Your support helps us to tell the story

From reproductive rights to climate change to Big Tech, The Independent is on the ground when the story is developing. Whether it's investigating the financials of Elon Musk's pro-Trump PAC or producing our latest documentary, 'The A Word', which shines a light on the American women fighting for reproductive rights, we know how important it is to parse out the facts from the messaging.

At such a critical moment in US history, we need reporters on the ground. Your donation allows us to keep sending journalists to speak to both sides of the story.

The Independent is trusted by Americans across the entire political spectrum. And unlike many other quality news outlets, we choose not to lock Americans out of our reporting and analysis with paywalls. We believe quality journalism should be available to everyone, paid for by those who can afford it.

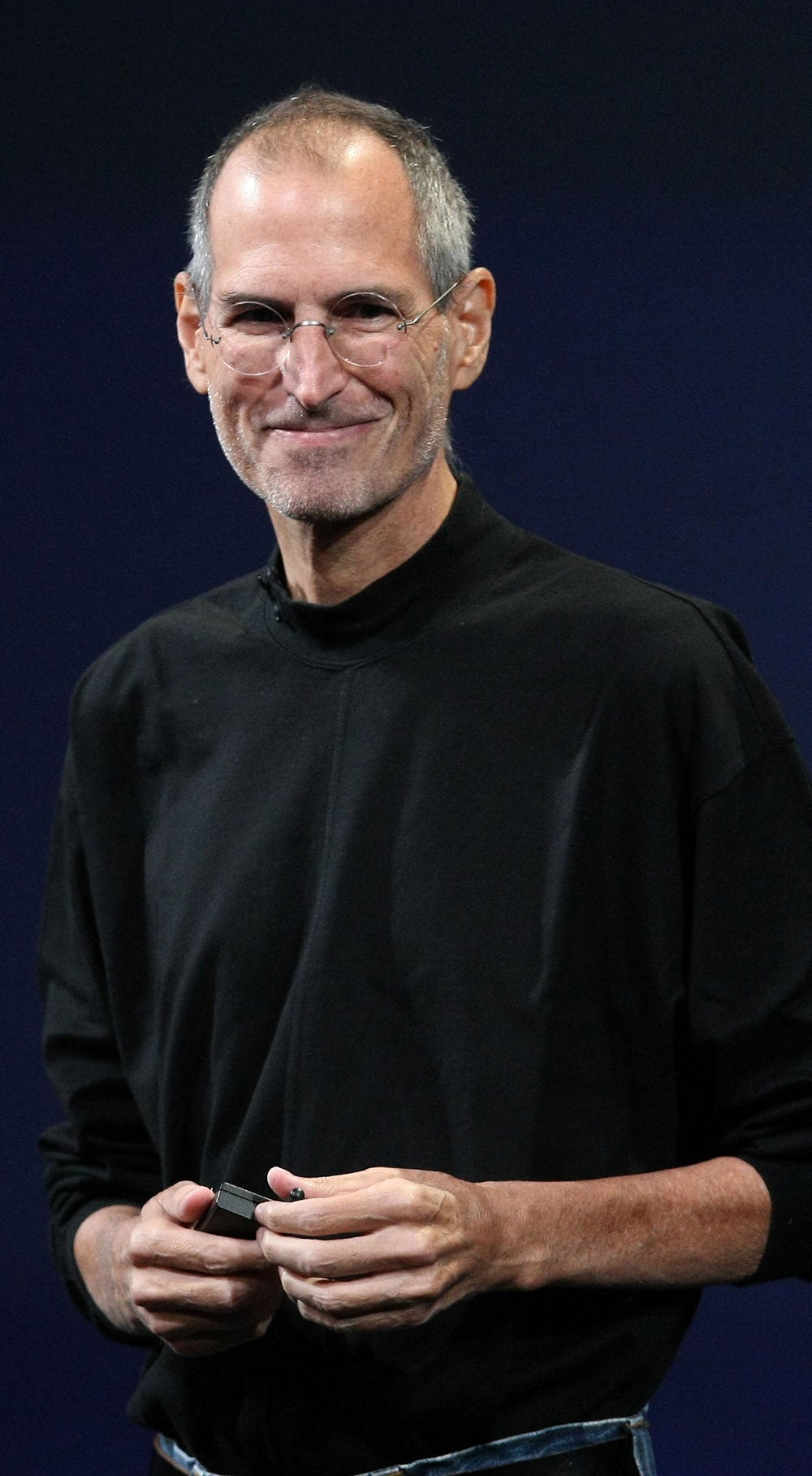

Your support makes all the difference.As he's done for the last decade, Apple Chief Executive Steve Jobs took home his customary US$1 annual salary in 2008, but the economic meltdown and Apple's falling stock price whacked half a billion dollars off the value of his personal holdings in the company.

Apple said in a regulatory filing that Jobs, 53, who holds 5.5 million shares of Apple's stock, hasn't sold any of the shares since rejoining the company in 1997. That means what he lacks in annual compensation is made up for in the enormous amount of stock he already holds - a horde that took a beating in 2008 amid fears about the Mac and iPhone maker's vulnerability to the US recession.

Apple shares have lost more than half their value since the end of 2007, when they were trading at nearly $200 and Jobs' holdings were worth more than $1 billion. The stock finished Wednesday's trading session down $2.01, 2 per cent, at $91.01, meaning Jobs' stake is worth around $500 million.

A big hit by any measure, the decline still barely dents Jobs' massive fortune, estimated by Forbes magazine earlier this year at $5.7 billion and ranking him 61st on the publication's list of the richest Americans.

Most of Jobs' wealth comes not from Apple but from the 138 million shares he owns of The Walt Disney Co., a 7.3 per cent stake that makes him Disney's largest individual shareholder.

Jobs scored the Disney stake through a brilliant deal in which he sold Pixar Animation Studios, a company he bought from director George Lucas for $10 million in 1986, to Disney in a multibillion-dollar stock trade 20 years later.

Jobs' Disney holdings are now worth $3.2 billion, more than $1 billion less than the stock was worth last year.

Jobs has a similar relationship with Disney, where he serves on the board, as he does with Apple when it comes to pay. He doesn't take a salary for his work as a Disney director.

Apple's annual proxy filing with the Securities and Exchange Commission shows that its strategy is remarkably egalitarian when it comes to the CEO's compensation. The company doesn't reimburse Jobs for the perks that top executives usually get like home security systems or a chauffeur, but it did reward him in a big way in 1999 after he engineered an impressive turnaround at the company: Jobs' bonus that year was a $90 million Gulfstream V jet, whose operation Apple still helps pay for.

Apple said in the filing that it reimbursed Jobs for $871,000 in expenses in 2008 for his use of the private plane on company business. In 2007, those costs were $776,000, and in 2006, it was $202,000.

Jobs' compensation hasn't been without controversy, however. The company was embroiled in a scandal two years ago over its mishandling of stock option awards, some of which went to Jobs.

At the height of the corporate "backdating" scandals that emerged in 2006, federal investigators began looking at Apple over possible criminal violations in the way the company handled its options, including an award of 7.5 million options given to Jobs in 2001.

Jobs never cashed out the options; they were cancelled two years later while they were "underwater," or worthless, along with other outstanding options. Instead he was given millions of shares of restricted stock that make up nearly all of his current holdings.

Prosecutors closed the criminal investigation last year without filing charges, though two former executives - former General Counsel Nancy Heinen and former Chief Financial Officer Fred Anderson - were charged by the SEC over the so-called "backdating," or manipulating stock awards so they look like they were issued earlier than they were.

Apple eventually took an $84 million charge after it acknowledged it had backdated 6,428 grants between 1997 and 2002.

Jobs was in the news for another reason this week when he revealed before the Macworld trade show that a hormone imbalance has caused the weight loss that made him look gaunt at recent events. Jobs said he wanted to squash rumours that he is gravely ill.

Apple said that its annual meeting is scheduled for Feb. 25 at the company's Cupertino headquarters.

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies

Comments