Budget 2014: To raise living standards we must increase productivity

The first debate is whether the UK might improve its economic performance in the medium-term; the second, how the Government’s detailed moves are likely to affect different groups

Your support helps us to tell the story

From reproductive rights to climate change to Big Tech, The Independent is on the ground when the story is developing. Whether it's investigating the financials of Elon Musk's pro-Trump PAC or producing our latest documentary, 'The A Word', which shines a light on the American women fighting for reproductive rights, we know how important it is to parse out the facts from the messaging.

At such a critical moment in US history, we need reporters on the ground. Your donation allows us to keep sending journalists to speak to both sides of the story.

The Independent is trusted by Americans across the entire political spectrum. And unlike many other quality news outlets, we choose not to lock Americans out of our reporting and analysis with paywalls. We believe quality journalism should be available to everyone, paid for by those who can afford it.

Your support makes all the difference.So we will this year get back to the past peak of GDP. That is the good news; now for the bad. We will not get back to the past peak of GDP per head – a proxy for living standards – until 2018. The reason is that the country’s population has risen, so there are more people having to share out the same amount of dosh. There is no getting away with this: in terms of the way we live it will indeed be a lost decade.

True, things may turn out a little better. It is plausible, given the revisions to the GDP stats that keep coming through, that we have already reached the previous peak. It is plausible, given the quite cautious growth forecasts of the Office for Budget Responsibility, that we will get to the peak in GDP per head a bit sooner too. But this is detail. The big message of today is that we have repaired about half the damage both to public finances and to living standards. But the job is only half done, and the brighter tone of the Chancellor does nothing to change that.

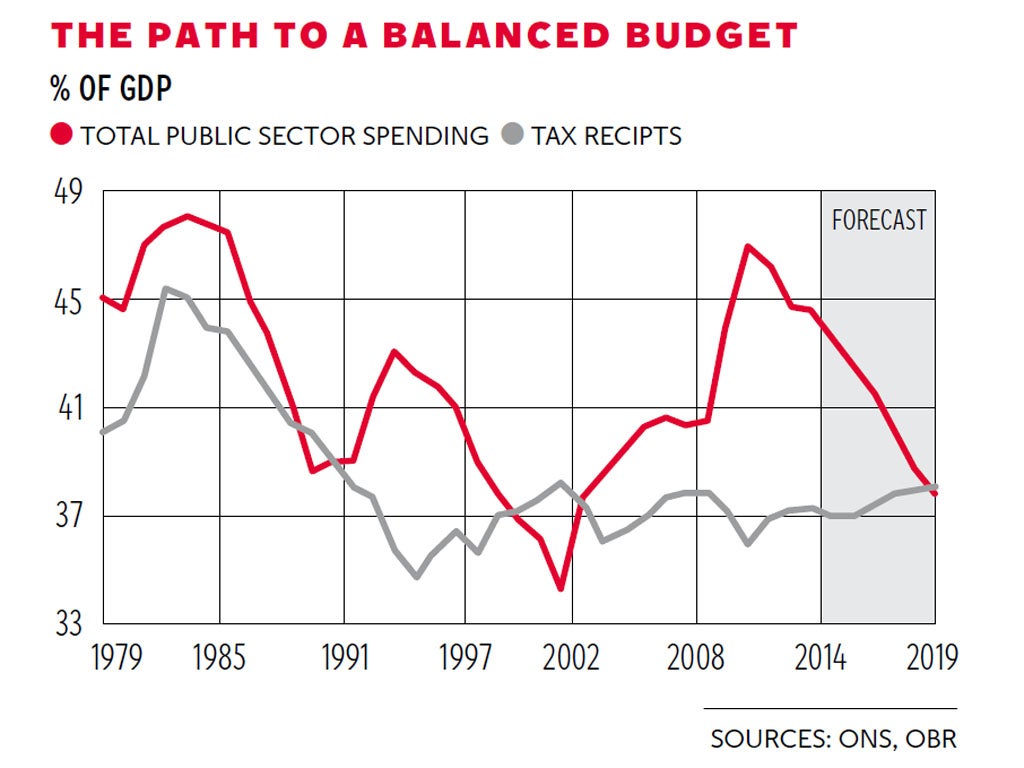

The pattern of both public spending and tax receipts since 1978 are shown in the graph. Receipts have been remarkably constant since 1990, though thanks largely to North Sea they were higher in the 1980s. Spending has been more of a roller-coaster, with three peaks and only two periods when it dipped below receipts. We are heading towards a third dip by 2018, though as you can see overall public spending will still be higher than it was in the late 1990s, in the early years of Gordon Brown as Chancellor. The projections today for public finances were only marginally better than they were a year ago, notwithstanding the better growth outlook. The cyclical position has improved but the structural one has not. That is why the squeeze continues.

That leads into two huge debates. The first is whether the UK might improve its economic performance in the medium-term; the second, how the Government’s detailed moves are likely to affect different groups of people.

On the first the issue is productivity. We have been very successful at getting people into jobs during the past four years, as good figures on employment confirmed today. The flipside is poor productivity growth, actually negative productivity growth. Maybe as growth broadens and deepens we will be able to keep growing above trend and recover lost ground. But maybe the economy is closer to full capacity than it seems and we won’t be able to do so.

There is a really interesting passage in the OBR report looking at how big the output gap is, not quite the same as spare capacity, but the truth is that we really don’t know. What we do know is that if we are to increase living standards we have to increase productivity. This will be a huge challenge for the Government, but even more for companies and indeed individual workers in the years ahead.

The second debate is more political. There were two big shifts of policy: the incentives for business, and the changes to private pensions and savings. Both are surely welcome. It would reject the charge, but the Coalition does seem to have given the impression to many business people that it was quite anti-business, more so that the Labour government before it. The string of detailed changes announced today, coupled with the previously announced cuts in corporation tax, will go a long way to rebutting that charge.

This comes as companies are starting to increase investment, always a sign of confidence, and it will help to reinforce this.

The other shift will be slower acting but over time may quite transform society. By making ISAs a larger portion of people’s personal financial planning and giving much more flexibility in the way personal pensions are deployed, the Government will give a boost to the idea that people should take greater responsibility for their own financial futures. Couple that with the cap on welfare spending and other changes to personal pensions, and over a generation this could reshape the country in much the same way as the growth of home ownership reshaped it from the 1950s onwards.

Budgets are as much about politics as economics, this one more so than usual. The Chancellor is benefiting from the cyclical upswing. That is a global phenomenon. Maybe because we started a long way back it is reasonable to expect us to pick up pace now. But we certainly need to, and we will bear the scars in terms of lower living standards for some years yet.

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies

Comments