Victory lap? George Osborne’s handling of the economy has resulted in an ignominious defeat for the Chancellor

Your support helps us to tell the story

From reproductive rights to climate change to Big Tech, The Independent is on the ground when the story is developing. Whether it's investigating the financials of Elon Musk's pro-Trump PAC or producing our latest documentary, 'The A Word', which shines a light on the American women fighting for reproductive rights, we know how important it is to parse out the facts from the messaging.

At such a critical moment in US history, we need reporters on the ground. Your donation allows us to keep sending journalists to speak to both sides of the story.

The Independent is trusted by Americans across the entire political spectrum. And unlike many other quality news outlets, we choose not to lock Americans out of our reporting and analysis with paywalls. We believe quality journalism should be available to everyone, paid for by those who can afford it.

Your support makes all the difference.The International Monetary Fund in its World Economic Outlook has now upgraded its forecast for UK growth in 2014 to 2.9 per cent, up 0.4 per cent from its January forecast. But that will be as good as it gets, according to the IMF, who believe that growth in 2015 will slow to 2.5 per cent, up 0.3 per cent from January, just in time for the election.

It is true that this is faster growth than in any G7 country in 2014, but the IMF forecasts faster growth in the US in 2015. This upgrade was treated by some government apologists as a cause for celebration. Chris Giles in the Financial Times even went as far as to claim that “a rhetorical victory lap over the UK economy is justified” when, of course, it isn’t.

The ex-Barclays Tory MP Jesse Norman tweeted me: “UK growth upgrade offers a philosophical lesson for @NYTimeskrugman @D_Blanchflower @IMF: try not to believe your own biases #enlightenment.” A “philosophical lesson”, and all of this based on a single forecast. Not even on any actual data – and he accuses me of bias; well, let’s see whose biases are showing.

Before we go on, perhaps I should remind Jesse what the Government’s forecast was in June 2010 when the Coalition took office. The actual outcomes are in parentheses. The OBR forecast GDP growth would be 1.2 per cent (1.7 per cent) in 2010, 2.3 per cent (1.1 per cent) in 2011, 2.8 per cent (0.3 per cent) in 2012, and 2.9 per cent (1.7 per cent) in 2013. Moral of tale: forecasts don’t always turn out so well. The economy grew more in 2010 under Labour than the OBR expected, and rather than the cumulative 7.1 per cent the OBR forecast, the economy grew by less than half that (3.2 per cent).

The OBR also forecast positive wage growth of 1.2 per cent in 2012 and 2.9 per cent in 2013, and we actually got, according to the OBR, falls in real wages of 0.8 per cent and 1.1 per cent respectively.

I do recall that in his June 2010 Budget speech the Chancellor claimed “what is more, the forecast shows a gradual rebalancing of the economy, with business investment and exports playing a greater role”. Well, that hasn’t happened either. Of course, we shouldn’t forget that Oscar Jorda and Alan Taylor in their definitive paper on the issue estimated that GDP is 3 per cent lower than it should have been absent George Osborne’s misguided austerity.

Of course, as Jonathan Loynes at Capital Economics has noted, there are reasons why Mr Osborne may want to think twice before declaring that “Plan A” has been fully vindicated. Mr Loynes points out that the Chancellor has adjusted his fiscal plans quite substantially. The deficit has fallen and is expected to continue falling much more slowly than was originally set out in Plan A, and even under Labour’s plans. Mr Loynes continues that Mr Osborne may want to keep the champagne on ice for a while, not least because he “has also scaled back the pace of fiscal consolidation … . In that regard, it would be stretching things for the Chancellor to claim that Plan A has been vindicated, since we’re arguably on Plan C or D”.

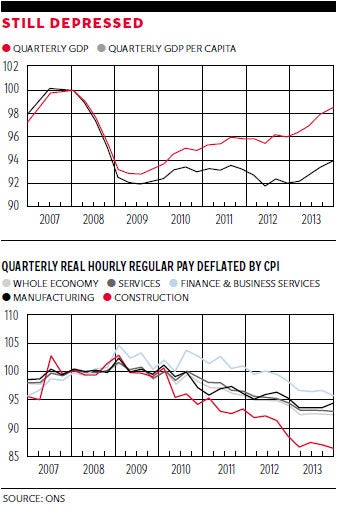

There were three highly relevant releases from the ONS last week that put Jesse’s claims in their proper context. In their latest Economic Review, the ONS released data on GDP and GDP per capita. Prior to the Great Recession, the last time GDP per capita fell in a sustained way through several quarters in a row was from Q3 1990-Q3 1991, when it declined by 1.8 per cent and took five quarters to recover. Before that, GDP per capita fell by 2.4 per cent from Q1 1980-Q1 1981 and took seven quarters to recover. The most recent decline is plotted in the first chart from 2007. GDP per capita fell by 8.1 per cent from Q2 2008-Q3 2009. GDP per head, by the way, grew by 1.3 per cent under Labour from Q4 2009-Q2 2010.

The ONS made clear that while aggregate output has grown strongly in recent quarters, GDP per capita has only recently started to turn up. While GDP has closed on the pre-downturn peak, GDP per capita remains some 6.1 per cent below the level in Q1 2008, and is only slightly higher than the level first achieved in early 2005. It is the worst recovery since the data were first collected in 1955. Let’s celebrate! This is an ignominious defeat if I ever saw one.

The ONS also released data on real wages by industry, in the second chart. Nominal hourly wages are adjusted for inflation as calculated in the consumer prices index (CPI). None of these industries has been immune from real wage reductions. Relative to 2008, average real hourly earnings fell in the services (-6.9 per cent), manufacturing (-5.6 per cent) and construction industries (-13.4 per cent), and by 7.6 per cent across the economy. By contrast, workers in finance and business services, who experienced real wage increases relative to 2008 as recently as 2011, had seen only a 4.2 per cent fall in average real hourly pay in Q4 2013.

In comparison with Q2 2010, real wages are down 5.3 per cent for both the economy as a whole and services. They are down 4.2 per cent in finance and business services, 4.7 per cent in manufacturing and 9.3 per cent in construction. Another rout.

Finally, last week’s ONS data on net trade showed that there has been no rebalancing at all. The onset of the global downturn resulted in the value of UK exports and imports falling sharply until Q2 2009. Growth in the value of trade in goods resumed from mid-2009 with improving global economic conditions. However, the value of both UK exports and imports have remained largely flat since mid-2011. In the three months ending February 2014, exports of goods fell by 2.5 per cent to £72.7bn. No rebalancing or success here.

Oh dear Jesse, there’s many a slip ’twixt the cup and the lip.

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies

Comments