Wake-up! It's house price bubble time

The Bank of England is just guessing when it comes to the output gap

Your support helps us to tell the story

From reproductive rights to climate change to Big Tech, The Independent is on the ground when the story is developing. Whether it's investigating the financials of Elon Musk's pro-Trump PAC or producing our latest documentary, 'The A Word', which shines a light on the American women fighting for reproductive rights, we know how important it is to parse out the facts from the messaging.

At such a critical moment in US history, we need reporters on the ground. Your donation allows us to keep sending journalists to speak to both sides of the story.

The Independent is trusted by Americans across the entire political spectrum. And unlike many other quality news outlets, we choose not to lock Americans out of our reporting and analysis with paywalls. We believe quality journalism should be available to everyone, paid for by those who can afford it.

Your support makes all the difference.There are big personnel changes coming to the all-male Monetary Policy Committee (MPC) at the Bank of England as Governor Mark Carney made clear at his inflation report press conference last week.

The three MPC members on the stage with him – Charlie Bean, Spencer Dale and Paul Fisher – were all attending their last press conference. On 1 June Andy Haldane takes over as chief economist; on 1 July Ben Broadbent becomes a deputy governor and on 1 August Nemat Shafik also takes up an appointment as deputy governor.

The appointment of the tenured MIT economics professor Kristin Forbes, who is an expert on the global financial crisis and who has experience as a policy maker, is to be welcomed. By August there won’t be a single member left from the disastrous MPC that I sat on that failed to spot the Great Recession.

The MPC gave away very little in the inflation report, as it would make little sense to pre-commit these new members to future policies. The forecast was rather more dovish than most commentators had expected, which lead to an immediate drop in the pound. Expectations of a rate rise coming in 2014 seem to have been squashed. Interest rates, it seems, are not going to rise for some time; mid-2015 may even be too optimistic. Somewhat controversially, Mr Carney made clear that in his view it wasn’t the job of the MPC to contain a housing bubble. It was the job of the Financial Policy Committee, which he also heads, to sort that one out.

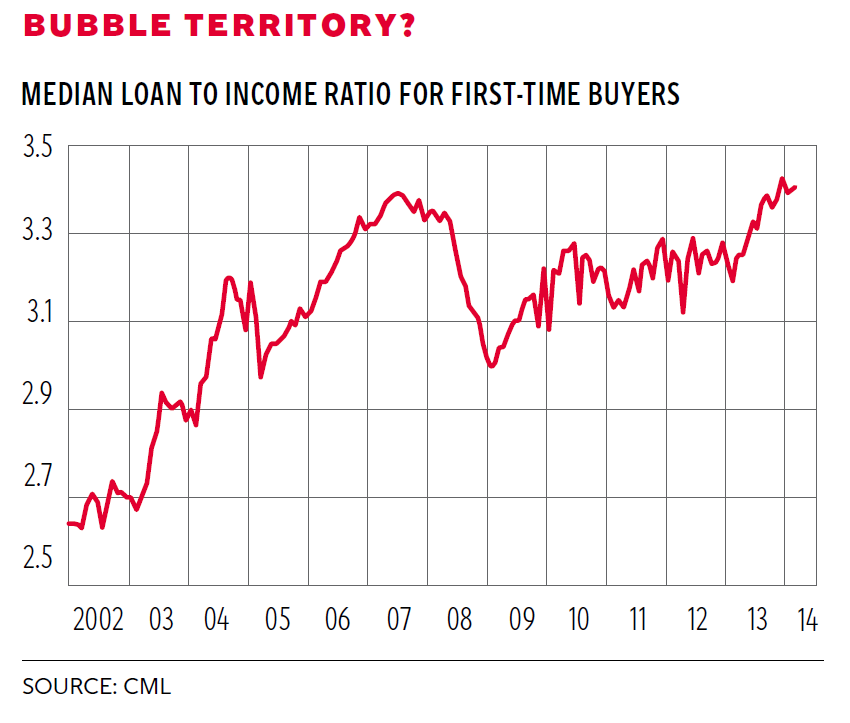

House prices have risen faster than earnings, but the house price-to-earnings ratio remains below 2007 levels. The MPC noted that a growing share of recent mortgage contracts have been attributable to borrowers with loan-to-value ratios above 90 per cent, although this proportion also remains below pre-crisis levels. That rising share of higher loan-to-value mortgages, the MPC suggested, “may reflect the Government’s Help to Buy mortgage guarantee scheme, which facilitates the provision of mortgages to first-time homebuyers and home movers with small deposits”. As the chart below shows, new lending to first-time buyers at high loan-to-income ratios has surpassed pre-crisis levels, particularly for high-value properties, including those in London.

It does seem likely that the FPC will have to act on raging house prices in London. not least to prevent the MPC having to raise rates before the 2015 election. It should be said though there is some recent evidence of slowing in the housing market including new buyer enquiries which have eased across all regions with the exception of East Anglia, while the balance of surveyors reporting a rise in new buyer enquiries continues to edge down. The view of Chris Pointon of Capital Economics is that Bank of England action to prick the bubble is most likely to come on loan-to-income ratios, which will inevitably bite hardest in London.

Of interest also is the MPC’s attempt to estimate the amount of spare capacity in the economy, which is predominantly driven by what is going on in the labour market. The MPC defines spare capacity as the additional output that could be produced before slack stops reducing inflation. The MPC’s current estimate is that spare capacity is 1-1.5 per cent of GDP. The MPC believes that companies are working their existing capital and labour at around normal rates of intensity, so slack is concentrated in the labour market. As a matter of judgment the MPC reduces the amount of labour market slack because of the high level of long-term unemployment that exists in the UK economy. It claims, without foundation, that “the longer that someone has been out of work, the lower the probability of them finding a job and hence the less downward pressure they would tend to put on wages.” There is zero empirical foundation for this hand-waving guess.

The MPC also includes underemployment that David Bell and I have identified, as part of its measure of labour market slack. However the MPC has decided to ignore half of the reported amounts because of work reported in a recent speech by MPC member Martin Weale who suggested that in the past, people who reported working fewer hours than desired subsequently seemed satisfied with smaller increases than they said they wanted. Unfortunately this work is simply not credible, given that it is based on a sample with a non-response rate of about 40 per cent, with the major exclusion being the young and recent immigrants whose hours are the most constrained. This work has not been peer reviewed, nobody has had any access to the data and there are no supporting studies, so the adjustment is just wishful, made-up guessing.

These two ill-considered downward adjustments to the level of slack are a big reason why the MPC has overestimated the growth in real wages, which it had to downgrade in its latest forecast. Consequently, in my view, the level of spare capacity in the UK is greater than the MPC estimates, implying that rates are going to remain lower for even longer.

That will be true until the FPC, which has been asleep since it was formed, finally decides to do something about that house price bubble.

Wakey wakey!

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies

Comments