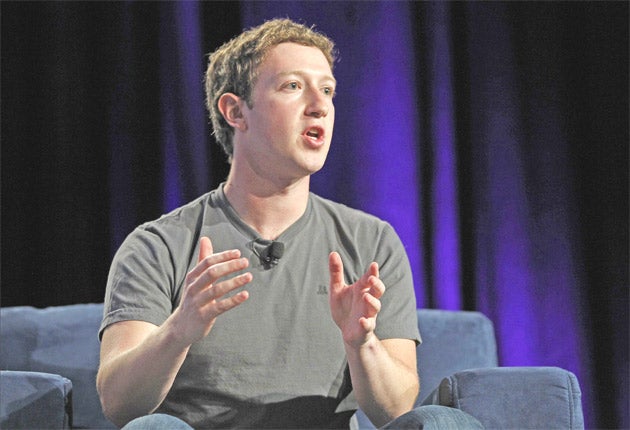

The middle men making a killing out of Facebook

Mark Zuckerberg may not yet earn anything from his invention, but for a shadowy group of investors it's a goldmine

Your support helps us to tell the story

From reproductive rights to climate change to Big Tech, The Independent is on the ground when the story is developing. Whether it's investigating the financials of Elon Musk's pro-Trump PAC or producing our latest documentary, 'The A Word', which shines a light on the American women fighting for reproductive rights, we know how important it is to parse out the facts from the messaging.

At such a critical moment in US history, we need reporters on the ground. Your donation allows us to keep sending journalists to speak to both sides of the story.

The Independent is trusted by Americans across the entire political spectrum. And unlike many other quality news outlets, we choose not to lock Americans out of our reporting and analysis with paywalls. We believe quality journalism should be available to everyone, paid for by those who can afford it.

Your support makes all the difference.Whether you are in Silicon Valley or on Wall Street – or anywhere with a portfolio of shares and some money to spare – the hottest topic in investment has long been, when will Facebook float on the stock market? But for some rich individuals, and cast of brokers and other middlemen, there is no patience for finding out. They want a piece of Facebook now – and they're getting it.

While the social networking site is firmly embedded in the culture, with more than 500 million users worldwide, its young founder, Mark Zuckerberg, is still trying to work out a way to generate profits commensurate with its social influence and with the huge financial hopes pinned on him.

Shares in the company have been given to only a small gaggle of employees, past and present, and to the firm's early venture capital backers, but that hasn't stopped a feeding frenzy in which they are changing hands at higher and higher valuations on private markets. In recent weeks, some stock has sold at a price that values the company at $41bn (£26bn), suggesting it is the No 3 most valuable internet business after Google and Amazon.

Industry observers have watched in amazement as expectations of vast profits have ratcheted up over the past few months, and as Facebook's valuation has soared from $23bn in June and $33bn just two months ago.

A whole ecosystem now consists of share-trading platforms, brokers and so-called "single-asset funds" trading in Facebook shares. The single-asset funds offer what are effective Facebook derivatives; instead of buying the shares individually, investors get a share in the fund, for a minimum investment of about $100,000.

"It is exciting to be at a party or to have friends over and to be able to say, 'I'm in Facebook'," says Larry Albukerk, whose firm EB Exchange Funds runs single-asset funds. "Our investors tend to be venture capitalists or executives at other tech companies, such as Google. I get excited being involved with these investors."

Facebook was founded less than six years ago when Mr Zuckerberg was still an undergraduate at Harvard University, and quickly became an internet sensation. Mr Zuckerberg's fictionalised story was recently turned into the blockbuster movie The Social Network, adding to the hype surrounding the company. As its user numbers grow, as people spend more of their time and share more of their private lives inside the site, Facebook has been making money by selling targeted advertising for display on people's profiles. Last week, it unveiled an email system and a plan to encourage users to channel all their existing messages, including email, texts and instant messaging, through Facebook.

It is this ambition, and to challenge Google as the best place for advertisers, that has investors salivating. Although the company is expected to generate $2bn in revenue this year, that's what Google makes in a month.

"We understand there is a great deal of interest in our past and potential financial performance," Google's Jonathan Thaw said after the share price surge. "However, external attempts to forecast revenue or to value the company are fundamentally speculative. We're focused on building our business to be successful over the long term."

It is a warning echoed by Mr Albukerk, who says that private companies are under no obligation to disclose the financial details of their business. "Most of my investors don't have the financials. I don't either. I just provide access so they go off what they have heard and read."

Securities' regulations in the US prevent Mr Albukerk from saying whether one of his funds is a Facebook fund, although documents sent to investors confirm it. New York firms GreenCrest Capital and Felix Investments also reportedly run Facebook funds.

Similar funds are springing up around other hot technology companies, including Twitter and Zynga, the games company behind Facebook favourite Farmville. In the US, if a company has more than 500 shareholders, it must float. The single-asset funds may offer a way round that.

The lessons learnt6 in the dot.com bubble have encouraged companies to wait until internet firms have established themselves as sustainably profitable, and Facebook is rumoured to have pencilled in 2012 as a possible float date. The $41bn valuation is calculated on trades enacted on SecondMarket, an exchange for private company stock. A secondary market in Facebook shares has existed since last year, so that the company could allow some current and former employees to cash out of some of their share options and stock grants.

More recently, a new company called 137 Ventures has begun lending money to former employees to pay their tax bill when they exercise their share options. In return, 137 Ventures takes interest and also a percentage of the stock and, it suspects, it might make more money from the stock.

The internet's most profitable websites

$190bn: Google

The undisputed king of the internet rakes in profits – profits, not just sales – at a rate of $1m per hour. Facebook thinks it can topple Google, and the social network targets advertisements based on what it knows about its users, which it thinks will be more valuable than adverts based merely on words people type into a search box.

$76bn: Amazon

The online retailer has made $736m in profit so far this year. Jeff Bezos founded the company in a California garage in 1994, in the process revolutionising the retail and publishing industry.

$40bn: eBay

Much copied, but never surpassed, eBay brought together buyers and sellers in a vast flea market that is used regularly by 90 million users. Goods worth a total of $2,000 change hands every single second.

$21bn: Yahoo

While investors might have fallen out of love with Yahoo, its vital stats are still impressive, with hundreds of millions of people regularly using its email.

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies

Comments