Davos 2014: For the real news, don’t listen ... watch

Whatever the leaders gathering at the Swiss ski resort say to reporters, to really understand the strength of the recovery, we need to follow the money

Your support helps us to tell the story

From reproductive rights to climate change to Big Tech, The Independent is on the ground when the story is developing. Whether it's investigating the financials of Elon Musk's pro-Trump PAC or producing our latest documentary, 'The A Word', which shines a light on the American women fighting for reproductive rights, we know how important it is to parse out the facts from the messaging.

At such a critical moment in US history, we need reporters on the ground. Your donation allows us to keep sending journalists to speak to both sides of the story.

The Independent is trusted by Americans across the entire political spectrum. And unlike many other quality news outlets, we choose not to lock Americans out of our reporting and analysis with paywalls. We believe quality journalism should be available to everyone, paid for by those who can afford it.

Your support makes all the difference.It is Davos time again, and for the next few days the media will be full of stuff about the great and the not-so-great leaders holed up in the Swiss resort. Aficionados of these meetings, which have been running since the 1970s, will say that they aren’t quite what they used to be. But they are certainly good for the Swiss economy, and they give a feel for the concerns and hopes of the people who run half the world’s big companies.

This year, there are three things to watch for.

First and most obvious, we should look for any clues about the character and duration of the global recovery. The rule here is not to listen to what people say in public but look at what they do in private. If you listen to what they say you get it wrong. There was, for example, hardly any hint in the 2008 sessions of the looming economic catastrophe, but you could see banks trying to reduce their cross-border activities and step back (not nearly fast enough) from more risky activities, and companies scaling back investment plans.

Now the picture is quite different. In the developed world at least there is widespread belief that the recovery is secure; profits are high; companies are stuffed with cash. It may have taken a long time for the benefits of this recovery to filter through to ordinary working people, and there are parts of Europe, in particular, that are lagging behind. But viewed overall, the prospect is bright. That optimism is reflected in the financial markets. The FT100 index has been one of the laggards among the developed world equity markets, up “only” 16 per cent on a year ago, but it is around a couple of percentage points off its all-time high.

So the thing to look for is what the corporate world is actually doing. Is investment really rising and where are the bets being placed? It is too huge a subject to summarise here, except to note two things. One is that at this stage of the economic cycle you always start to see a solid rise in investment, for investment follows rising demand rather than leading it. The other is that the nature of investment now is different from the nature of investment even 10 years ago: it used to be physical assets but increasingly it is intellectual property: brands and people.

The second thing to watch for will be judgements about the relationship between the developed world and the emerging one. Davos brings these together. There has been a marked downward shift in perception of the emerging world. Political risk is seen as climbing (Turkey, Thailand, etc), and economic growth is falling (Brazil, India, to some extent China). The fact remains that growth will continue to be much higher in the emerging world than in the developed one, but the gap will not be as large in the next three years as it has been in the past three. The basic story of the past decade, that we are shifting to a multi-polar world, is intact. But it is going to happen a little slower than seemed inevitable two or three years ago.

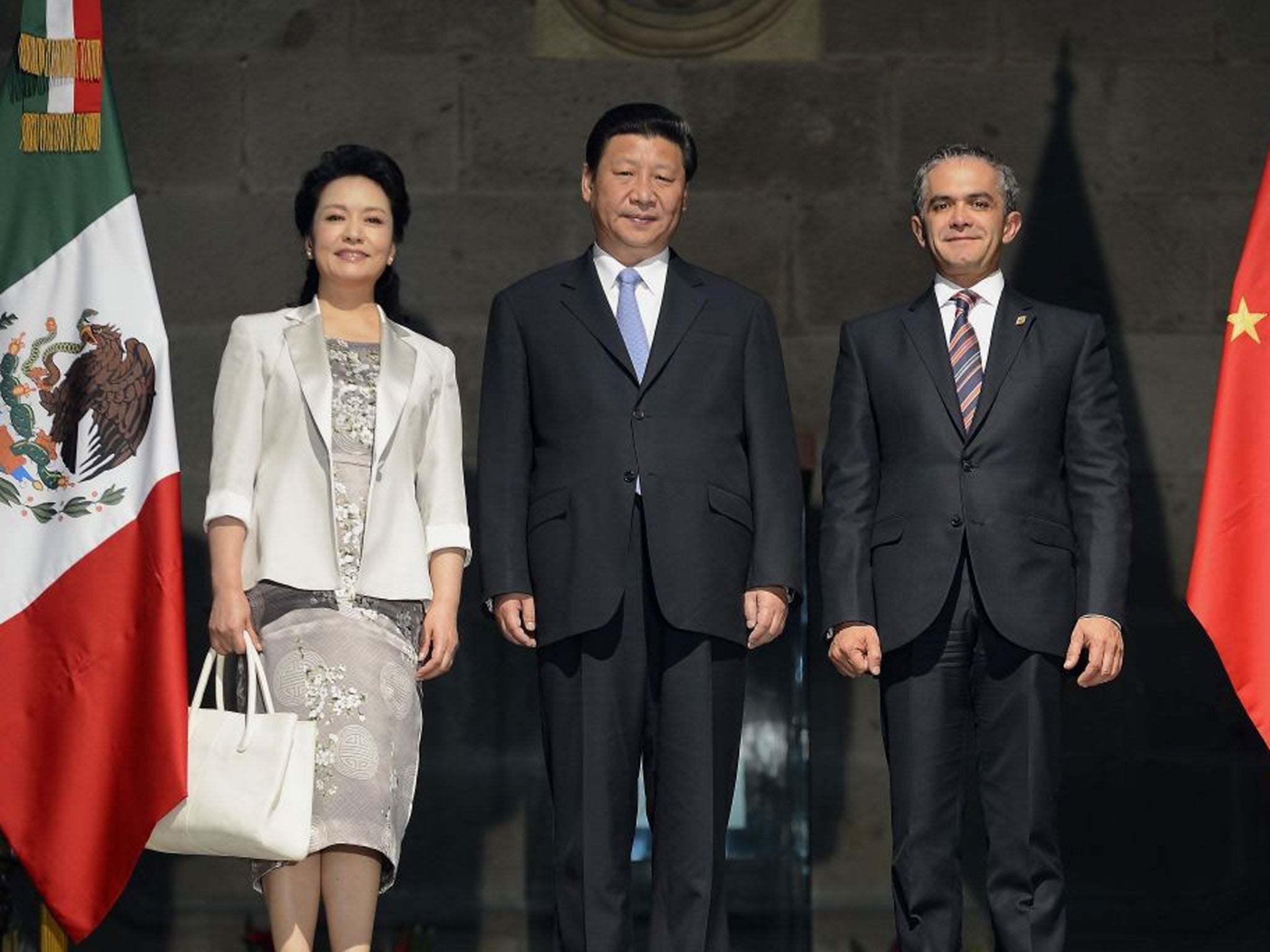

And the third thing will be China. I think we may look back on 2013-14 as being as important for China as 1978-79, for it seems that the reforms that began with Deng Xiaoping are taking a quite different direction under President Xi Jinping. For the past 35 years state control of the investment process has been central to development. The market signalled the detail; the authorities controlled the overall pattern. This was a strategy that worked very well in the downturn, for domestic investment substituted for external demand. But that left a legacy of bad debts, and to stop that happening again there have to be better decisions in resource allocation. The market will have a bigger role in trying to reach these. Meanwhile there will be what, by Chinese standards, might seem a little like austerity. Excess will be out (sales of posh cars are down), and not before time.

Stand back and you can see the clear over-arching mood at the moment that the developed world is back on song. That is evident here in the UK, a feeling that “phew, at last things are on the move”. It is, too, in the US, with shares up 27 per cent in the past 12 months. You can even catch a bit of it in Europe, with European Commission President José Manuel Barroso saying the eurozone crisis is over.

There will be a lot of this optimism in Davos. We may even get a bit from David Cameron, who is attending. But we should beware triumphalism, wherever it comes from. While living standards in most of the developed world remain lower than they were five years ago, in some cases much lower, and where so many people remain out of work, the world economy remains under repair.

Those repairs will need to continue for another five years, and the longer-term question – how does the developed world improve productivity and so create a better lifestyle for all its citizens? – remains as hard to answer as ever.

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies

Comments