Owen Jones: If rigging rates isn't anti-social behaviour, what is, dude?

Did they ever stop, stare out of the window, and ponder the impact of their profiteering?

Your support helps us to tell the story

From reproductive rights to climate change to Big Tech, The Independent is on the ground when the story is developing. Whether it's investigating the financials of Elon Musk's pro-Trump PAC or producing our latest documentary, 'The A Word', which shines a light on the American women fighting for reproductive rights, we know how important it is to parse out the facts from the messaging.

At such a critical moment in US history, we need reporters on the ground. Your donation allows us to keep sending journalists to speak to both sides of the story.

The Independent is trusted by Americans across the entire political spectrum. And unlike many other quality news outlets, we choose not to lock Americans out of our reporting and analysis with paywalls. We believe quality journalism should be available to everyone, paid for by those who can afford it.

Your support makes all the difference.High testosterone, class privilege and a lack of morals are a dangerous combination indeed. Reading through emails sent by Barclays traders to each other bragging about manipulating the Libor rate made me cringe, because there was something deeply familiar about the macho language. "Done… for you big boy," wrote one. "Dude. I owe you big time! Come over one day after work and I'm opening a bottle of Bollinger,'" boasted another.

It was deeply familiar because I knew these people: or, rather, people like them. The homoerotic lingo, the Americanisms, the champagne; all that was missing was describing each other as "legends". Going to Oxford University was a culture shock, not because I'm a working-class hero (I'm not), but there was nonetheless a big gap between being educated at a Northern comp and having middle-class public sector worker parents, and fellow students with some of the most privileged backgrounds in Britain. Not that I should generalise about those ex-public school kids who ended up as bankers, management consultants and corporate lawyers: people vary wildly, whatever their upbringings. Others were aware of the odds that had been stacked in their favour since birth, and ended up working for charities, community organisations or state education, for example. But when I saw braying Old Harrovians and Old Paulines spraying each other with champagne in college quads, it was difficult not to be aware that I was staring at some of the country's future rulers.

Some of the antics boiled down to anti-social behaviour of the kind usually associated by the media with so-called "sink estates". I made the mistake once of leaving my room door unlocked when the rowing team was having one of its raucous dinners. One team member – who I had never even spoken to – had climbed into my bed and wet himself. As well as hedonistic, these types could engage in grotesque snobbery towards people they had never mixed with because our education system segregates people by the bank balances of their parents. I first heard the word "chav" bandied around in crisp public school accents, but as a catch-all term for those lower down the social ladder. For some, any perceived challenge to their hyper-privileged upbringings could be seen as beyond insulting. In my first few weeks at university, I suggested abolishing private education. Big mistake: it was as though I had called for the parents of the posh to be publicly executed as enemies of the revolution.

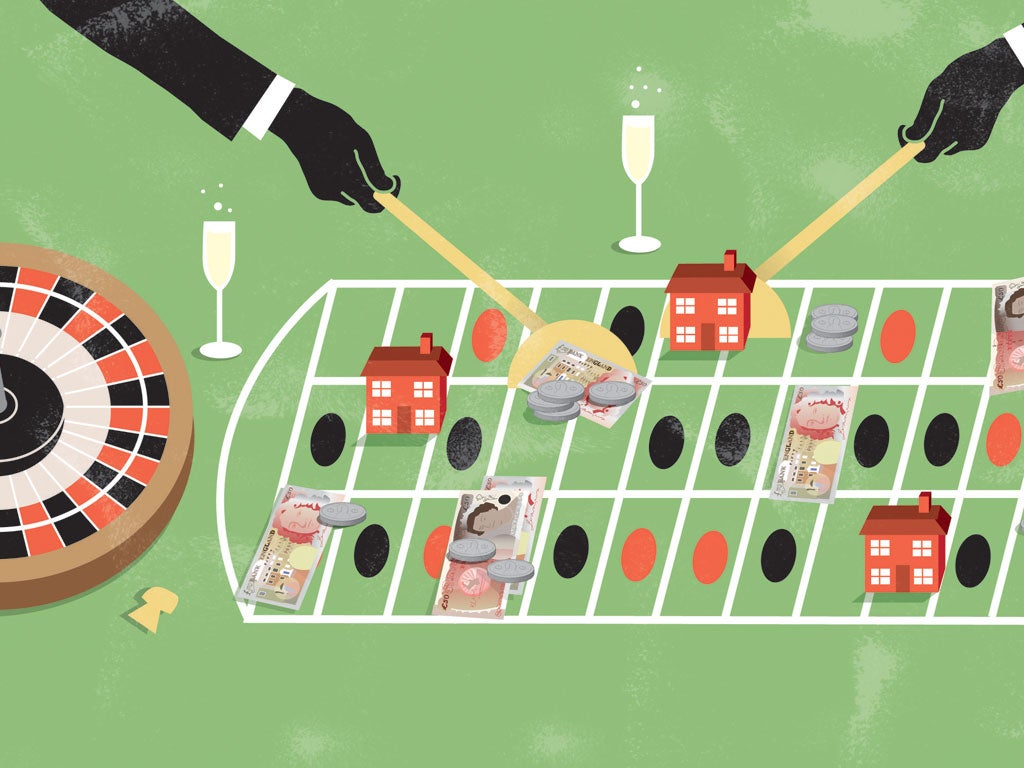

A large chunk of them ended up in the City, not all that long before the whole system came crashing down until the taxpayer was forced to rescue it, at incalculable cost. Big finance appealed to a number of qualities: an attraction to cut-throat competition; a love of risk and thrills; an unashamed view that wealth should be relished as an end in itself; and a lack of interest in the consequences of the individual's pursuit of money for the rest of society (a term most would probably sneer at). And it is exactly this that emerges in the Libor scandal.

It is worth thinking through the psychology of what these traders were doing. Vast sums of money – up to $500 trillion, an unimaginable amount of dosh – are notionally attached to Libor, or the amount it costs for banks to borrow between each other. If the Libor rate is manipulated by just the tiniest amount – 0.01 per cent – it can create a profit or loss running into many millions. The traders could make their bank's balance sheets look healthier, boost their own bonuses, and get an adrenaline rush out of it to boot. But, of course, having more money to splash out on Bollinger has consequences for the rest of society. Libor's rate determines other interest rates – such as the cost of personal borrowing, mortgage rates, and the cost of Government borrowing. Ordinary people's lives are affected, whether through having to spend more on mortgages, or paying for higher interest on Government debts.

Did they ever stop, stare out of the windows of their skyscrapers and wonder about the wider impact of their own selfish profiteering? Of course not. As one left-wing mole in the City (who tweets as @TheLeftBanker) put it to me: "They're driven by how much money they can make for themselves. They wouldn't think of the day-to-day consequences." Confined in a bubble, they fear only being upstaged by colleagues (or, rather, rivals). Not that the state views the most anti-social elements in Britain as a problem to be dealt with. Benefit fraudsters are hauled into police cells, but the Masters of the Universe – who helped plunge the world into economic catastrophe – are still splashing out in the bars of Mayfair. As disabled people have their benefits confiscated, thousands lose their jobs, and Educational Maintenance Allowances are snatched out of the hands of the poorest children, do not walk around the Square Mile looking for signs of remorse or guilt.

Of course, Western society has not been plunged into crisis because of the personality flaws of a few thousand individuals. It suits the Westminster elite (who have acted as though they were the political wing of the City) to dismiss our current protracted nightmare as the consequence of the actions of a few rogue elements or bad apples. Blame your Bob Diamonds and Fred the Shreds, and leave the rest be, is their message. No, it is the system – capitalism – that is at fault. But just as poverty and unemployment can help us understand but not excuse, say, muggings or burglaries, this does not let the individuals off the hook. The fates of all of us are left dependent on the whims of those with little interest in other people. Only a madman would have designed a society to work like this.

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies

Comments