalls. We believe quality journalism should be available to everyone, paid for by those who can afford it.

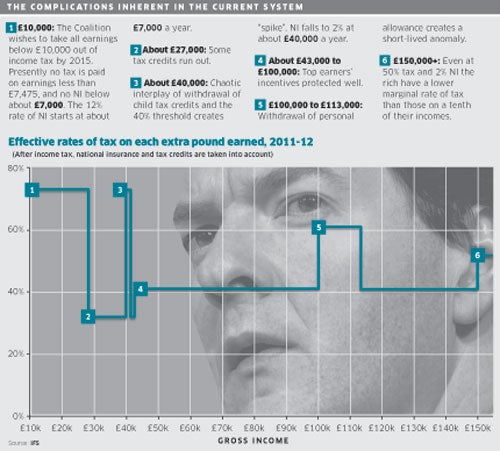

Your support makes all the difference.Our graphic of the UK's chaotic system of taxation illustrates precisely what is wrong with it – it is erratic, irrational and unfair.

The key thing to remember is that, despite its name, national insurance (NI) is simply another form of income tax, as is, in a way, the withdrawal of child tax credits and child benefit as earnings rise. Also included is the way tax thresholds and personal allowances kick in – especially when they're not uprated for inflation, as now.

Anyway, laid out in graphical form, our random tax rates resemble some piece of geometric art, or maybe the profile of Battersea power station. Less artful is the way that those earning, say £10,000 a year, pay about 70p in the pound in NI and tax on every extra pound they earn; yet someone on £150,000 pays only 52p on each extra £1.

While most of us know whether the top slice of our annual earnings is taxed at the rate of 20 per cent, 40 per cent or 50 per cent, few know that we pay a further 12 per cent or 2 per cent in NI, or nothing, on our weekly income.

It's all a product of political cowardice and historical accident. In the Edwardian dawn of the welfare state, national insurance contributions were just that – linked to entitlement and benefits (hence the old nickname "the stamp"). Now it just goes into a gigantic Treasury pot.

Every chancellor since Lloyd George has shied away from reform, for fear of us realising just how much the state takes; and they found it easier to stealthily raise NI than tax. In fact it was the Lib Dems alone who argued for a combination of tax and NI. Now it seems George Osborne may get the credit for another of their policies.

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies

Comments