Daily catch-up: Despite the U-turn on tax credits, Osborne's measures will still hurt the working poor

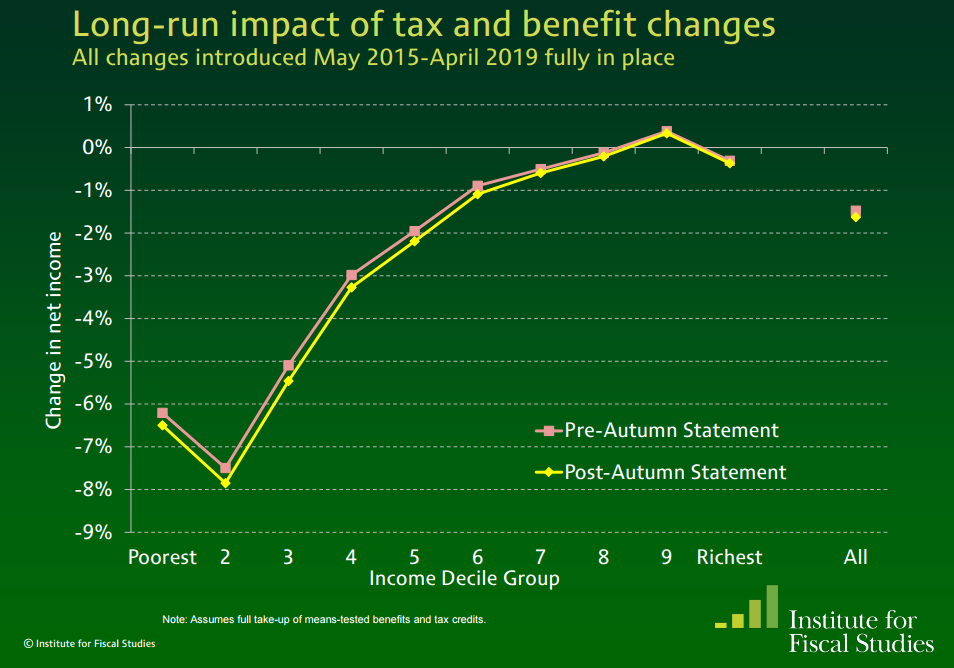

The Institute for Fiscal Studies' analysis shows that the Autumn Statement changes will still, over time, take more from the poor than from the rich

Your support helps us to tell the story

From reproductive rights to climate change to Big Tech, The Independent is on the ground when the story is developing. Whether it's investigating the financials of Elon Musk's pro-Trump PAC or producing our latest documentary, 'The A Word', which shines a light on the American women fighting for reproductive rights, we know how important it is to parse out the facts from the messaging.

At such a critical moment in US history, we need reporters on the ground. Your donation allows us to keep sending journalists to speak to both sides of the story.

The Independent is trusted by Americans across the entire political spectrum. And unlike many other quality news outlets, we choose not to lock Americans out of our reporting and analysis with paywalls. We believe quality journalism should be available to everyone, paid for by those who can afford it.

Your support makes all the difference.I did say that yesterday's judgement was provisional and awaiting the verdict of the Institute for Fiscal Studies. I said that George Osborne had prudently produced a centrist, social-democratic budget, but now the IFS has done the distributional analysis that the Treasury refuses to publish on the day, and it turns out that, after four years, the Chancellor's measures are just as regressive as they were in the July Budget.

The U-turn on tax credits is a big progressive improvement in year one, next year. It means no losses for existing claimants. But as new claimants come in, circumstances change and people are transferred to Universal Credit, the cuts come in by 2019 anyway. The long-run effect of the Autumn Statement changes is to make the cuts slightly more anti-poor than planned (the difference between the pink and yellow lines above: chart from slide 9 here).

This is surprising, not least to me, because I have assumed for some time that Universal Credit was never going to happen and that Iain Duncan Smith was kept on in the Cabinet purely for the purposes of preventing him from leading the "Leave the EU" campaign. Seven months ago, just 1 per cent of benefit claimants were on UC. But perhaps there will be some miraculous acceleration of the programme in the next four years. The other curiosity is that no one is supposed to lose out by transferring to UC, but presumably that protection doesn't last, or is lost when circumstances change. There are going to be some sharp incentive effects discouraging claimants from taking work in case they lose it again.

So I would not expect the shape of the Autumn Statement effects to look like the chart above when we arrive in the sunlit slightly higher ground of 2019, not least because future Budgets will make further changes. There will also be gains for those on lower incomes from higher employment and the National Living Wage. But the message from the IFS is stark. The poorest three tenths of the population will lose more than 5½ per cent of their income from this week's changes, while the richest three tenths will be more or less unaffected.

The Treasury's response to the IFS analysis was a double-speak disgrace:

Comparing what someone making a new claim would receive under the new system in 2020 to what they would be eligible for now is not legitimate.

As the Chancellor set out, for current tax credit claimants, because of the government’s economic plan, we can now help with the transition to Universal Credit by avoiding changes to tax credits altogether. This means there will be no losses in tax credits and the suggestion that tax credit cuts have somehow been postponed or transferred into Universal Credit is completely misleading.

Or in other words, "completely true".

If only there were a vigorous opposition committed to social justice that could hold this pretend "One Nation" government to account.

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies

Comments