Revealed: How British tourists are losing hundreds of millions to rip-off currency conversion charges

Exclusive: One UK airline offers a rate of only €0.99 to £1 for customers paying in sterling

Your support helps us to tell the story

From reproductive rights to climate change to Big Tech, The Independent is on the ground when the story is developing. Whether it's investigating the financials of Elon Musk's pro-Trump PAC or producing our latest documentary, 'The A Word', which shines a light on the American women fighting for reproductive rights, we know how important it is to parse out the facts from the messaging.

At such a critical moment in US history, we need reporters on the ground. Your donation allows us to keep sending journalists to speak to both sides of the story.

The Independent is trusted by Americans across the entire political spectrum. And unlike many other quality news outlets, we choose not to lock Americans out of our reporting and analysis with paywalls. We believe quality journalism should be available to everyone, paid for by those who can afford it.

Your support makes all the difference.Unsuspecting British holidaymakers are losing £1m per day through “dynamic currency conversion” (DCC) – a scheme that increases the cost of using credit cards abroad at the expense of the traveller.

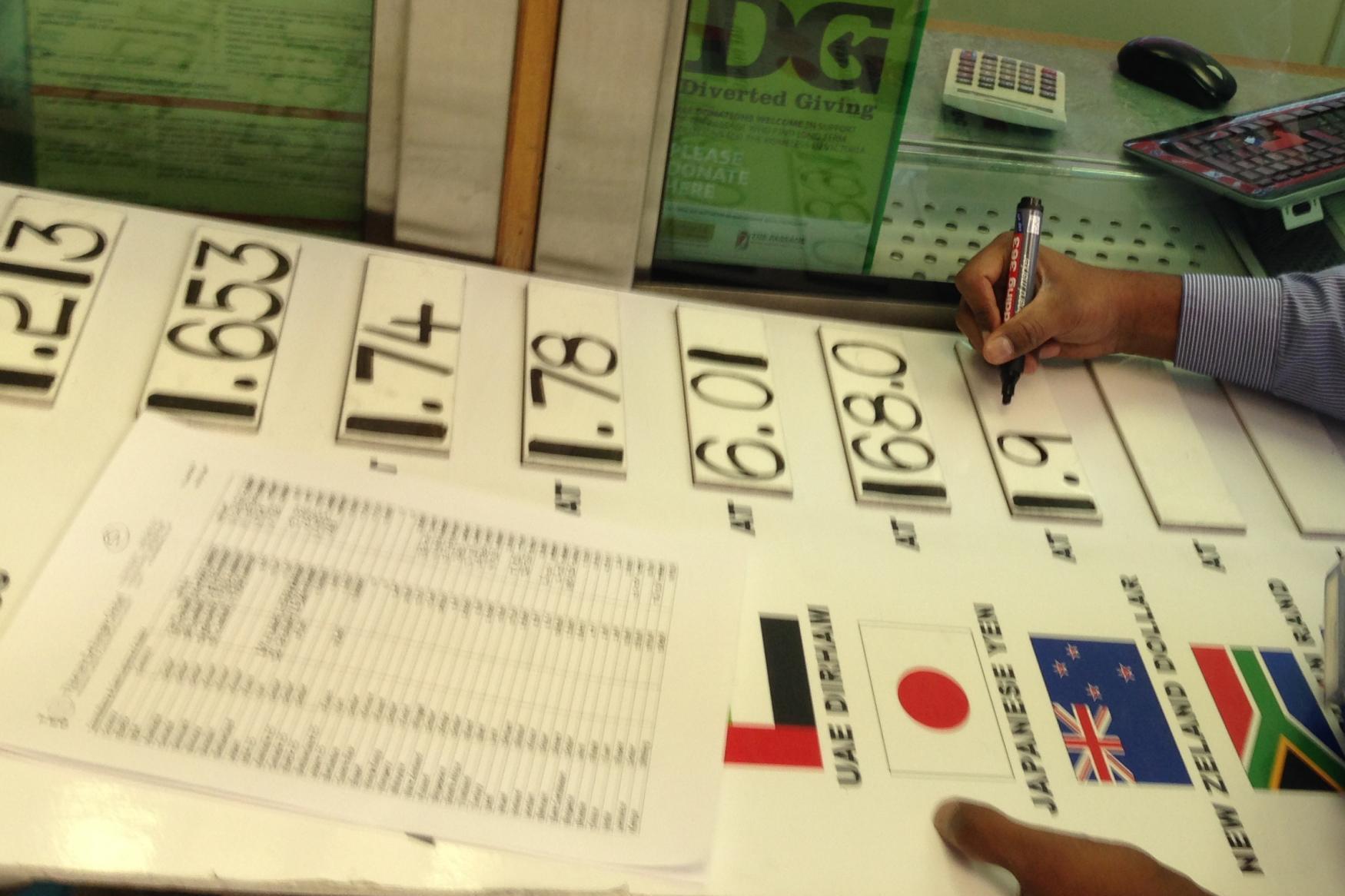

Hotels, restaurants and shops are incentivised to persuade UK visitors to settle credit card bills abroad in sterling. While travellers may be attracted by the certainty of knowing the cost in pounds, the option is usually offered at a derisory exchange rate.

At a time when sterling is trading at very low rates, a handsome profit margin is shared between the trader and the financial intermediary.

According to UK Finance, which represents card issuers, in 2017 British travellers spent £25.1bn on credit cards abroad in a total of 467 million transactions.

The average value of each transaction was £54 – typically the price of a good lunch, a shopping trip or an ATM withdrawal.

While UK Finance does not know how many transactions involved dynamic currency conversion, information from one of the larger providers of “DCC” indicates that the figure is around one in five. That means £5bn of annual spend was made at lousy rates.

The margin, typically 5-6 per cent, is split between the trader and their DCC provider.

The Ireland-based financial intermediary, Elavon, tells prospective business customers: “With each DCC transaction, you receive a rebate – which means the more international business you do, the more you can earn.”

The company quotes Dara de Buitlear, marketing manager for Carrolls Irish Gifts, as saying: “With a large percentage of our customers travelling from overseas, the rebate earned over the course of the year is very important to our bottom line figure.”

While UK card issuers often take a slice of the cost of transactions, it is normally lower than 3 per cent. Specific travel-friendly cards, such as Halifax Clarity Mastercard, apply no foreign transaction fees.

Over the course of a year, the cost of DCC to British holidaymakers is around £280m. With August as the peak summer month, at least £1m per day is being extracted from British holidaymakers, often without their knowledge or consent.

The Mastercard code of practice on dynamic currency conversion insists that the cardholder must be told in advance “that they have the right to choose the currency in which the transaction will be completed”.

But anecdotal evidence indicates that some traders are failing to offer a choice, and instead presenting the bill with sterling pre-selected on the credit card terminal.

While alert customers may notice the scam and demand to pay in local currency, many holidaymakers do not.

The EU-funded European Consumer Organisation, known as Beuc, says: “It is almost impossible for a consumer to make an informed decision when presented with the DCC option, because of various ‘nudging’ strategies put in place by the DCC service providers and merchants.”

DCC is also offered to travellers using ATMs to withdraw cash.

A German consumer group, Stiftung Warentest, found DCC charges at ATMs between 2.6 and 12 per cent – with the highest rates in the Czech Republic, Poland and Hungary.

British travellers booking flights that originate outside the UK may unwittingly pay with dynamic currency conversion, increasing the cost of the tickets.

For inbound flights to the UK booked with a British-issued card, Ryanair automatically selects DCC. On a day when £1 was at €1.12 on the inter-bank rate, the airline was offering only €1.05.

Switching to sterling is unintuitive. It involves clicking on a link marked “Click here for more information on our guaranteed exchange rate”, then scrolling down and unticking a box.

One traveller told The Independent: “This is surely taking those ‘hidden’ charges to the next level.”

A spokesperson for the airline said: “All Ryanair fares are quoted in the currency of the departure country, and our booking system automatically identifies the currency of the card (using dynamic currency conversion “DCC”) during the booking process.

“Customers have the option of paying in the currency of the card with absolute certainty of what the final payment will be at the time of booking.

“Alternatively, they have the option of taking the yet unknown exchange rate applied by their bank/card provider.

“Customers are advised of the dynamic currency conversion rate applied and have the option to avail of this rate or not.”

One UK airline is offering an even worse rate to travellers buying flights from the Mediterranean to Britain.

Test bookings made with Jet2 showed the pound being worth less than €1. On a trip from Alicante to Leeds Bradford costing €205, the cost of settling the bill in sterling is shown as £206.86.

Even assuming a transaction charge of 3 per cent for converting from euros to sterling by a UK bank, the Jet2 rate inflates the cost of a flight by one-tenth.

An airline spokesperson said: “Jet2.com uses a company exchange rate which changes daily with the fluctuations in currency values.

“Prices are displayed in both currencies throughout the booking process to ensure the conversion is clear.

“The customer makes the decision as to which currency they wish to pay in and has the option throughout the process of changing this.”

The European Union is proposing to regulate DCC, saying: “Payment service providers will have to disclose the full costs charged to consumers.”

But the new rules will not be in place by the time the UK leaves the EU, and will therefore not apply to British travellers.

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies

Comments