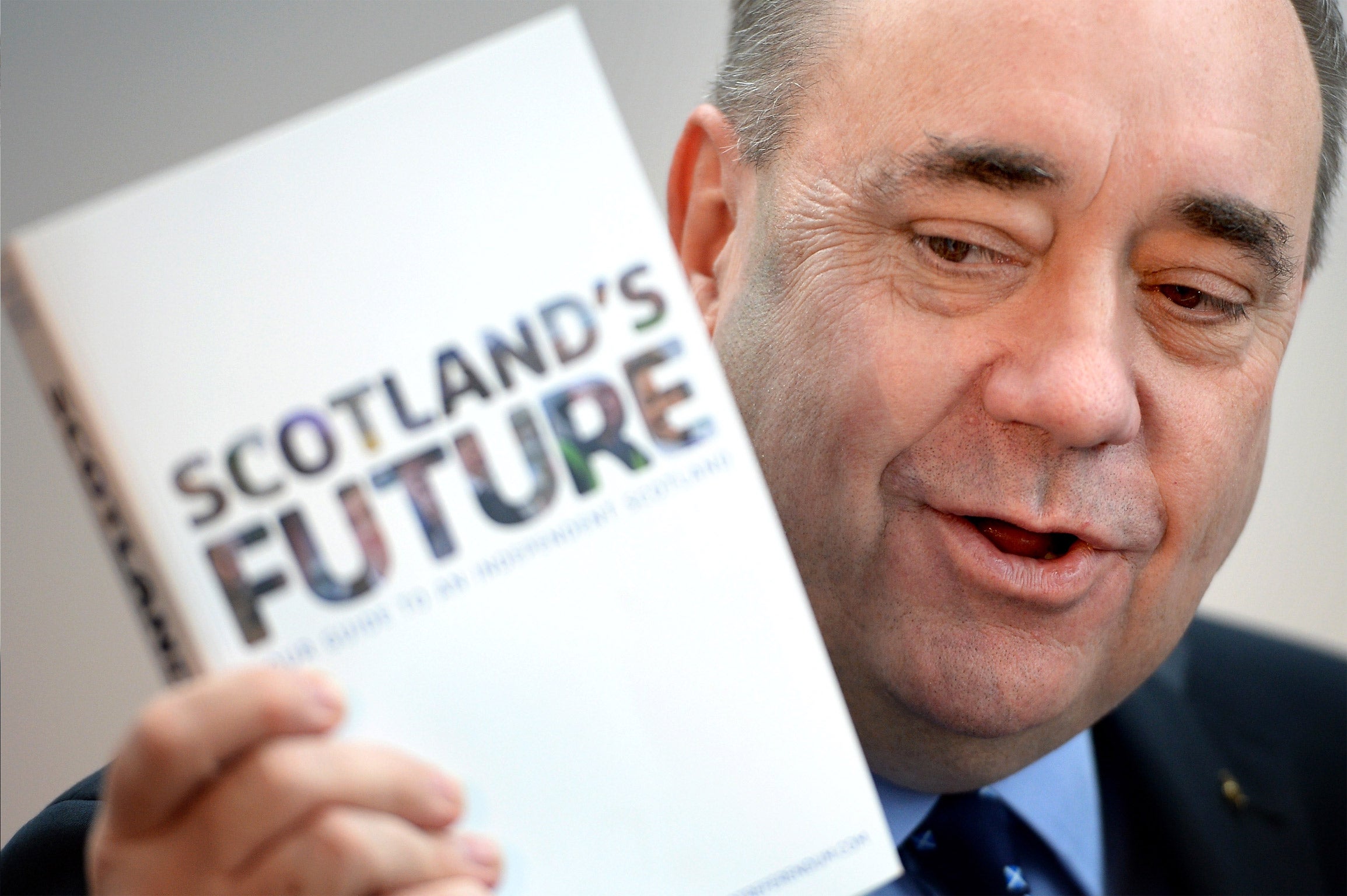

Why an independent Scotland could become the richest country on Earth

On a per capita basis, the nation has all the ingredients to be one of the world's most prosperous nations

Your support helps us to tell the story

From reproductive rights to climate change to Big Tech, The Independent is on the ground when the story is developing. Whether it's investigating the financials of Elon Musk's pro-Trump PAC or producing our latest documentary, 'The A Word', which shines a light on the American women fighting for reproductive rights, we know how important it is to parse out the facts from the messaging.

At such a critical moment in US history, we need reporters on the ground. Your donation allows us to keep sending journalists to speak to both sides of the story.

The Independent is trusted by Americans across the entire political spectrum. And unlike many other quality news outlets, we choose not to lock Americans out of our reporting and analysis with paywalls. We believe quality journalism should be available to everyone, paid for by those who can afford it.

Your support makes all the difference.An independent Scotland could become the richest country on earth. I’m not joking. It has all the necessary ingredients. Let me explain.

Each year the World Bank, the IMF and the CIA each independently publish a list of the richest countries in the world - as measured by GDP per capita at purchasing power parity.

The UK sits at a rather disappointing 21st, but topping those rankings you have the likes of Qatar, Luxembourg, Singapore, Brunei, Norway and Switzerland.

Some of these nations have got there thanks to their oil. But oil isn’t everything – otherwise the likes of Saudi Arabia (28th), Russia (43rd) or Iran (78th) would feature.

Others have got there because they are financial or commercial centres. But the same regulatory options that have enabled them to be so are open to other countries - they have just not been adopted.

There is, however, one characteristic common to all the top ten ranking nations, bar one. It is that they are small. In the top five, Singapore and Norway both have around 5 million; Qatar 3 million; Luxembourg and Brunei around half a million.

The one exception is the US. It ranks 6th (IMF), 7th (World Bank) and 14th (CIA). In 1950, and indeed in 1970, it was top. Back then though, its states were semi-autonomous and, on a gold standard, its money was independent. As its state has grown and power become more centralized, its ranking has slid.

This is because there is a direct correlation between the size of the state and the wealth of the people - the bigger the former, the smaller the latter. The more power is concentrated, the less wealth is spread.

But in a small nation, forced to live from a smaller tax base, there is more of a limit to how big state institutions can grow. Monitoring becomes more efficient, it is harder to obfuscate, so there is more transparency and accountability, and less waste. Change is easier to implement, making a nation flexible, dynamic and competitive. With fewer people, there is less of a wealth gap between those at the top and the bottom.

The evidence of history is that the free-est countries with the widest dispersal of power have always been the most prosperous and innovative.

The city-states of pre- and early-Renaissance Italy are a good example. There was no single ruling body except for the Roman Catholic Church. If people, ideas or innovation were suppressed in one state, they could quickly move to another, so there was competition. Venice, in particular, showed great innovation in turning apparently useless marsh into a unique, thriving city. Renaissance Italy became breathtakingly prosperous and produced some of the greatest individuals that ever lived.

But it would be overtaken by Protestant northern Europe. The bible was translated into local vernacular, and Gutenberg’s printing press furthered the spread of knowledge – and thus the decentralization of power. The pace was set by Holland, also made up of many small states, then Britain led the pack. In spite of its union with Scotland and its later empire building, England would disperse centralized power by reducing the authorities of the monarch after the Civil War of 1642–51, and later by linking its currency to gold.

Since its unification in the late 19th century, Italy has been nothing like the force it once was, blighted by infighting, bureaucracy, organized crime, corruption, rent- seeking, inflation and division. Its state is bloated, its political system dysfunctional.

So back to Scotland.

It now has the opportunity to enact the same legislation, taxation and regulation that other top ten countries on that list employ, following, say, the blueprint of Singapore. It already has a rich tradition in trade, finance and banking.

It has the oil.

And, with just five million people, it is small.

It has all the ingredients to be the richest country on earth – on a per capita basis. It has ‘the triple’. I can think of no other nation in the world with such a wonderful opportunity.

The Scottish contribution to the world, whether in engineering, invention, industry or finance, has been astounding. Think Adam Smith, Alexander Fleming, John Logie Baird, James Watt. You cannot doubt Scottish talent - they are a formidable people. But they do not dominate the global stage as they once did. There will be a tough period of adjustment to get through, yes, but independent, living off their tax base, with dynamism and self-belief restored, they can do so once again.

But, first, they must make the right choices.

Dominic Frisby is the author of Life After The State. An audiobook version is available here.

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies

Comments