Everything that was missing from Philip Hammond's Autumn Statement

The deterioration of future forecasts due to Brexit is the most important element of today’s statement, and the Chancellor’s response was notable by what he has failed to do

Your support helps us to tell the story

From reproductive rights to climate change to Big Tech, The Independent is on the ground when the story is developing. Whether it's investigating the financials of Elon Musk's pro-Trump PAC or producing our latest documentary, 'The A Word', which shines a light on the American women fighting for reproductive rights, we know how important it is to parse out the facts from the messaging.

At such a critical moment in US history, we need reporters on the ground. Your donation allows us to keep sending journalists to speak to both sides of the story.

The Independent is trusted by Americans across the entire political spectrum. And unlike many other quality news outlets, we choose not to lock Americans out of our reporting and analysis with paywalls. We believe quality journalism should be available to everyone, paid for by those who can afford it.

Your support makes all the difference.This was the new Chancellor’s first Autumn Statement. It will also be his last. In future the Budget will move to the autumn and there will be a more limited statement, so to speak, in the spring. But there were limits enough in this one.

The much-touted “industrial strategy” didn’t materialise. The phase is mentioned a handful of times in the Treasury’s document accompanying Philip Hammond’s speech – but always preceded by “forthcoming”. There is a single mention of families who are “just about managing”. That mention comes in the context of a planned fuel duty rise being cancelled once again. Seven years in a row, that rise has been axed. Avoiding it is hardly distinctive to “Mayism”.

There are bigger gaps still on forecasting the future course of the UK’s economy. The Office for Budget Responsibility (OBR) reports that, rather than getting details about the Government’s plans for Brexit, they were pointed to a couple of passages from the Prime Minister’s speeches. They asked about whether the Government’s discussions with Nissan had created any contingent liabilities which they should build into their forecasts for public spending. The Treasury “declined to say”.

These absences are in one sense unsurprising. It would have been an odd choice for the Government to reveal its plans for Brexit via the OBR. Faced with the lack of detail, however, the OBR could be criticised for flattering the public finances.

It seems that it regards some prime ministerial speeches as more reliable guides to future policy than others. For example, it calculates future tax revenues on the assumption that, while Government will reduce immigration levels, it won’t push them down to the “tens of thousands” – despite that being the Prime Minister’s stated goal. This is significant because much lower immigration would reduce tax revenues and productivity growth, beyond the deterioration that is already recorded in the OBR’s new forecasts.

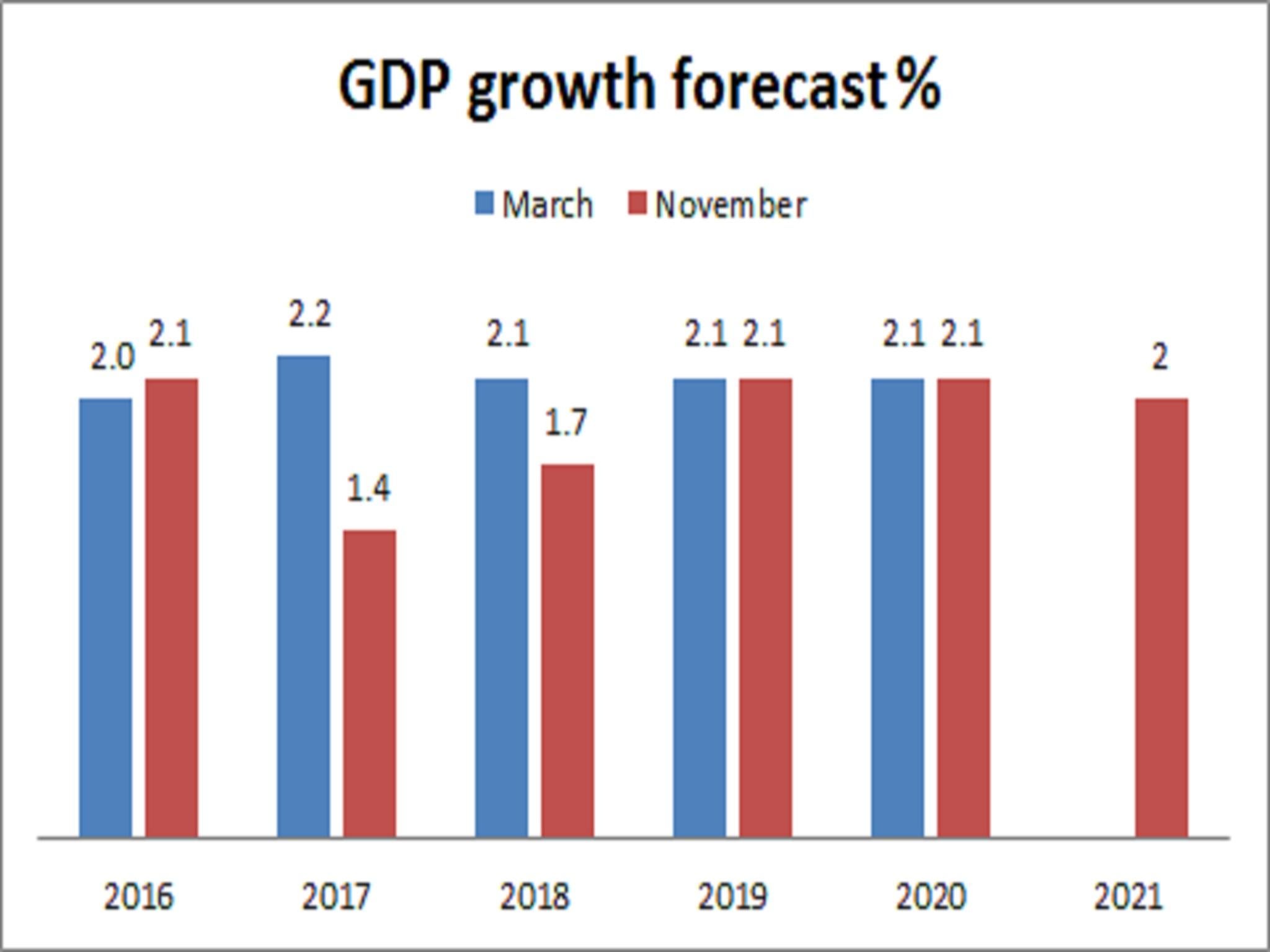

That deterioration in the forecasts for future years, due mainly to Brexit, is nevertheless the most important element of the Autumn Statement. And here, too, the Chancellor’s response is more notable by what he has failed to do.

He has not increased taxes or cut public spending in order to stick to the previous path of deficit reduction. The “punishment budget” that was muttered about darkly before the referendum has been shelved.

In fact, despite the deteriorating forecasts for growth and tax revenues, the Chancellor said in his speech that he would press ahead with delivering expensive Conservative manifesto commitments such as increasing the personal tax allowance and the threshold for the higher rate of tax. Again, the OBR has helped him out by not putting the effect of these changes – lowering future tax revenues and increasing borrowing – into its forecasts. Apparently they are “ambitions” rather than firm policy.

This looks like a continuity statement, except with much higher levels of borrowing due to Brexit. The major policy departures from Osbornomics – a more ambitious industrial strategy and the additional spending associated with it – are still yet to come.

Emran Mian is director of the Social Market Foundation

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies

Comments