Stop blaming businesses like Google for tax avoidance and look to lawmakers instead

The Public Accounts Committee meeting was a pantomime in which Margaret Hodge cast herself as the hero. In fact, only politicians have the power to reform tax law

Your support helps us to tell the story

From reproductive rights to climate change to Big Tech, The Independent is on the ground when the story is developing. Whether it's investigating the financials of Elon Musk's pro-Trump PAC or producing our latest documentary, 'The A Word', which shines a light on the American women fighting for reproductive rights, we know how important it is to parse out the facts from the messaging.

At such a critical moment in US history, we need reporters on the ground. Your donation allows us to keep sending journalists to speak to both sides of the story.

The Independent is trusted by Americans across the entire political spectrum. And unlike many other quality news outlets, we choose not to lock Americans out of our reporting and analysis with paywalls. We believe quality journalism should be available to everyone, paid for by those who can afford it.

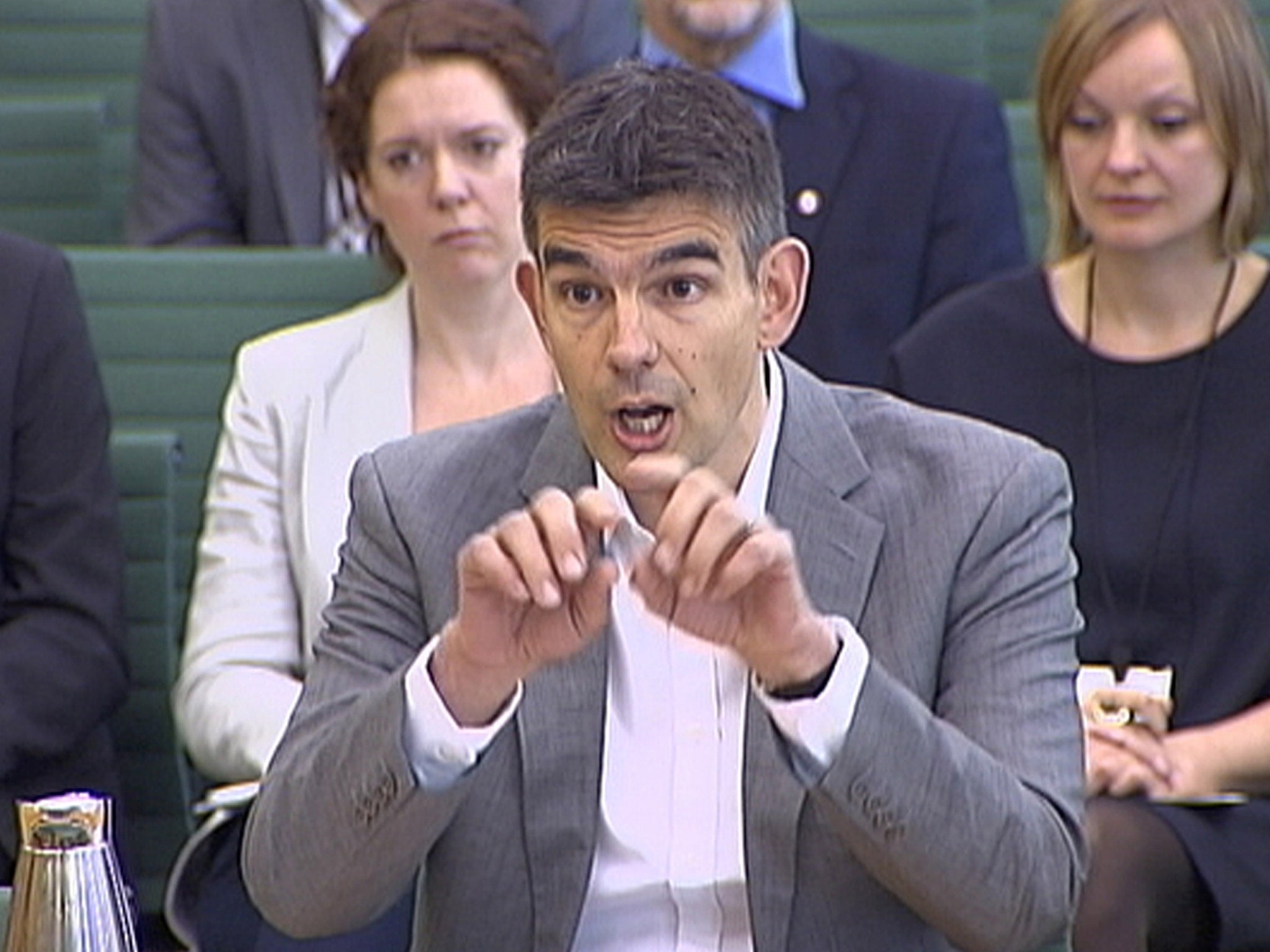

Your support makes all the difference.The emotive issue of tax avoidance hit the headlines again this week, after Google defended itself in front of politicians over the amount the tech giant pays in taxes to the British government. But Google wasn’t the only one that got a hard time. Tax consultancy Ernst & Young, and even the HMRC were the big bad wolves in committee chairman Margeret Hodge MP’s pantomime of blustering. Hodge, unfortunately, spent her time throwing out soundbites and denying Matt Brittin, Google’s head of operations in Northern Europe, an opportunity to answer the accusations thrown at him. Words like “devious”, “calculating” and “unethical” were repeatedly peppered throughout the grilling. Meanwhile, a handful of the other MPs were more incisive and calm in their questioning, but it was not enough to mitigate Hodge’s effect of pushing Brittin, and Google, into a more positive light.

Brittin, who was giving evidence for the second time in the last six months, had to explain why the search engine behemoth only paid £6m in corporation tax in 2011, despite racking up £2.5bn in annual revenues in Britain the same year. When the ordinary working person is bearing the brunt of rising costs and falling wages, hearing that one of the world’s largest companies in the world only has to scrape together corporate chump change in the form of taxes, is undoubtedly painful. However, what transpired only highlighted the highly complex and fractured tax system that politicians are responsible for creating.

"No money changes hands in the UK. Firstly, the rights to what we sell and are sold are owned by Google in Ireland, under intellectual property rights,” said Britten. "In the UK, we cannot sell what we don't own, we cannot agree a price, we cannot agree on volume discount and we can't close a deal in Britain." The point is, Google can legally court and nurture customer relationships in the UK. However, at the point of closing a deal, only Ireland can issue and seal a contract. Therefore the money can change hands elsewhere. Ergo, the sale did not take place in Britain. But who is to blame for such a seemingly dastardly way of paying less tax?

As HMRC's chief executive and permanent secretary Lin Homer said, “We are duty bound to collect and investigate under regulations, set out by lawmakers, not on what 'you'd like' us to collect on." Whether it is your local fish and chip shop owner or a Mega Corp 101, businesses will always look for, and be advised on how to keep as much of their profits as they legally can. Rules are rules and law is cold. Emotions, ethics and morality do not necessarily equate to good business sense.

We know this all too well, nearly seven years on, from the onset of one of the world’s worst financial crises. Many politicians are taking a step in the right direction by conducting parliamentary meetings and actively spending vast amount of time and resources to investigate a subject that strikes at the heart of every hardworking, ordinary British citizen. However, nothing will change if MPs use the issue as a vote raking tool, and not as an opportunity for sealing up loopholes in the law.

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies

Comments