Japan has finally joined the quantitative easing party - and better late than never

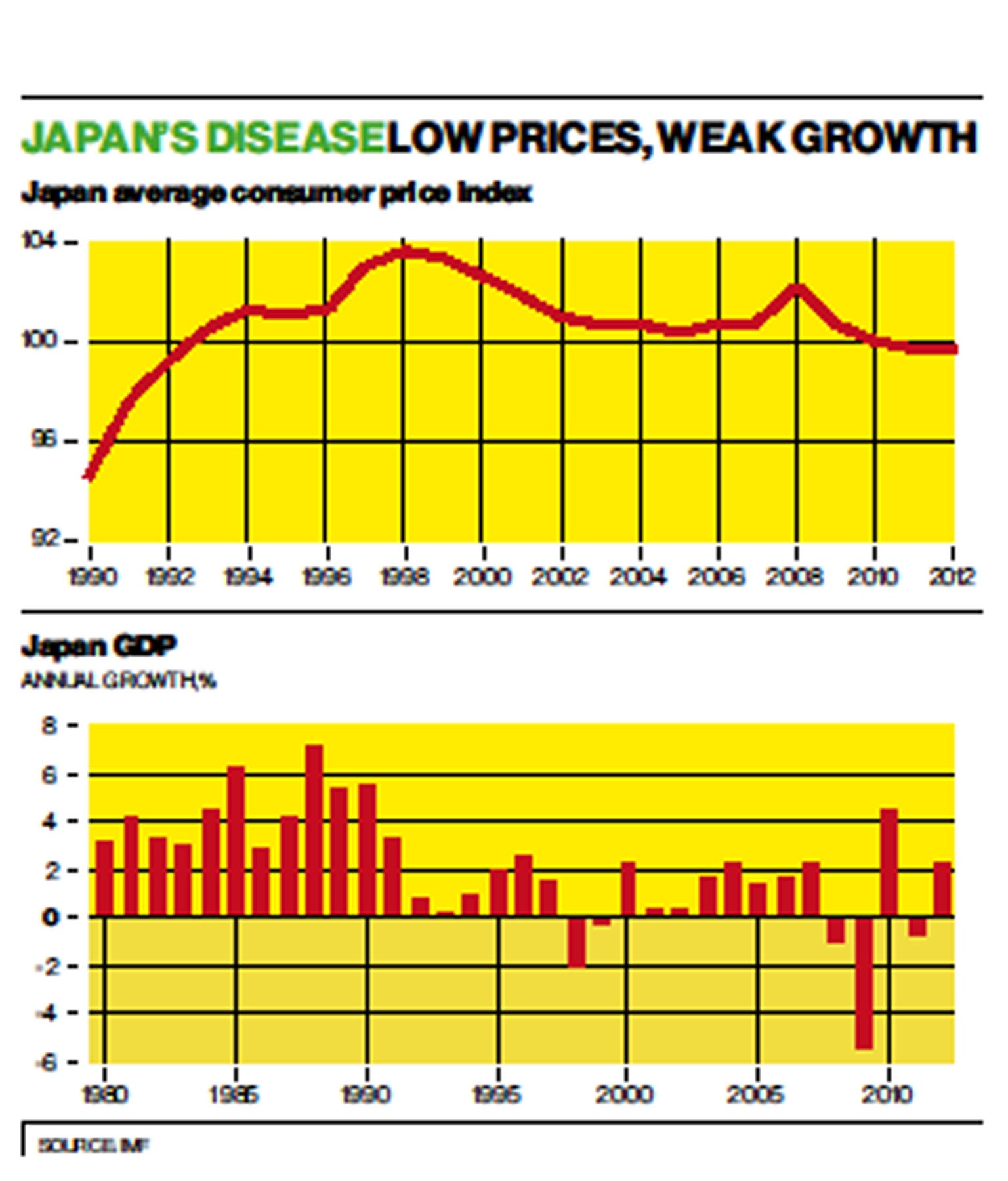

Central bank watchers in search of excitement must turn to Japan. The hope is that this dramatic action will break the two-decade deflationary spiral

Your support helps us to tell the story

From reproductive rights to climate change to Big Tech, The Independent is on the ground when the story is developing. Whether it's investigating the financials of Elon Musk's pro-Trump PAC or producing our latest documentary, 'The A Word', which shines a light on the American women fighting for reproductive rights, we know how important it is to parse out the facts from the messaging.

At such a critical moment in US history, we need reporters on the ground. Your donation allows us to keep sending journalists to speak to both sides of the story.

The Independent is trusted by Americans across the entire political spectrum. And unlike many other quality news outlets, we choose not to lock Americans out of our reporting and analysis with paywalls. We believe quality journalism should be available to everyone, paid for by those who can afford it.

Your support makes all the difference.Central bank watchers like me didn’t have much excitement in Europe last week, even though there were two decisions. The Monetary Policy Committee did nothing and didn’t even issue a statement explaining why not.

The likelihood is that Mervyn King was in the minority again, for the third month in a row. He only has two more meetings to go before he is replaced by Mark Carney, and it looks like he will not go out in a blaze of glory. That is what happens when you don’t spot the biggest recession in a hundred years, or the double-dip for that matter, and keep telling people the recovery is fast approaching.

In all likelihood he couldn’t even persuade Spencer Dale, Charlie Bean and Paul Tucker, whom he appointed, to vote with him. We will find out how the vote went when the minutes are published on 17 April. A governor in the minority has never happened in the US or in Europe, certainly not seven times.

The European Central Bank didn’t move either, although its governor, Mario Draghi, did suggest that they may cut rates down the road. It remains unclear why not now, given that inflation in the euro area fell this month to 1.7 per cent while unemployment remained at 12 per cent and having risen on the month in Spain (26.3 per cent); France (10.8 per cent); Cyprus (14.0 per cent) and the Netherlands (6.2 per cent). Of the 17 euro area countries, nine have double digit unemployment rates. Youth unemployment rates are 24 per cent for the euro area as a whole and 31 per cent in Ireland, 38 per cent in Italy and Portugal, 56 per cent in Spain and 58 per cent in Greece. This is the Great Depression #2 in those countries, with worse to come. Just as in the UK, austerity has failed miserably.

The big surprise last week, though, was the action by the Japanese central bank, whose governor, Haruhiko Kuroda, announced a commitment to meet its 2 per cent inflation target in two years by at long last joining the quantitative easing party. It represents a U-turn from its stance over the last couple of decades, and is now about to follow the strategy of monetary loosening being followed in Washington and London. Lack of growth will do that. Better late to the game than never.

The announcement caused much excitement, and the Nikkei 225 index of Japanese shares rose 2.2 per cent on the day of the announcement, while Japanese bonds swung wildly. The benchmark 10-year bond yield dipped as low as 0.325 per cent, beating the previous low set a decade ago, before bouncing back to 0.65 per cent.

The hope is that this dramatic action will break the deflationary spiral Japan has been in for two decades – see first chart. To put this in context the second chart shows Japan’s annualised growth, which was weak during the 1990s. Over the last nine quarters, Q42010-Q42012, Japan hasn’t grown at all, with five of them being negative; which is comparable to the UK, which has also had no growth other than in the single Olympics quarter of Q32012. In both countries five of the last nine quarters have been negative. In contrast, the unemployment rate in Japan is 4.2 per cent compared with 7.7 per cent in the UK. My friend and colleague and Japan expert Adam Posen, formerly of the Bank of England and currently of the Peterson Institute, told me he heartily endorsed the Tokyo government’s plans for loose money and more aggressive inflation targeting from the Bank of Japan. If it’s good for him it’s good for me!

Some commentators even went as far as saying that for the Japanese central bank to meet its inflation target will require a burst of inflation. The central bank announced that this would involve a major increase in asset purchases, including longer dated bonds and private sector assets. Planned purchases will expand the monetary base from 29 per cent of GDP to 55 per cent by the end of 2014.

This had a major effect on the yen, which depreciated sharply. This is part of the intention of the bank, making Japanese goods more competitive and encouraging domestic import substitution. Since last November, when it became clear that Japan would see the election of a new government on a platform of aggressive monetary stimulus, the Nikkei has risen by 40 per cent, while the yen has fallen by over 15 per cent against the dollar. The Japanese currency is still trading close to its weakest level in three and a half years, erasing all the gains it made in the wake of the Cyprus bailout.

This is QE wars aimed at weakening currencies. One central bank does QE that lowers their currency, which forces others to react, including the Fed and eventually the MPC. The ECB, though, remains stultified in inactivity so the euro strengthens, causing European firms to become less competitive and so unemployment rises further. The eurozone crisis worsens once again because of overly tight fiscal and monetary policies. Stagnation continues.

George Soros called the move to expand monetary easing “an avalanche” in the yen, suggesting that there is more depreciation to come. In an interview in Hong Kong he said: “If the yen starts to fall, which it has done, and people in Japan realize that it’s liable to continue and want to put their money abroad, then the fall may become like an avalanche. If what they’re doing gets something started, they may not be able to stop it.” So it looks like this really is the year of the central banks. Interesting days.

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies

Comments