Daily catch-up: Professor Balls on the 'catastrophe' of running a surplus

Another instalment from the course in contemporary history at King's College, London, taught by the Treasury's top civil servant

Your support helps us to tell the story

From reproductive rights to climate change to Big Tech, The Independent is on the ground when the story is developing. Whether it's investigating the financials of Elon Musk's pro-Trump PAC or producing our latest documentary, 'The A Word', which shines a light on the American women fighting for reproductive rights, we know how important it is to parse out the facts from the messaging.

At such a critical moment in US history, we need reporters on the ground. Your donation allows us to keep sending journalists to speak to both sides of the story.

The Independent is trusted by Americans across the entire political spectrum. And unlike many other quality news outlets, we choose not to lock Americans out of our reporting and analysis with paywalls. We believe quality journalism should be available to everyone, paid for by those who can afford it.

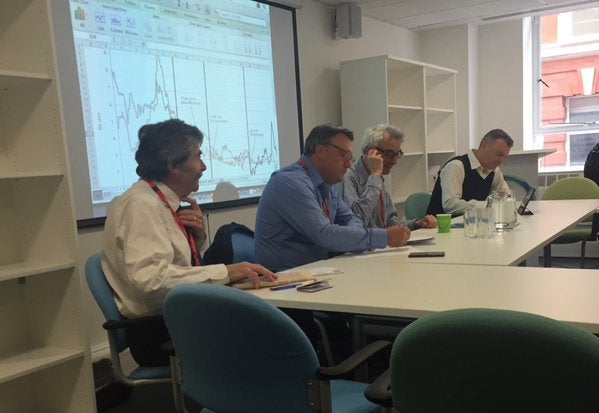

Your support makes all the difference.Ed Balls, the former shadow chancellor and now visiting professor at King's College, London, took a seminar in the "History of the Treasury since 1945" Masters course on Friday. I wrote about his contribution at the start of the course: last week's was a session led by him on the decision to make the Bank of England operationally independent in 1997.

Balls explained that "we needed an anchor" against inflation. After the ERM crisis in 1992, "we didn’t want the exchange rate or the euro; and we thought the Ken and Eddie Show was risky for Ken Clarke and would be disastrous for us". The "Ken and Eddie Show" was the monthly meeting between Kenneth Clarke, the Conservative Chancellor, and Eddie George, the Governor of the Bank fo England, to discuss and agree interest rates, with the minutes published a few weeks later for the sake of transparency.

The decision to grant the Bank of England independence was hailed as a masterstroke at the time, and had immediate benefits.

"From the autumn of 1998 through into 1999, the [independent] Bank of England was more aggressive in cutting interest rates when the economy slowed than politicians would have been," said Balls. If the Labour government had been responsible for those decisions, "it would have been a crisis".

So successful was the boost to confidence in policy that the economy was soon growing fast and tax revenue was coming in much faster than expected. "We were almost embarrassed" by the flood of money, said Sir Nicholas Macpherson, the current permanent secretary at the Treasury who co-teaches the course with Jon Davis, ultra-contemporary historian at King's. At the time, Macpherson was Principal Private Secretary to Gordon Brown, and worked closely with Balls, Brown's special adviser.

By 2000 and 2001, the government books were in surplus. Balls said: "None of us expected these surpluses. It was a complete disaster. We wanted a small deficit and a bit of capital spending." Then the 4G mobile phone auction raised another £22bn. "It was a complete catastrophe." He was joking, because it made it harder to resist spending demands, from Tony Blair and other ministers, but it underlines the success of early Labour economic policy, building on the benign legacy left by Kenneth Clarke.

It was an excellent seminar, which discussed Blair's claim to have been the main author of the policy of Bank of England independence. Balls simply looked sceptical, but Macpherson said his recollection was: "It was quite clear who the proposer was. Blair was giving consent on behalf of the government."

• In The Independent on Sunday yesterday, I wrote about the remarkable career of Jeremy Hunt, the Health Secretary, and wonder why he has taken on the junior doctors, "the parish priests of the national religion".

• The Top 10 in The New Review, the Independent on Sunday magazine, was Idioms From Other Languages. One I missed was: "Playing piano to a cow" (Chinese). Thanks to Lofuji in the comments.

• And finally, thanks to Moose Allain for this etiquette advice:

"The correct way to address a statue is Statue Esq."

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies

Comments