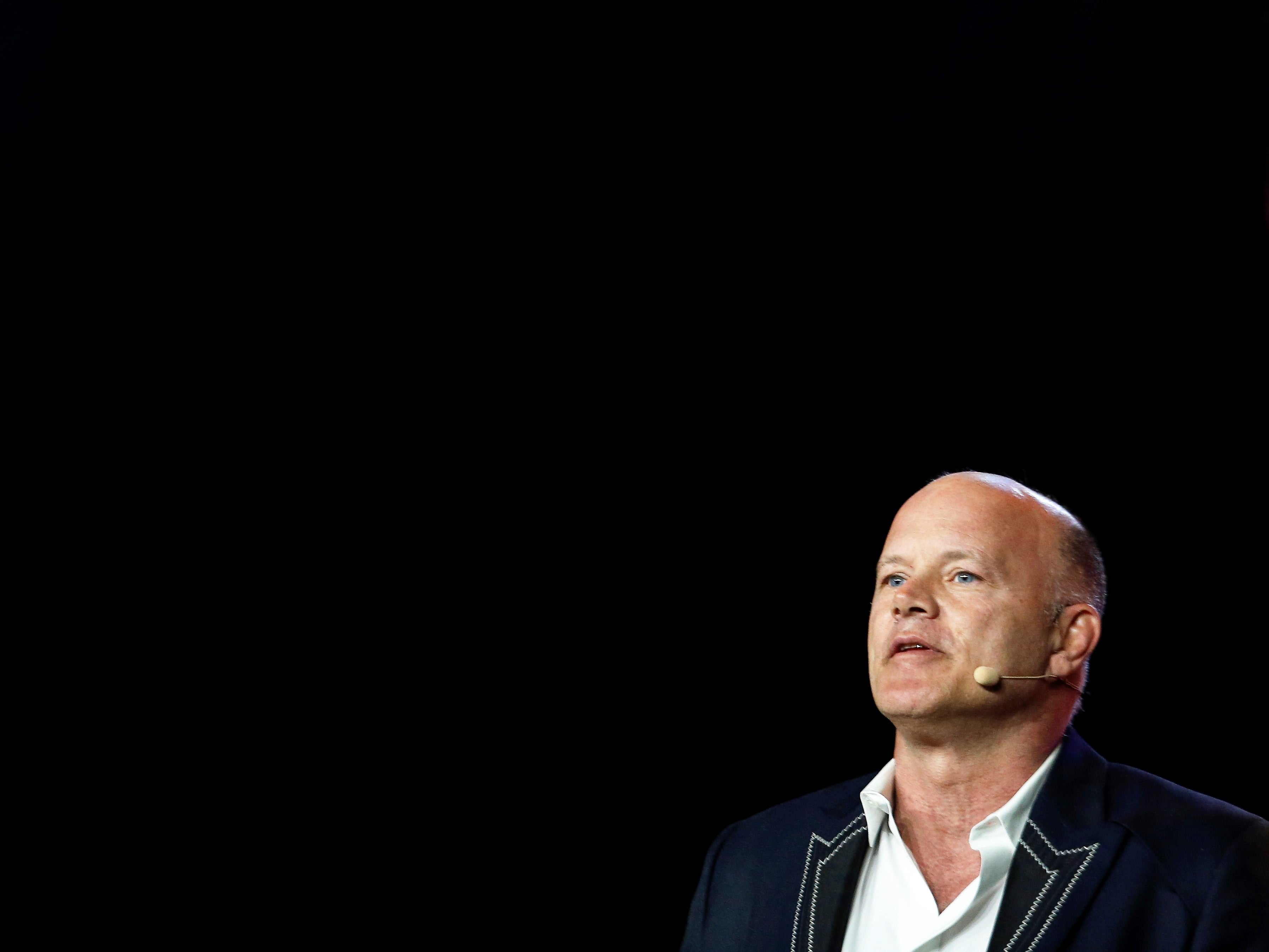

‘Worst tattoo in history’: Billionaire mocked after LUNA crypto price crashes to $0

Mike Novogratz says howling wolf tattoo will serve as ‘constant reminder’ after net worth crumbles

Your support helps us to tell the story

From reproductive rights to climate change to Big Tech, The Independent is on the ground when the story is developing. Whether it's investigating the financials of Elon Musk's pro-Trump PAC or producing our latest documentary, 'The A Word', which shines a light on the American women fighting for reproductive rights, we know how important it is to parse out the facts from the messaging.

At such a critical moment in US history, we need reporters on the ground. Your donation allows us to keep sending journalists to speak to both sides of the story.

The Independent is trusted by Americans across the entire political spectrum. And unlike many other quality news outlets, we choose not to lock Americans out of our reporting and analysis with paywalls. We believe quality journalism should be available to everyone, paid for by those who can afford it.

Your support makes all the difference.In March 2021, after investing tens of millions of dollars into the LUNA cryptocurrency, billionaire Mike Novogratz told his Twitter followers that he would get a LUNA tattoo if its price hit $100.

At the time, LUNA was trading just below $20 but within nine months the price target had been hit. The Galaxy Digital CEO followed through with his promise, tweeting an image of a howling wolf tattoo covering the top half of his left arm.

“I’m officially a lunatic!!” he tweeted, referring to the name advocates of the cryptocurrency call themselves.

LUNA eventually peaked at close to $120, before the collapse of its sister cryptocurrency TerraUSD (UST) caused it to crash to just one ten thousandth of one cent.

Described by its developers as the “holy grail of cryptocurrencies”, LUNA lost more than 99 per cent of its value virtually overnight. Mr Novogratz’s net worth plummeted from $8.5 billion to $2.5 billion, according to the Bloomberg Billionaire’s Index.

The unprecedented capitulation wiped more than $40 billion from its market cap and left some investors complaining that they had lost their life savings.

It also prompted criticism against those who had promoted the crypto project, as well as drew mockery of Mr Novogratz’s tattoo.

“The worst tattoo in history just got even worse,” one Twitter user wrote.

Another tweeted: “Some tattoos don’t age well.”

The tattoo was not Mr Novogratz’s first crypto tattoo, having previously inked a bitcoin logo on his body, and forms part of a recent trend.

The booming crypto market throughout most of 2021, which included record-breaking price rallies for bitcoin (BTC) and Ethereum (ETH), saw a surge in interest for crypto-related tattoos.

Recent research from comparison platform Crypto Head found that there was a 222 per cent increase in searches for terms like ‘bitcoin tattoo’ and ‘crypto tattoo’ over the past year.

On Wednesday, Mr Novogratz published an open letter offering his first public comments on the cryptocurrency’s downfall.

“With hindsight things always look clearer,” he wrote. “My tattoo will be a constant reminder that venture investing requires humility.”

Mr Novogratz, who told Business Insider last year that 85 per cent of his wealth was tied up in cryptocurrency, did not give specific details about how much he or Galaxy Digital lost as a result of the collapse, though did reveal that his firm had “taken profits along the way”.

Therehas been speculation that many of the so-called ‘whales’ who had major holdings of LUNA and UST were able to cash out using the reserves stockpiled by the Luna Foundation Guard, which oversees the two cryptocurrencies. Everyday retail investors, however, have seen their holdings evaporate.

“Reading the stories of retail investors who lost their savings in one investment is heart-wrenching,” Mr Novogratz wrote. “It’s important that less experienced market participants only risk what they are comfortable losing.”

He concluded by claiming that Galaxy Digital was “in a strong capital and liquidity position” and “well-positioned for long-term growth”.

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies

Comments